Get the free Auto Title Loan You can lose your car. Payments Cost Disclosure

Show details

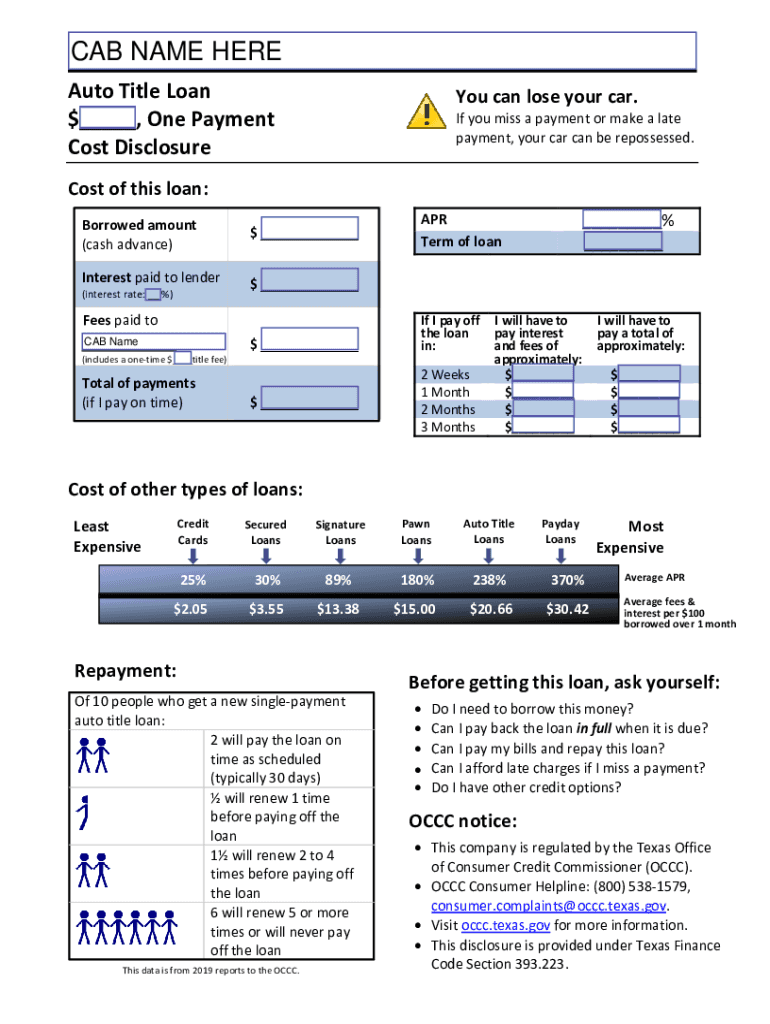

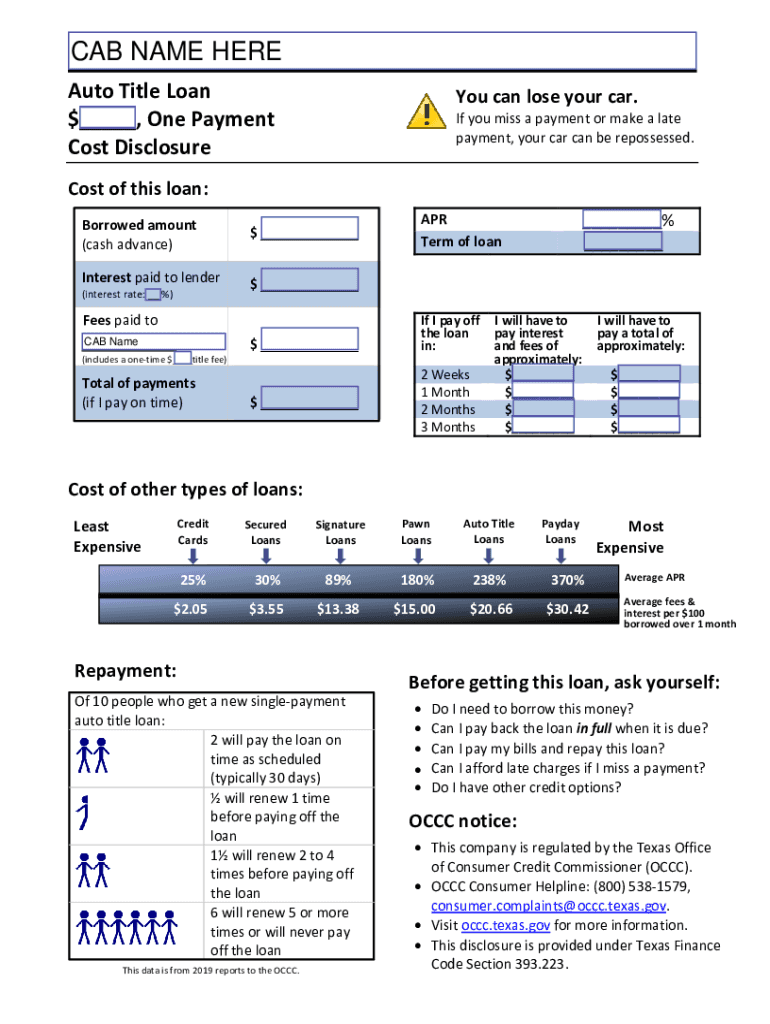

CAB NAME HERE Auto Title Loan $, One Payment Cost Disclosure can lose your car. If you miss a payment or make a late payment, your car can be repossessed. Cost of this loan: Borrowed amount (cash

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign auto title loan you

Edit your auto title loan you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your auto title loan you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit auto title loan you online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit auto title loan you. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out auto title loan you

How to fill out auto title loan you

01

To fill out an auto title loan application, follow these steps:

02

Start by gathering all the necessary documents, including your driver's license, proof of income, proof of residence, and the vehicle title.

03

Contact a reputable auto title loan lender or visit their website to begin the application process.

04

Provide your personal information, such as your name, address, phone number, and Social Security number.

05

Enter details about your vehicle, including its make, model, year, mileage, and condition.

06

Submit the required documents and complete any additional forms or disclosures as requested by the lender.

07

Review the loan terms and conditions, including the interest rate, repayment schedule, and any fees or penalties.

08

If approved, sign the loan agreement and receive your funds. Be sure to understand your repayment obligations and due dates.

09

Make timely payments according to the loan agreement to avoid defaulting on the loan and potential repossession of your vehicle.

10

Once the loan is repaid in full, you will receive your vehicle title back.

11

Note: It is important to carefully consider the terms and costs associated with auto title loans before applying and to only borrow what you can afford to repay.

Who needs auto title loan you?

01

Auto title loans may be suitable for individuals who:

02

- Need quick access to cash but have limited credit options

03

