Get the free FLEXIBLE SPENDING ACCOUNT (FSA) - NueSynergy

Show details

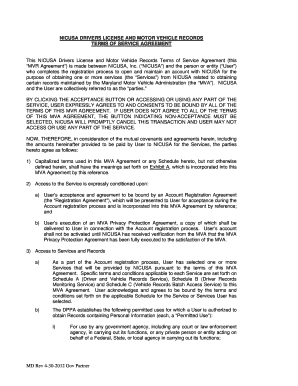

FLEXIBLE SPENDING ACCOUNT (FSA) Welcome KitNueSynergy, Inc. 4601 College Blvd, Ste. 280 Leawood, KS 66211 855.750.9440 CustomerService NueSynergy.com www.mybluekcfsa.comYOUR FSA What is an FSA? Dependent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending account fsa

Edit your flexible spending account fsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending account fsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flexible spending account fsa online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit flexible spending account fsa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible spending account fsa

How to fill out flexible spending account fsa

01

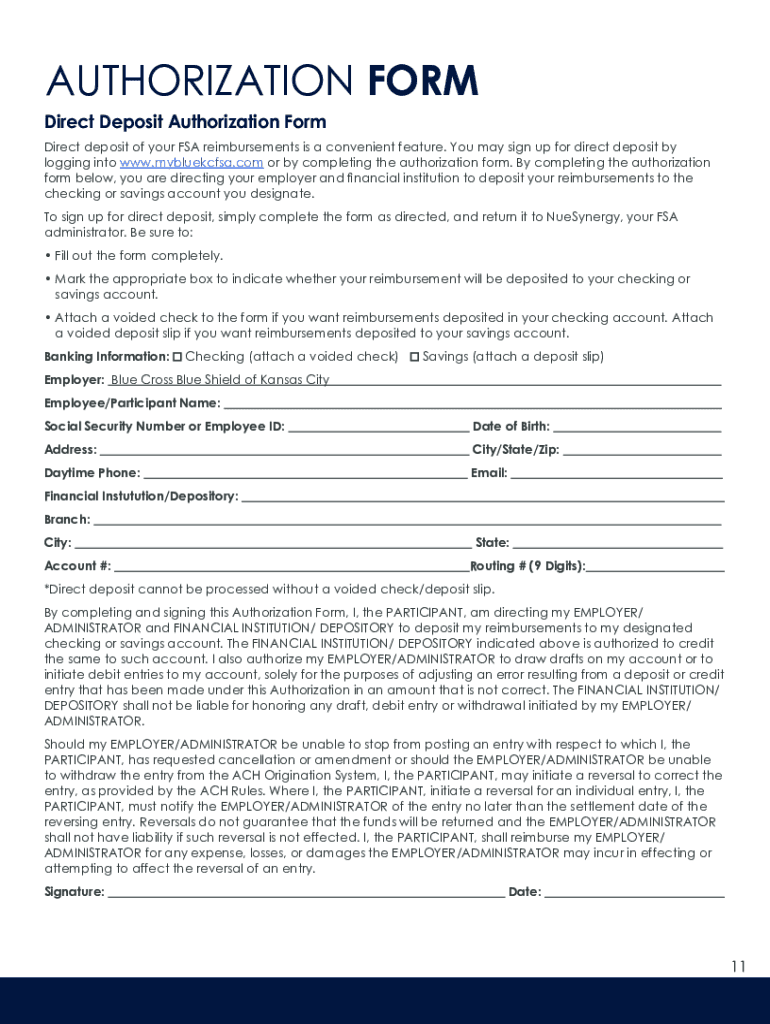

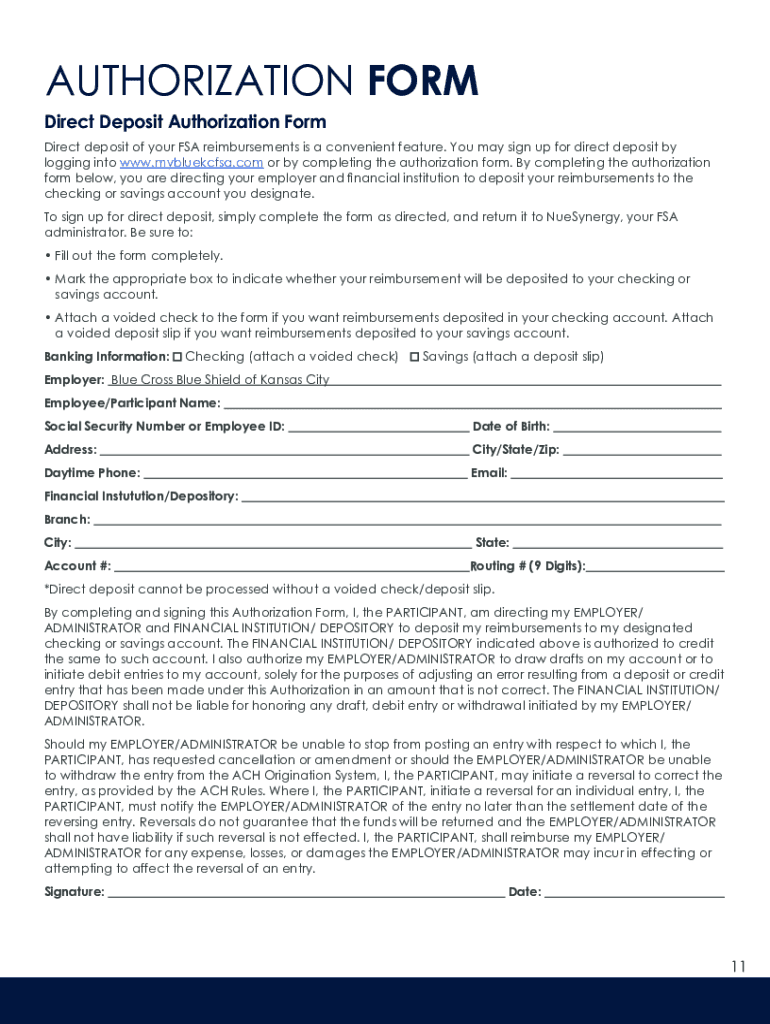

To fill out a flexible spending account (FSA), follow these steps:

02

Determine the amount you want to contribute to your FSA for the year. This is the maximum amount you can save on a pre-tax basis.

03

Check with your employer to understand the specific rules and deadlines for your FSA enrollment.

04

Enroll in your employer's FSA program during the open enrollment period.

05

Estimate your eligible expenses for the year, such as healthcare or dependent care costs.

06

Keep track of your eligible expenses throughout the year by saving receipts and other relevant documentation.

07

Submit claims for reimbursement according to the procedures outlined by your FSA administrator.

08

Make sure to adhere to any deadlines for submitting claims and spend the allocated funds within the plan year.

09

Consult with your employer or FSA administrator for any specific instructions or additional details.

Who needs flexible spending account fsa?

01

