Get the free Outgoing Wire Transfers - Financial Services

Show details

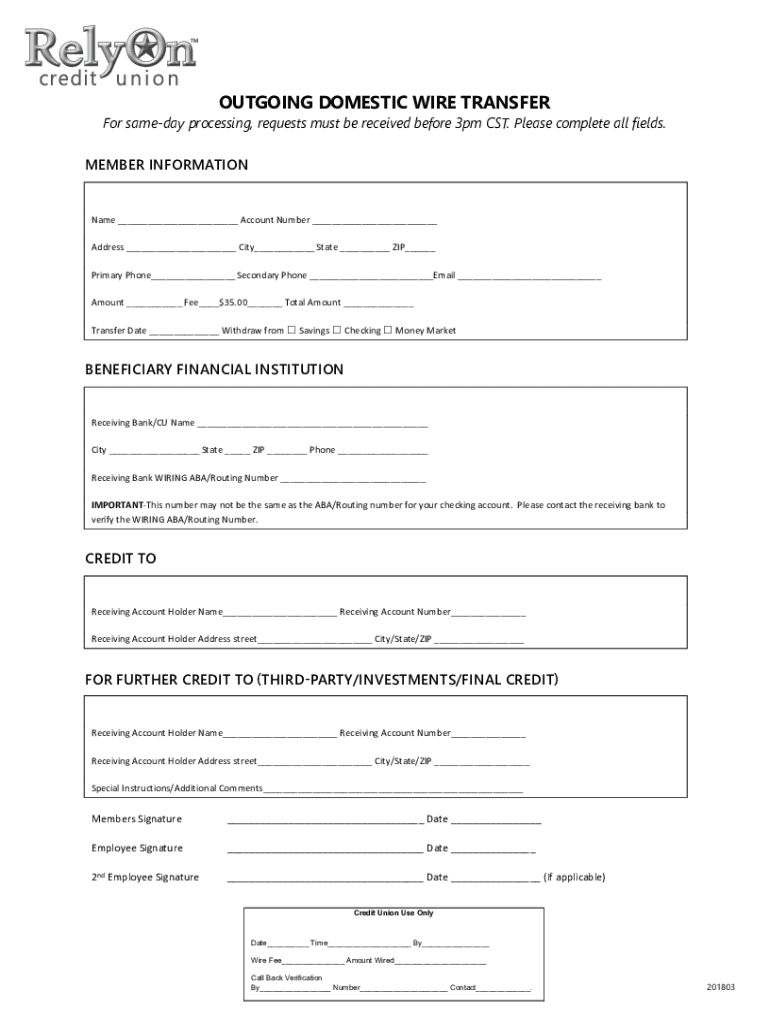

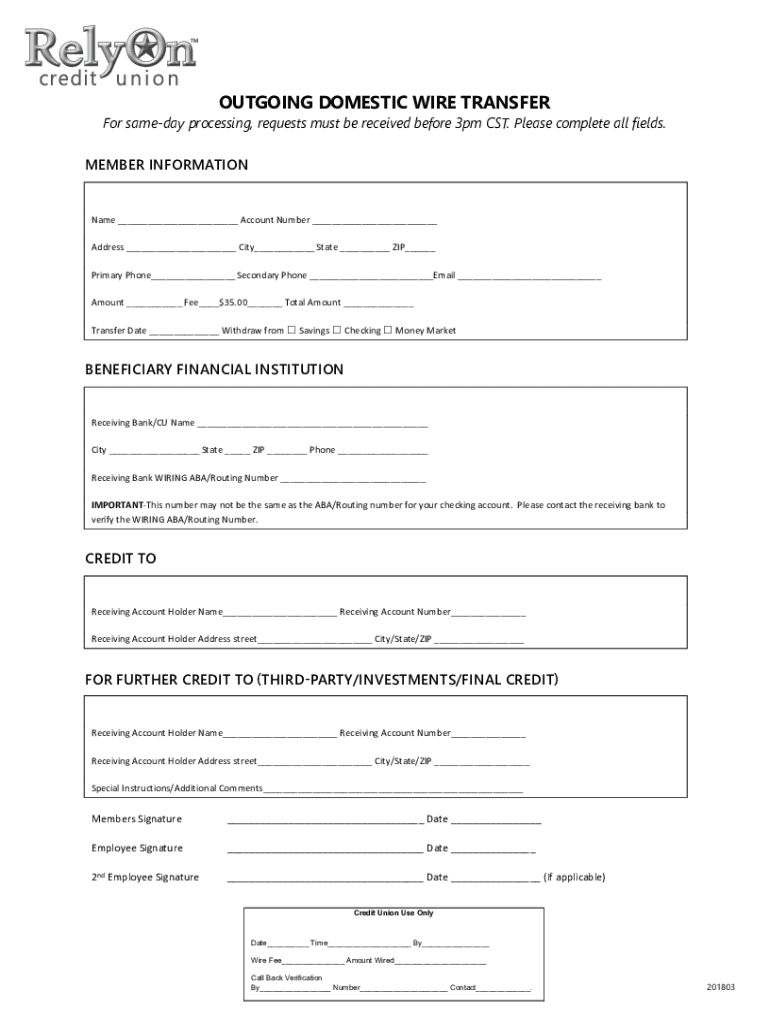

OUTGOING WIRE TRANSFERDOMESTIC OUTGOING DOMESTIC WIRE Transferor someday processing, must be received before 3pm Please complete For same requests day processing, requests must be received before

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign outgoing wire transfers

Edit your outgoing wire transfers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your outgoing wire transfers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing outgoing wire transfers online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit outgoing wire transfers. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out outgoing wire transfers

How to fill out outgoing wire transfers

01

Step 1: Gather the necessary information. You will need the recipient's name, bank account number, and bank routing number.

02

Step 2: Contact your bank or financial institution. They will provide you with a wire transfer form to fill out.

03

Step 3: Fill out the wire transfer form. Enter the recipient's information accurately and double-check for any errors.

04

Step 4: Specify the amount you wish to transfer. Ensure that you have enough funds in your account to cover the transfer amount and any fees.

05

Step 5: Review the form and make sure all the details are correct. Verify any additional charges or fees associated with the wire transfer.

06

Step 6: Submit the completed form to your bank or financial institution. They may require you to sign the form or provide additional identification.

07

Step 7: Provide any additional information requested by your bank, such as the purpose of the wire transfer or any reference numbers.

08

Step 8: Wait for the confirmation of the wire transfer. Your bank will provide you with a receipt or confirmation number for future reference.

09

Step 9: Keep a copy of the wire transfer receipt or confirmation for your records.

10

Step 10: Monitor your bank account to ensure that the transfer has been completed successfully.

Who needs outgoing wire transfers?

01

Outgoing wire transfers are needed by individuals or businesses who wish to send money electronically to another bank account within or outside their country.

02

Individuals who need to make international payments or send large amounts of money quickly often use outgoing wire transfers.

