Get the free Division of Revenue & Taxation - PalauGov.pw

Show details

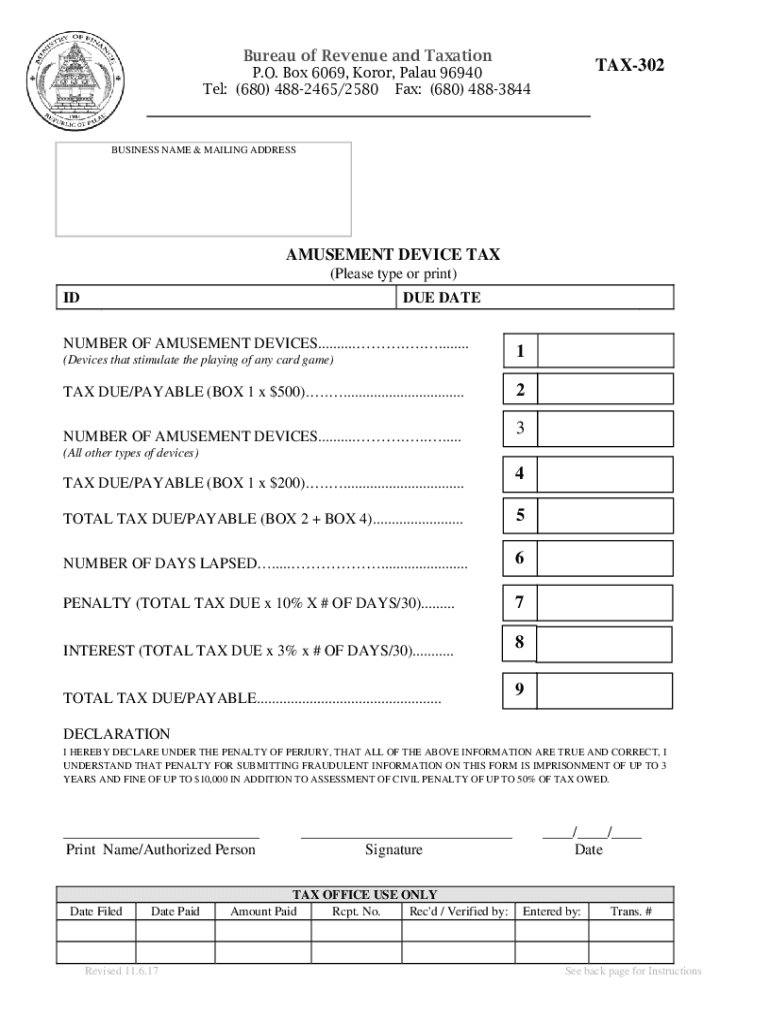

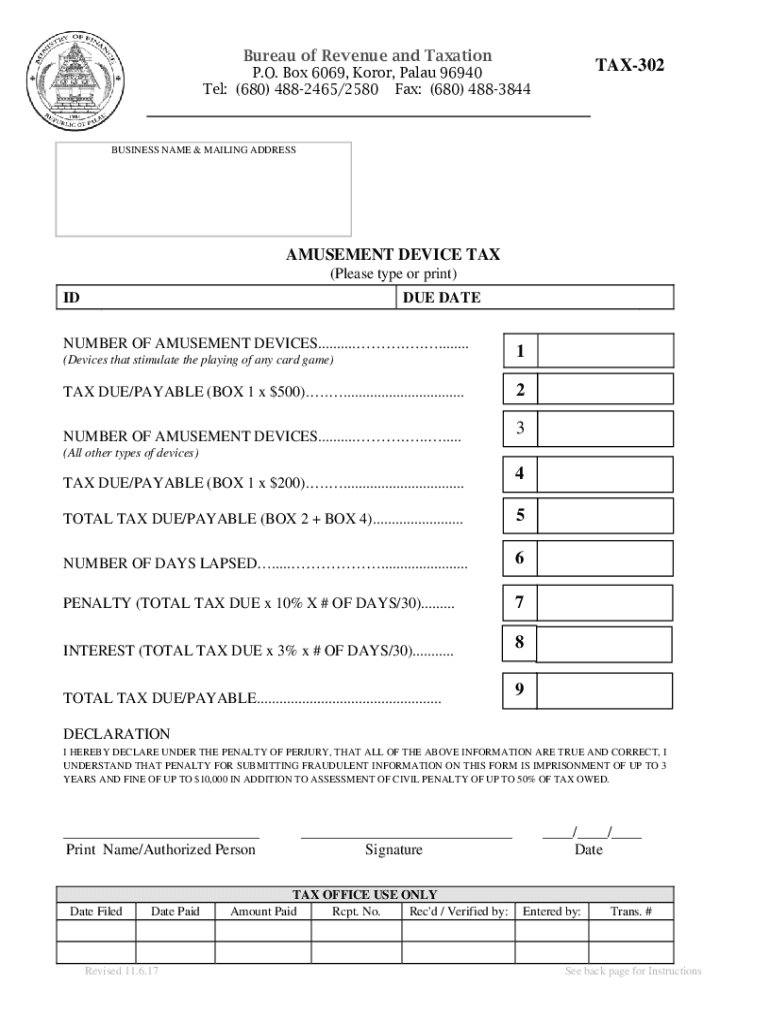

Bureau of Revenue and TaxationTAX302P. O. Box 6069, Color, Paley 96940 Tel: (680) 4882465/2580 Fax: (680) 4883844BUSINESS NAME & MAILING ADDRESSAMUSEMENT DEVICE TAX (Please type or print) DUE OUTNUMBER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign division of revenue ampamp

Edit your division of revenue ampamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your division of revenue ampamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing division of revenue ampamp online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit division of revenue ampamp. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out division of revenue ampamp

How to fill out division of revenue ampamp

01

Start by gathering all the necessary financial data, such as revenue figures, expenses, and any other relevant financial information.

02

Determine the period for which you want to calculate the division of revenue. It could be monthly, quarterly, or annually.

03

Decide on the basis for dividing the revenue. It could be a certain percentage split among stakeholders, or it could be based on individual contributions or investments.

04

Calculate the total revenue for the chosen period by adding up all the income sources.

05

Calculate the total expenses for the same period by summing up all the costs incurred.

06

Determine the profit or loss by subtracting the total expenses from the total revenue.

07

Allocate the division of revenue according to the predetermined basis. This could involve dividing the profit among stakeholders or distributing it based on individual contributions.

08

Document the division of revenue in a clear and concise manner, including all relevant calculations and details.

09

Communicate the division of revenue to all relevant parties, ensuring transparency and clarity.

10

Regularly review and adjust the division of revenue as needed, taking into account changing circumstances or stakeholders' requirements.

Who needs division of revenue ampamp?

01

Division of revenue is primarily needed by businesses and organizations that have multiple stakeholders or partners.

02

