Get the free INSTRUCTIONS FOR FILING MONTHLY EMPLOYMENT UTILIZATION ...

Show details

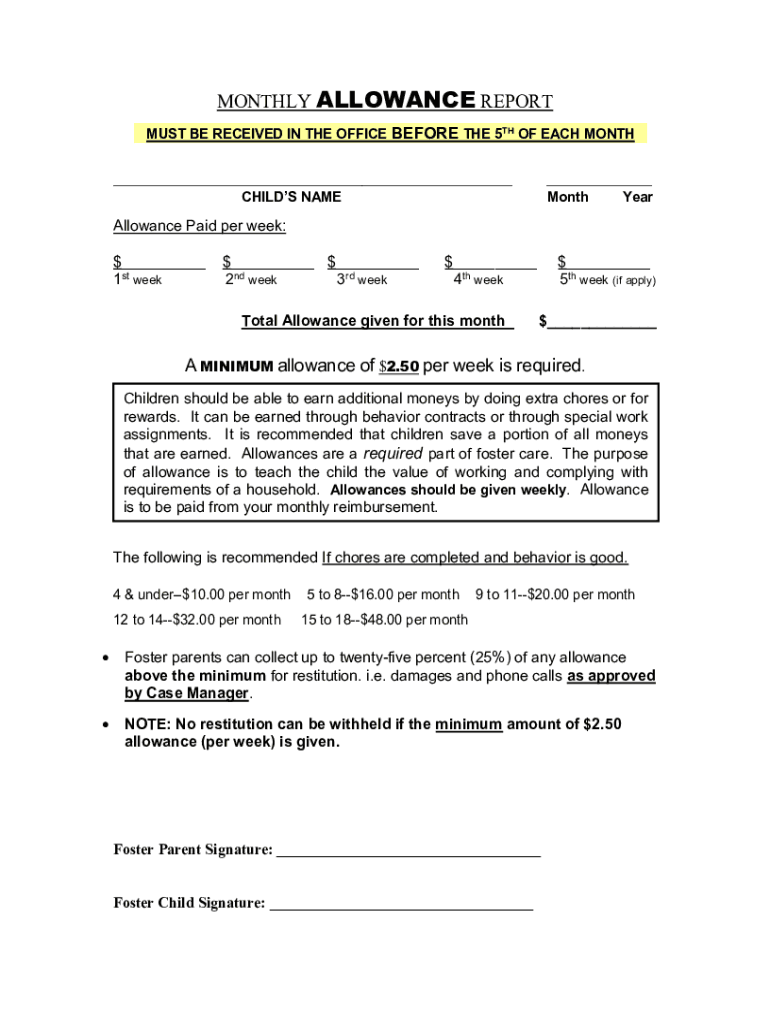

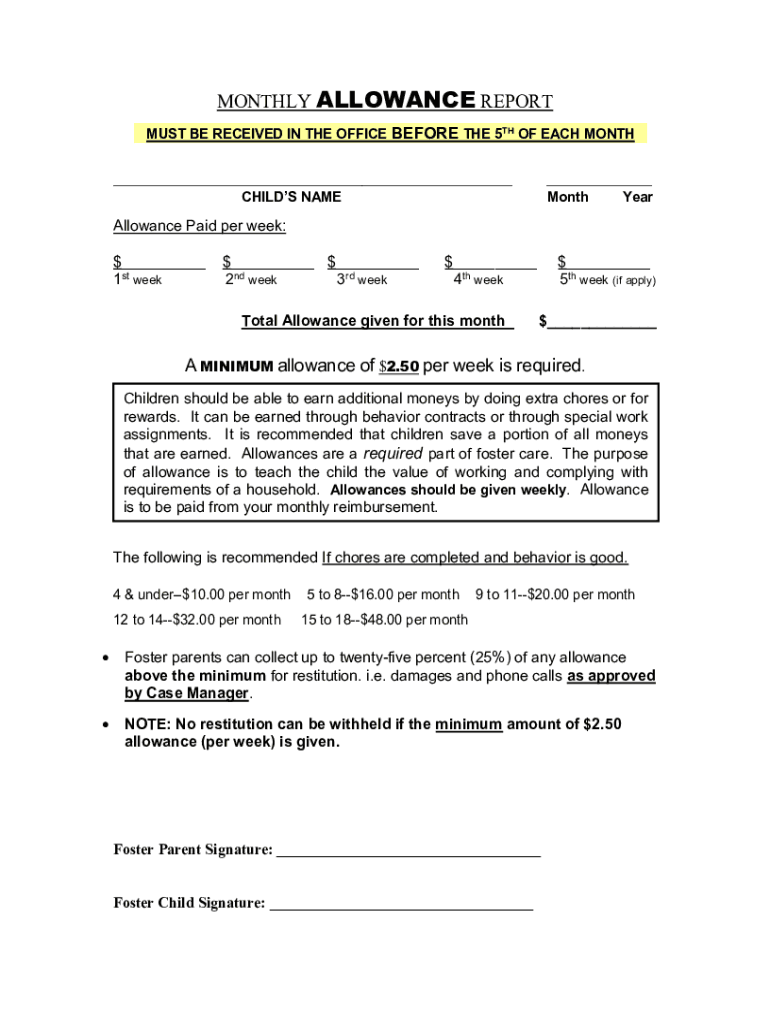

MONTHLY ALLOWANCE REPORT MUST BE RECEIVED IN THE OFFICE BEFORE THE 5TH OF EACH MONTH CHILD NAMEMonthYearAllowance Paid per week: $ 1st week $ 2nd week 3rd week 4th teetotal Allowance given for this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for filing monthly

Edit your instructions for filing monthly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for filing monthly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit instructions for filing monthly online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit instructions for filing monthly. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for filing monthly

How to fill out instructions for filing monthly

01

To fill out instructions for filing monthly, follow these steps:

02

Start by gathering all the necessary documents and information related to the monthly filing.

03

Create a new document or open the existing template for filing instructions.

04

Add a title or header to clearly indicate that it is the instructions for filing monthly.

05

Begin with an introduction or overview of the filing process, explaining the purpose and importance of monthly filing.

06

Divide the instructions into clear and concise sections or steps, making it easier for the reader to follow.

07

Provide detailed explanations and examples for each step, if applicable.

08

Use bullet points or numbered lists to organize the information and make it visually appealing.

09

Include any relevant forms, documents, or references that need to be filled out or consulted during the filing process.

10

Review and proofread the instructions to ensure they are clear, accurate, and easy to understand.

11

Save the document in a suitable format, such as PDF or Word, and distribute it to the intended audience.

12

If necessary, update the instructions regularly to reflect any changes in the filing process or requirements.

13

Finally, make sure to provide contact information or additional resources for further assistance or clarification.

Who needs instructions for filing monthly?

01

Anyone who is required to file monthly reports or submissions needs instructions for filing monthly.

02

This can include individuals, businesses, organizations, or government entities.

03

