Get the free Assessor's True and Fair Value ... - Thurston County

Show details

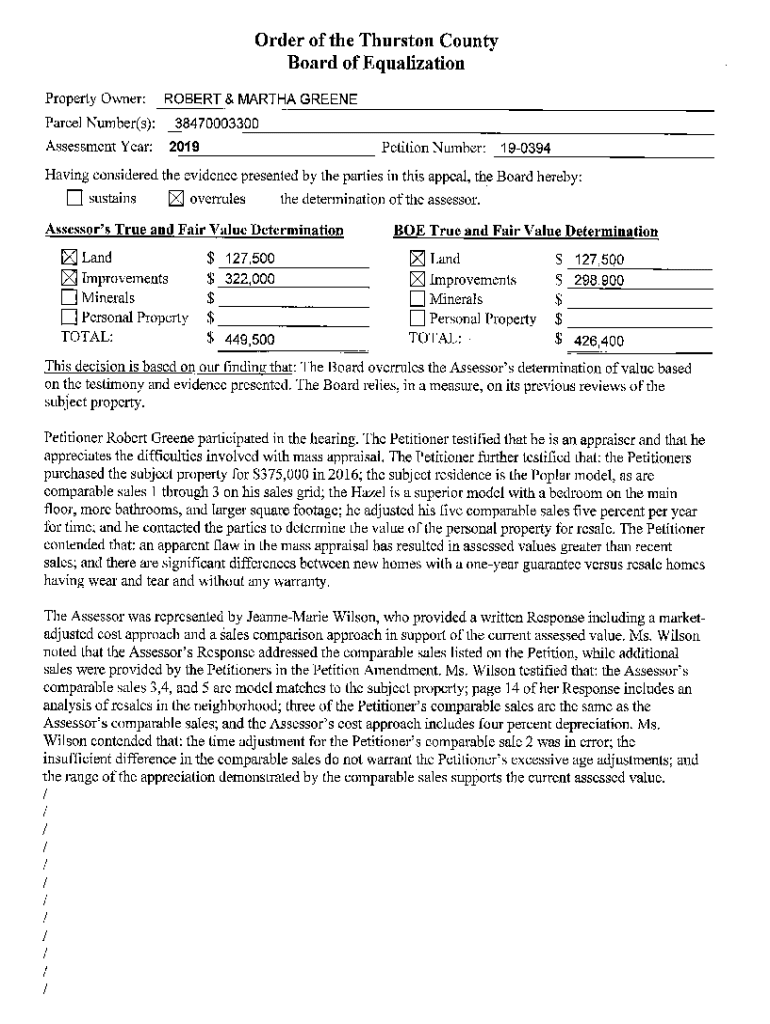

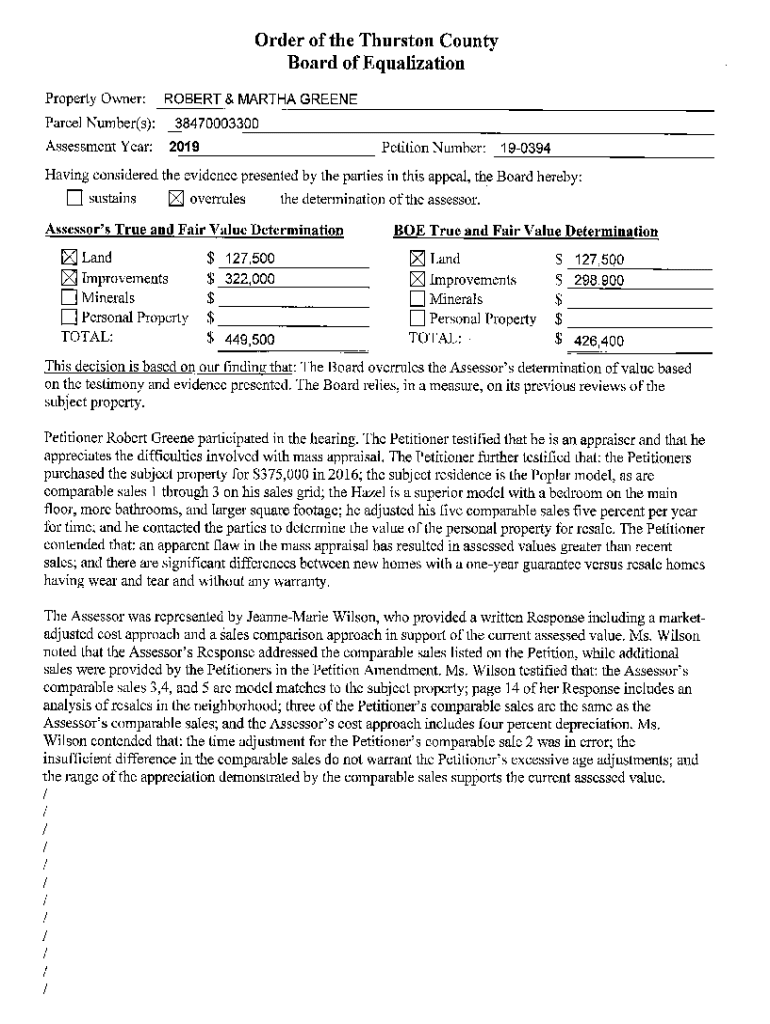

Order of the Thurston County Board of EqualizationProperty Owner: Parcel Number(s): AssessmentYear:ROBERT & MARTHA GREENE 38470003300 2019Petition Number:19 0394Having considered the evidence presented

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assessors true and fair

Edit your assessors true and fair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assessors true and fair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing assessors true and fair online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit assessors true and fair. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assessors true and fair

How to fill out assessors true and fair

01

To fill out assessors true and fair, follow these steps:

02

Read the instructions carefully to understand the purpose and requirements of the assessors true and fair.

03

Gather all the relevant financial information, including balance sheets, income statements, and cash flow statements.

04

Review the financial data to ensure its accuracy and completeness.

05

Analyze the financial data to assess the company's overall financial position and performance.

06

Evaluate the company's assets, liabilities, and equity, considering factors like depreciation, inventory valuation, and capitalization methods.

07

Assess the company's revenue recognition policies, expense recognition practices, and accounting for contingencies.

08

Review and validate the disclosures made in the financial statements.

09

Apply relevant accounting standards, regulations, and principles to ensure compliance.

10

Prepare a comprehensive report summarizing your findings and concluding whether the financial statements present a true and fair view of the company's financial position and performance.

11

Review and revise the report as necessary before finalizing and submitting it.

Who needs assessors true and fair?

01

Assessors true and fair are primarily needed by:

02

- External auditors who evaluate the financial statements of companies to provide an independent and objective opinion on their true and fair presentation.

03

- Regulatory authorities that monitor compliance with accounting standards and regulations.

04

