Get the free Offshore Voluntary Disclosure Program - Internal Revenue Service

Show details

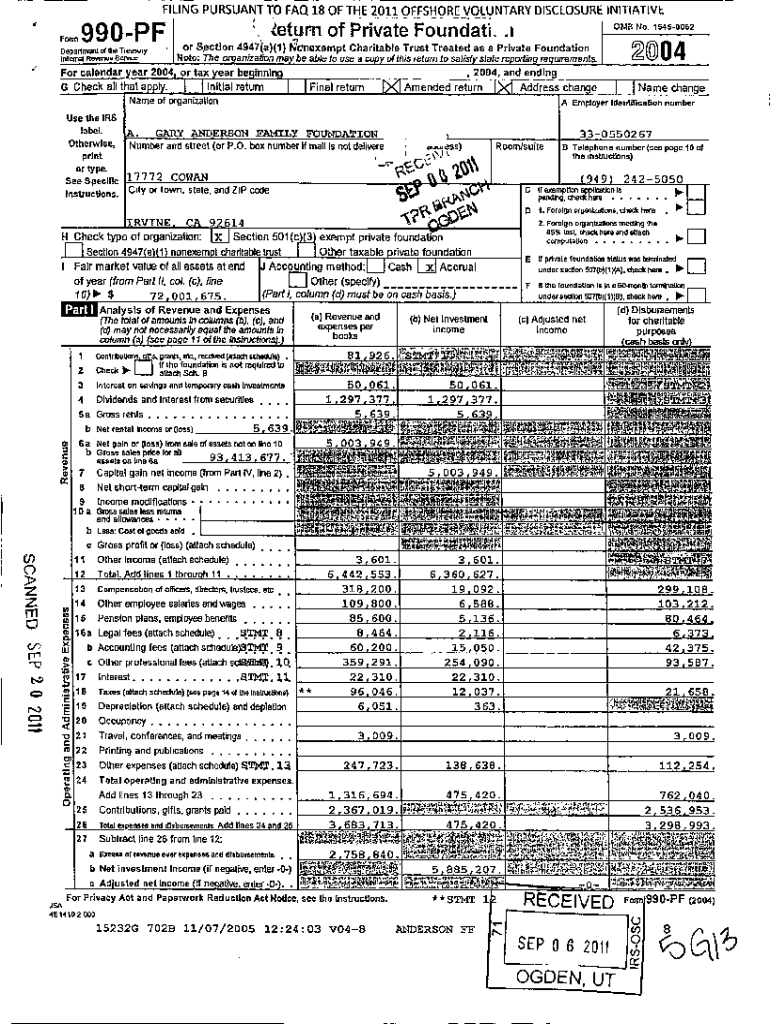

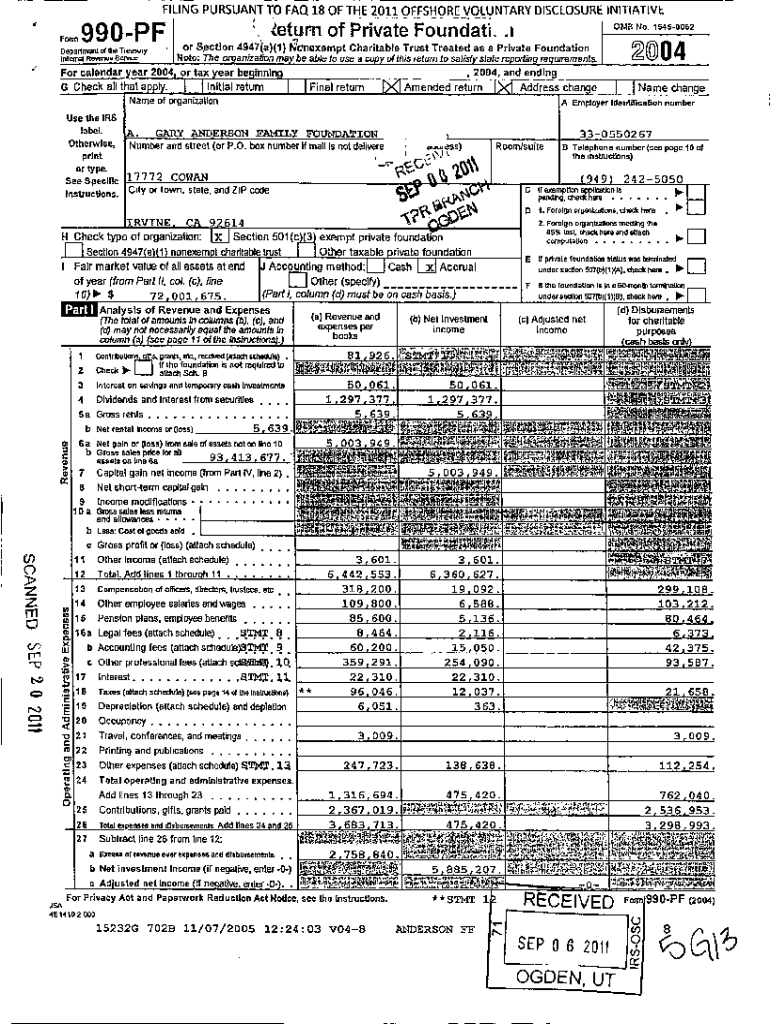

FILING PURSUANT TO FAQ 18 OF THE 2011 OFFSHORE VOLUNTARY DISCLOSURE INITIATIVE return of Private Foundation, Form 99oPF0MB No. 15450052

IOR Section 4947(a)(1) M2nexempt Charitable Trust Treated as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign offshore voluntary disclosure program

Edit your offshore voluntary disclosure program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your offshore voluntary disclosure program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing offshore voluntary disclosure program online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit offshore voluntary disclosure program. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out offshore voluntary disclosure program

How to fill out offshore voluntary disclosure program

01

Step 1: Gather all relevant information about your offshore accounts and assets, including bank statements, income records, and investment documents.

02

Step 2: Determine whether you are eligible to participate in the Offshore Voluntary Disclosure Program (OVDP) by reviewing the program requirements and guidelines.

03

Step 3: Complete the necessary forms and documents, such as Form 14457, Report of Foreign Bank and Financial Accounts (FBAR), and the relevant tax returns for each year of non-compliance.

04

Step 4: Calculate the associated taxes, penalties, and interest owed based on the OVDP instructions and guidelines.

05

Step 5: Submit the completed forms, documents, and payment to the Internal Revenue Service (IRS) address provided in the OVDP instructions.

06

Step 6: Await confirmation from the IRS regarding the acceptance of your voluntary disclosure and the resolution of your tax obligations.

07

Step 7: Cooperate with the IRS during any requests for additional information or documentation to ensure a smooth processing of your case.

08

Step 8: Consult with a tax professional or attorney specializing in offshore voluntary disclosures to guide you through the process and ensure compliance with all requirements.