Instructions are especially useful for those who are new to the filing process or those who need a refresher on the requirements.

04

Additionally, instructions can provide guidance and support for individuals with limited knowledge or experience in the specific filing procedure.

05

In summary, anyone who wants to ensure accurate and timely monthly filing should refer to instructions specifically tailored to their requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out instructions for filing monthly on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your instructions for filing monthly, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit instructions for filing monthly on an Android device?

The pdfFiller app for Android allows you to edit PDF files like instructions for filing monthly. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete instructions for filing monthly on an Android device?

Use the pdfFiller app for Android to finish your instructions for filing monthly. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is instructions for filing monthly?

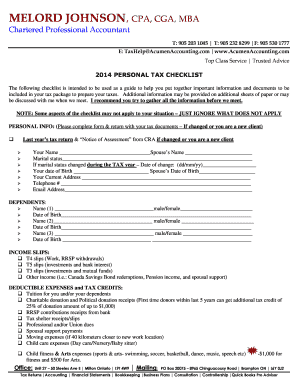

Instructions for filing monthly refer to the guidelines and procedures that individuals or businesses must follow to report their financial activities or tax obligations on a monthly basis.

Who is required to file instructions for filing monthly?

Generally, businesses and individuals who meet certain income thresholds or are involved in specific activities, such as sales tax reporting or payroll, are required to file monthly.

How to fill out instructions for filing monthly?

To fill out instructions for filing monthly, one should gather all necessary financial information, complete the designated forms accurately, and ensure all calculations are correct before submission.

What is the purpose of instructions for filing monthly?

The purpose of instructions for filing monthly is to ensure accurate and timely reporting of financial activities, which helps in compliance with tax regulations and facilitates proper revenue collection.

What information must be reported on instructions for filing monthly?

Typically, information such as gross sales, deductions, net taxable income, and any relevant tax amounts need to be reported on instructions for filing monthly.

Fill out your instructions for filing monthly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Filing Monthly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.