- Own a vehicle with a clear title

04

- Can demonstrate the ability to repay the loan

05

- Have a temporary financial need or emergency

06

- Do not have access to traditional bank loans or prefer not to go through the lengthy application process

07

However, it is essential to carefully evaluate the terms and costs of an auto title loan and consider alternatives before deciding to borrow using your vehicle as collateral.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my auto title loan you directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your auto title loan you and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify auto title loan you without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your auto title loan you into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out auto title loan you using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign auto title loan you and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is auto title loan you?

An auto title loan is a type of secured loan where the borrower uses their vehicle title as collateral. This allows individuals to borrow money quickly against the value of their car.

Who is required to file auto title loan you?

Individuals who own a vehicle and want to obtain a title loan are required to file for an auto title loan using their vehicle title.

How to fill out auto title loan you?

To fill out an auto title loan application, you typically need to provide personal identification, the vehicle title, information about the vehicle (such as make, model, year, and vehicle identification number), and details about your income and expenses.

What is the purpose of auto title loan you?

The purpose of an auto title loan is to provide quick access to cash for individuals who may need urgent funds, often for unexpected expenses or emergencies.

What information must be reported on auto title loan you?

The information that must be reported includes the borrower's personal details, the vehicle title information, income information, and any existing loans or liens on the vehicle.

Fill out your auto title loan you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Auto Title Loan You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.