Get the free Property Tax Educational ProgramsMaine Revenue Services

Show details

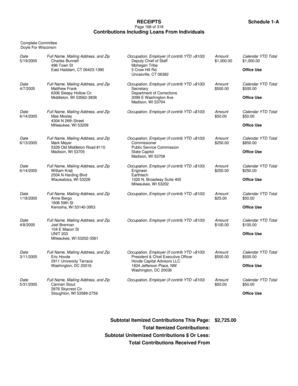

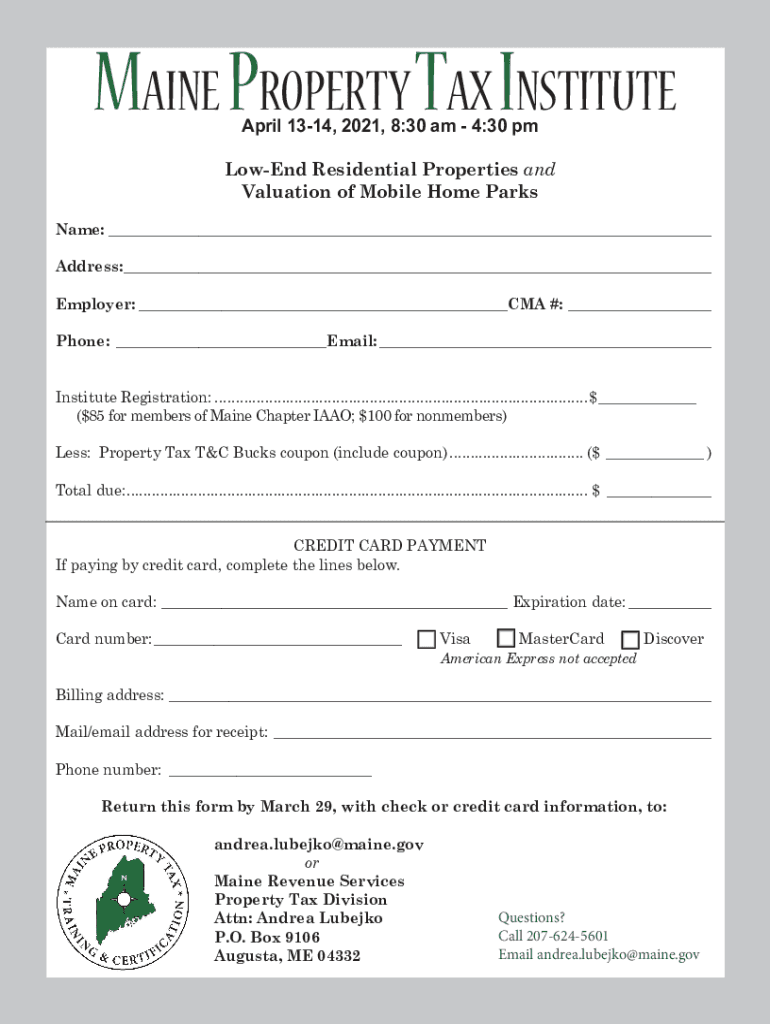

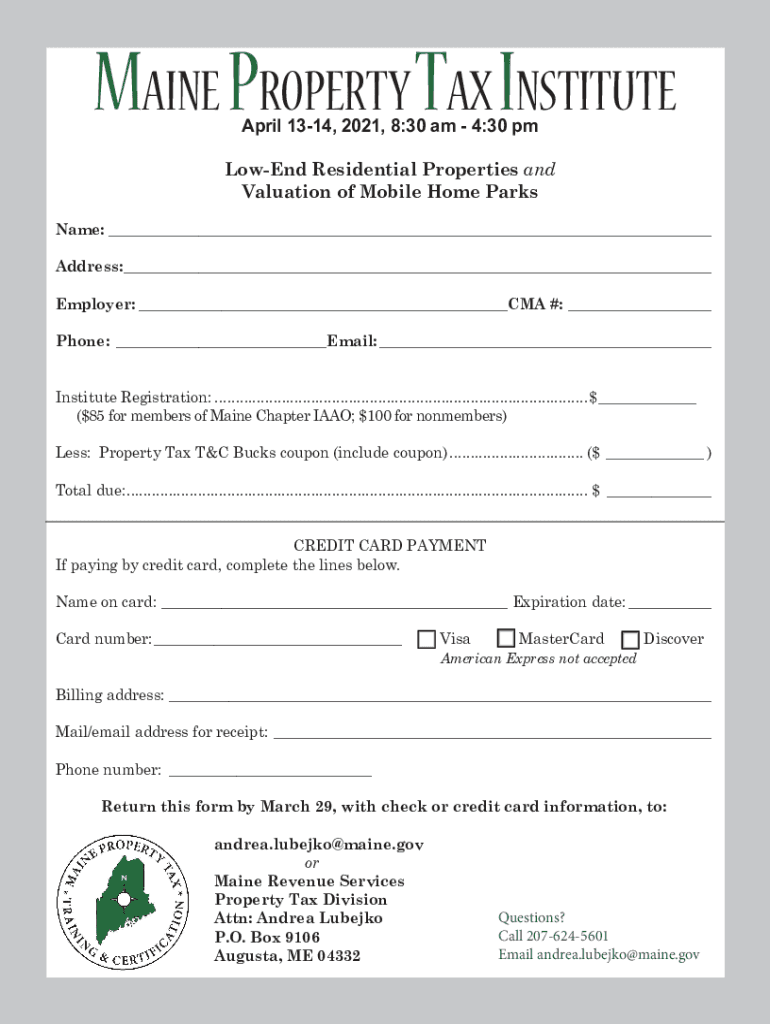

MAINE PROPERTY TAX INSTITUTE, 2021 presented by The Maine Property Tax Division and The Maine Chapter of IAA online, April 1314, 2021 Lowed Residential Properties Valuation of Mobile Home Parks Instructor:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax educational programsmaine

Edit your property tax educational programsmaine form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax educational programsmaine form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax educational programsmaine online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit property tax educational programsmaine. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax educational programsmaine

How to fill out property tax educational programsmaine

01

To fill out property tax educational programs in Maine, follow these steps:

02

Gather all relevant information about your property, including its location, assessed value, and any exemptions or special circumstances that may apply.

03

Determine which educational programs you are eligible for based on your property type and location. Visit the official website of your local municipality or county to find out which programs are available in your area.

04

Download the application form for the desired educational program or request a copy from the appropriate authority.

05

Read the instructions carefully and complete all required fields in the application form. Provide accurate and detailed information to avoid any delays or rejections.

06

Attach any supporting documentation that may be required, such as proof of residency, income statements, or property ownership documents.

07

Double-check all the information provided and make sure everything is accurate and up-to-date.

08

Submit the completed application form and supporting documents to the designated authority either in person or by mail. Keep copies of all documents for your records.

09

Wait for a confirmation or notification from the authority regarding the status of your application. Follow up if necessary.

10

If approved, comply with any additional requirements or obligations outlined in the educational program.

11

Keep track of important dates, such as renewal deadlines or changes in eligibility criteria, to ensure continued participation in the program.

12

Remember to consult the specific guidelines and procedures provided by your local municipality or county for more detailed instructions.

Who needs property tax educational programsmaine?

01

Property tax educational programs in Maine are beneficial for:

