Get the free Charities and Giving - Visalia Host Lions

Show details

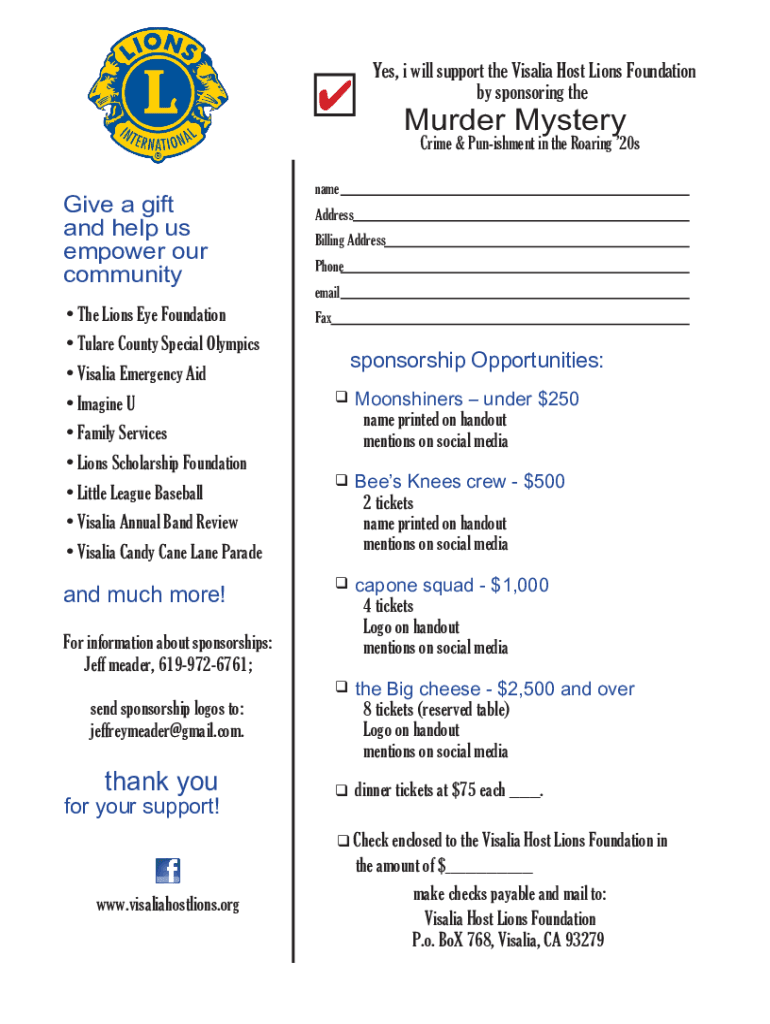

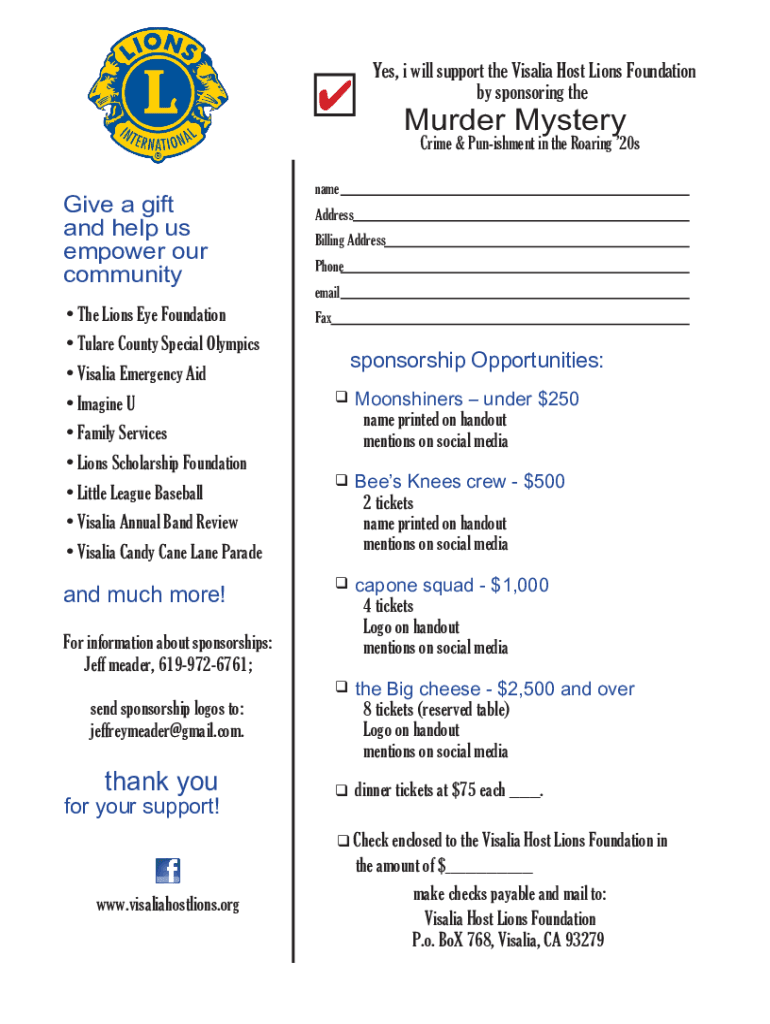

Yes, I will support the Visalia Host Lions Foundation

by sponsoring murder MysteryCrime & Punishment in the Roaring 20sGive a gift

and help us

empower our

community

The Lions Eye Foundation name

Address

Billing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charities and giving

Edit your charities and giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charities and giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charities and giving online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit charities and giving. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charities and giving

How to fill out charities and giving

01

Research and choose a cause or charity that aligns with your values and goals.

02

Determine the type and amount of donation you want to make, whether it's a cash donation, in-kind donation, or volunteering your time.

03

Contact the chosen charity to understand their donation process and any specific requirements.

04

Fill out the necessary donation forms provided by the charity, including personal information and donation details.

05

Ensure you understand the tax implications of your donation and keep any required documentation for tax purposes.

06

Follow any additional instructions provided by the charity to complete the donation process.

07

Track the impact of your donation and stay connected with the charity to see how your contribution is making a difference.

Who needs charities and giving?

01

Charities and giving are needed by various individuals and communities, including:

02

- Impoverished individuals and families who require financial assistance for basic needs like food, shelter, and clothing.

03

- Vulnerable populations such as children, the elderly, and those with disabilities who rely on charities for support and care.

04

- Victims of natural disasters, emergencies, or conflicts who need immediate relief and long-term recovery assistance.

05

- Non-profit organizations working towards social causes like education, healthcare, animal welfare, environmental conservation, and more.

06

- Local communities and grassroots initiatives aiming to improve social and economic conditions for residents.

07

- Researchers, scientists, and medical professionals who require funding to advance knowledge and find cures for diseases.