It is especially relevant in profit-sharing arrangements, joint ventures, or partnerships where the revenue needs to be fairly distributed among the involved parties.

03

Additionally, organizations with complex financial structures or those aiming for transparency may also utilize division of revenue to ensure accountability and clear financial reporting.

04

Ultimately, anyone involved in a financial arrangement where revenue is shared or distributed can benefit from implementing a division of revenue system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my division of revenue ampamp in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your division of revenue ampamp as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get division of revenue ampamp?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific division of revenue ampamp and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit division of revenue ampamp in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your division of revenue ampamp, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is division of revenue ampamp?

Division of revenue refers to the allocation and distribution of tax revenues among different government entities or departments.

Who is required to file division of revenue ampamp?

Entities or organizations that generate revenue, such as businesses, local government units, or municipalities, are typically required to file the division of revenue.

How to fill out division of revenue ampamp?

To fill out the division of revenue, individuals or entities need to complete the designated forms provided by the revenue authority, ensuring all required financial data is accurately reported.

What is the purpose of division of revenue ampamp?

The purpose of the division of revenue is to ensure fair distribution of tax revenues, support budgeting processes, and promote accountability in financial management.

What information must be reported on division of revenue ampamp?

Information that must be reported includes total revenue generated, the source of revenue, allocation percentages to different agencies, and any relevant financial projections.

Fill out your division of revenue ampamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Division Of Revenue Ampamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.