- Investors and financial institutions who rely on the true and fair assessment to make informed decisions about investing or lending to a company.

05

- Company management and shareholders who need assurance about the accuracy and reliability of the financial information for decision-making purposes.

06

- Potential buyers or partners who require an assessment of the company's financial health before entering into a transaction.

07

- Court or legal authorities involved in litigation or disputes that require a valuation of financial statements.

08

- Tax authorities who assess the company's tax liability based on the true and fair presentation of financial information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the assessors true and fair in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your assessors true and fair directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out the assessors true and fair form on my smartphone?

Use the pdfFiller mobile app to complete and sign assessors true and fair on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out assessors true and fair on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your assessors true and fair. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is assessors true and fair?

Assessors true and fair is a document that provides an accurate and honest assessment of the value of properties for taxation purposes.

Who is required to file assessors true and fair?

Property owners and assessors are typically required to file assessors true and fair to ensure proper valuation of properties for tax purposes.

How to fill out assessors true and fair?

To fill out assessors true and fair, you typically need to provide property details, valuation information, and any relevant supporting documents as required by the local tax authority.

What is the purpose of assessors true and fair?

The purpose of assessors true and fair is to ensure that property valuations are accurate and equitable, leading to fair taxation.

What information must be reported on assessors true and fair?

Information that must be reported includes property location, current valuation, ownership details, and any relevant exemptions or deductions.

Fill out your assessors true and fair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assessors True And Fair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.