08

- Arts and cultural organizations that promote creativity, expression, and preserve heritage.

09

- Individuals and groups affected by injustices or systemic issues who rely on advocacy and support from charities.

10

- Society as a whole, as charities and giving contribute to fostering empathy, compassion, and social cohesion.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my charities and giving in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your charities and giving as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send charities and giving for eSignature?

When you're ready to share your charities and giving, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit charities and giving on an Android device?

You can edit, sign, and distribute charities and giving on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is charities and giving?

Charities and giving refer to the act of providing assistance, resources, or financial support to nonprofit organizations and individuals in need. This can include donations, fundraising activities, and volunteering efforts aimed at promoting social welfare.

Who is required to file charities and giving?

Organizations that qualify as charities, typically those recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code, are required to file certain forms to report their financial activities and ensure transparency.

How to fill out charities and giving?

Filling out charities and giving forms typically involves gathering financial statements, detailing income and expenses, and providing information about the organization's mission and activities. Specific forms, such as Form 990, may need to be completed depending on the organization’s size and revenue.

What is the purpose of charities and giving?

The purpose of charities and giving is to promote social welfare by supporting those in need, funding community projects, and addressing various social issues such as poverty, education, healthcare, and the environment.

What information must be reported on charities and giving?

Charitable organizations must report information including revenue, expenses, program services, compensation for officers and directors, and details about governance practices, which can usually be found on forms like the IRS Form 990.

Fill out your charities and giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charities And Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.