NE DoR 13 2022-2026 free printable template

Show details

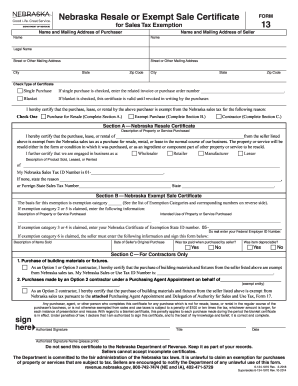

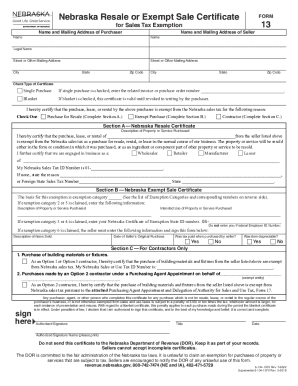

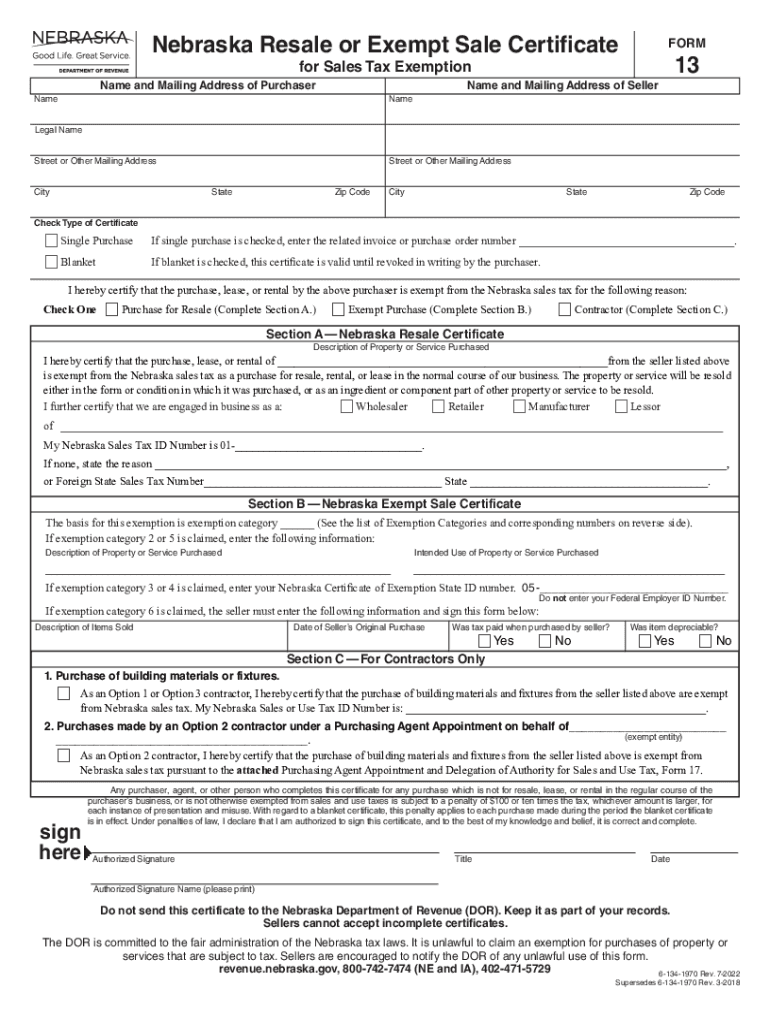

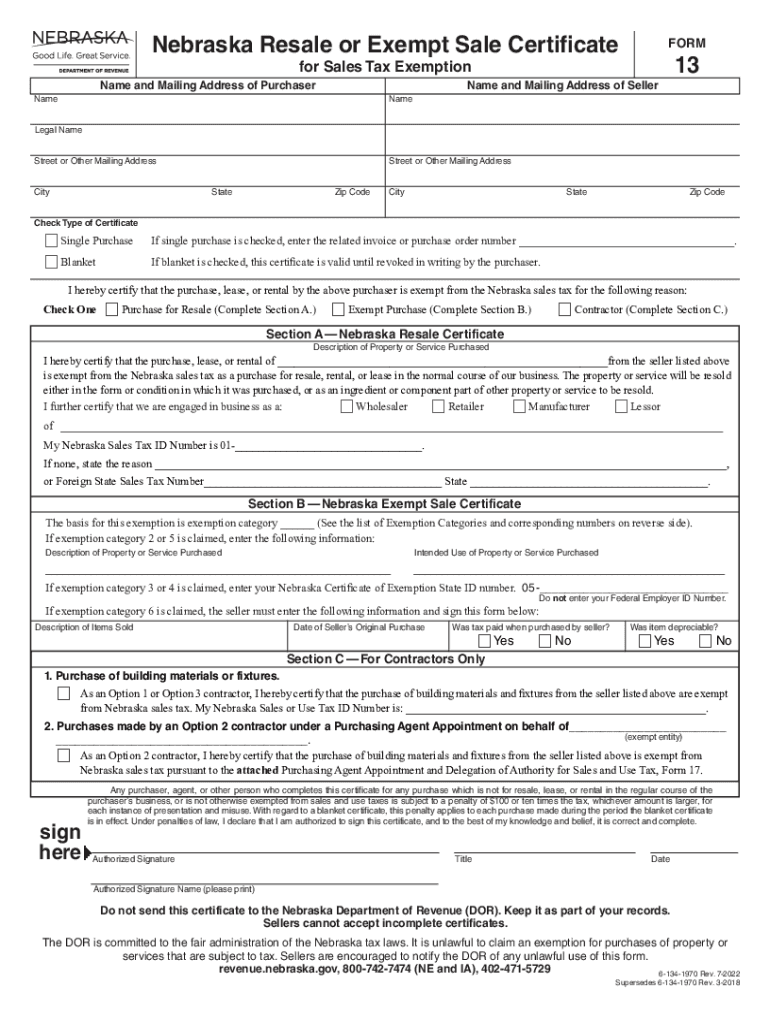

RESET FOOTPRINT FORM Nebraska Resale or Exempt Sale CertificateFORMfor Sales Tax ExemptionName and Mailing Address of PurchaserName and Mailing Address of SellerName13Name Legal Backstreet or Other

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ne form 13 tax exemption

Edit your nebraska form 13 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 13 exemption fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nebraska form 13 pdf online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 13 nebraska. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE DoR 13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nebraska revenue 13 tax exemption print form

How to fill out NE DoR 13

01

Gather necessary documents and information required for NE DoR 13.

02

Start by filling out the identification section with your name, address, and contact information.

03

Provide relevant details regarding the purpose for filing the NE DoR 13.

04

Complete any financial sections by reporting income or assets as required.

05

Review the form for accuracy and completeness before submission.

06

Submit the form by the specified method, ensuring you keep a copy for your records.

Who needs NE DoR 13?

01

Individuals or entities who are reporting specific financial information or changes.

02

Anyone required to comply with state reporting requirements.

03

Taxpayers seeking to clarify their reporting obligations under Nebraska state laws.

Fill

nebraska 13 resale exemption form

: Try Risk Free

People Also Ask about nebraska revenue resale certificate exemption

What is exempt from Nebraska sales tax?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)LaundromatsNoneMedicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNone9 more rows

At what age do you stop paying property tax in Nebraska?

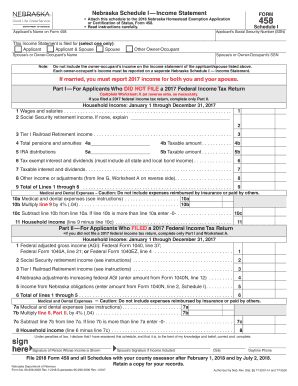

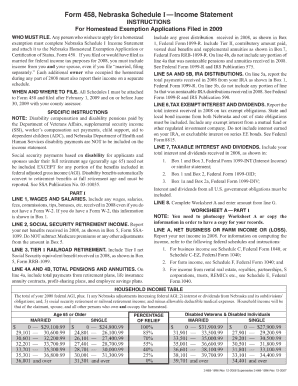

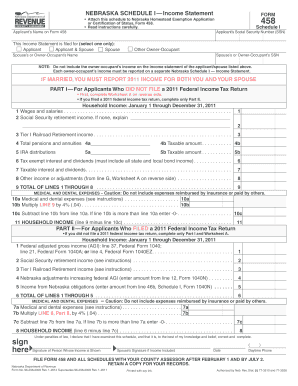

77-3502. To qualify for a homestead exemption under this category, an individual must: ❖ Be 65 or older before January 1 of the application year; ❖ Own and occupy a homestead continuously from January 1 through August 15; and ❖ Have qualifying household income – see Table I. Maximum Exempt Amount.