Flexible spending accounts (FSAs) are suitable for individuals who want to save money on eligible expenses through pre-tax dollars. Those who have predictable healthcare expenses, such as regular medications, doctor visits, or dental work, can benefit from an FSA. Additionally, parents who have dependent care expenses, including daycare or after-school programs, can also take advantage of an FSA. It's important to note that not everyone may need an FSA, and it is recommended to assess your individual financial situation and expenses before deciding to enroll.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my flexible spending account fsa directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your flexible spending account fsa and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit flexible spending account fsa from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including flexible spending account fsa, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute flexible spending account fsa online?

Easy online flexible spending account fsa completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is flexible spending account fsa?

A flexible spending account (FSA) is a special account that allows employees to set aside pre-tax earnings to pay for eligible expenses, such as medical expenses and dependent care costs.

Who is required to file flexible spending account fsa?

Typically, employees who have enrolled in a flexible spending account through their employer are required to file for reimbursement of eligible expenses.

How to fill out flexible spending account fsa?

To fill out a flexible spending account claim, gather all necessary receipts and documentation, complete the claim form provided by your employer or FSA administrator, and submit it along with the receipts for reimbursement.

What is the purpose of flexible spending account fsa?

The purpose of a flexible spending account is to help employees save money on taxes while allowing them to use pre-tax dollars to pay for eligible health and dependent care expenses.

What information must be reported on flexible spending account fsa?

Information that must be reported typically includes the amount of expenses incurred, description of the expenses, date of services, and receipts or proof of payment.

Fill out your flexible spending account fsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Account Fsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.