03

Businesses may use wire transfers for various purposes, such as paying vendors, transferring funds between accounts, or making overseas investments.

04

Wire transfers are also useful for individuals who need to send money urgently, such as in cases of emergencies or when making time-sensitive payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send outgoing wire transfers to be eSigned by others?

Once you are ready to share your outgoing wire transfers, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in outgoing wire transfers?

With pdfFiller, it's easy to make changes. Open your outgoing wire transfers in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I fill out outgoing wire transfers on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your outgoing wire transfers by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is outgoing wire transfers?

Outgoing wire transfers are electronic transfers of funds from one bank account to another, initiated by the sender, often used for sending money to individuals or businesses domestically or internationally.

Who is required to file outgoing wire transfers?

Financial institutions and individuals who initiate outgoing wire transfers are typically required to report these transactions to comply with federal regulations, especially for large transfers or those involving international transactions.

How to fill out outgoing wire transfers?

To fill out an outgoing wire transfer, you need to provide the recipient's name, address, account number, the recipient bank's name and address, and the amount to be transferred, along with any required reference information.

What is the purpose of outgoing wire transfers?

The purpose of outgoing wire transfers is to facilitate quick, secure, and electronic transference of funds between bank accounts, allowing for domestic and international payments, business transactions, or personal remittances.

What information must be reported on outgoing wire transfers?

Information that must be reported includes the sender's and recipient's names, addresses, bank account numbers, the amount transferred, and sometimes the purpose of the transaction.

Fill out your outgoing wire transfers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Outgoing Wire Transfers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.