How long do you have to pay property taxes in Nebraska?

Property taxes are paid to the county treasurer. The first half of the tax becomes delinquent on the following May 1, and the second half becomes delinquent on September 1; except in Douglas, Lancaster, and Sarpy counties, where the first half is delinquent on April 1, and second half becomes delinquent on August 1.

What is the tax break for seniors in Nebraska?

The maximum eligible income for partial exemptions to singles older than 65 will rise from $24,200 to $39,500. Married couples with income less than $34,701 will see a 100% exemption from property taxes. Those having developmental disabilities will become eligible.

What is the agricultural tax exemption in Nebraska?

Purchases and leases of depreciable agricultural machinery and equipment are exempt from Nebraska and local sales and use taxes when purchased or leased for direct use in commercial agriculture.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete nebraska 13 sale tax exemption form online?

Easy online NE DoR 13 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in NE DoR 13 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NE DoR 13 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the NE DoR 13 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NE DoR 13 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NE DoR 13?

NE DoR 13 refers to the Northeastern Department of Revenue's form that is used for specific reporting requirements related to financial activities.

Who is required to file NE DoR 13?

Entities and individuals engaged in certain financial transactions or operating within the Northeastern region may be required to file NE DoR 13.

How to fill out NE DoR 13?

NE DoR 13 should be filled out by providing the required financial information, ensuring all sections are completed accurately and submitting the form to the appropriate department.

What is the purpose of NE DoR 13?

The purpose of NE DoR 13 is to collect data on financial transactions for regulatory and tax compliance within the Northeastern jurisdiction.

What information must be reported on NE DoR 13?

NE DoR 13 requires reporting information such as financial transaction details, entity identification, and other relevant financial data.

Fill out your NE DoR 13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE DoR 13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.