02

- Property owners who want to reduce their tax burden through exemptions, abatements, or credits.

03

- Individuals or families with limited income or financial hardships who may qualify for property tax relief programs.

04

- Seniors or disabled individuals who may be eligible for special programs or exemptions based on age or disability.

05

- Educational institutions or organizations involved in property-related educational initiatives.

06

- Anyone who wishes to have a better understanding of property taxation in Maine and explore available options for financial assistance or incentives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get property tax educational programsmaine?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific property tax educational programsmaine and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the property tax educational programsmaine in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your property tax educational programsmaine directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out property tax educational programsmaine using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign property tax educational programsmaine and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is property tax educational programsmaine?

Property tax educational programs in Maine are initiatives aimed at informing and educating property owners about their property tax obligations, assessments, and available relief programs.

Who is required to file property tax educational programsmaine?

Property owners in Maine who wish to participate in the educational programs or seek property tax relief are typically required to file the respective forms.

How to fill out property tax educational programsmaine?

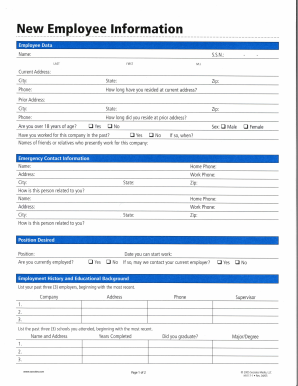

To fill out the property tax educational program forms in Maine, property owners need to provide their personal information, property details, and any relevant documentation related to their property tax situation.

What is the purpose of property tax educational programsmaine?

The purpose of property tax educational programs in Maine is to equip property owners with knowledge about the property tax system, help them understand their rights, and guide them in accessing available resources and relief options.

What information must be reported on property tax educational programsmaine?

Information that must be reported typically includes the property owner's name, address, property identification details, income information, and any relevant tax documentation.

Fill out your property tax educational programsmaine online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Educational Programsmaine is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.