Who needs offshore voluntary disclosure program?

01

Anyone who has undisclosed offshore accounts or assets that have generated income or produced taxable gains may need to consider participating in the Offshore Voluntary Disclosure Program.

02

Individuals or entities who have willfully failed to report their offshore income and assets, or purposely evaded U.S. tax obligations, are especially in need of the program to avoid potential criminal prosecution and mitigate civil penalties.

03

It is advisable for taxpayers with significant financial interests in foreign financial accounts, investments, or businesses to consult with a tax professional to determine if participation in the OVDP is appropriate for their specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send offshore voluntary disclosure program to be eSigned by others?

When your offshore voluntary disclosure program is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete offshore voluntary disclosure program online?

Filling out and eSigning offshore voluntary disclosure program is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out offshore voluntary disclosure program using my mobile device?

Use the pdfFiller mobile app to complete and sign offshore voluntary disclosure program on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is offshore voluntary disclosure program?

The Offshore Voluntary Disclosure Program (OVDP) is a program offered by the IRS that allows U.S. taxpayers with undisclosed foreign financial assets to report them and come into compliance with U.S. tax laws while avoiding severe penalties.

Who is required to file offshore voluntary disclosure program?

Taxpayers who have undisclosed foreign income, assets, or accounts, and who wish to avoid potential penalties and legal repercussions are required to file under the OVDP.

How to fill out offshore voluntary disclosure program?

To fill out the OVDP, taxpayers must complete the OVDP application, including Form 14653 (for streamlined disclosure) or Form 1150 (for traditional disclosure), and provide the necessary financial and tax information about their foreign accounts.

What is the purpose of offshore voluntary disclosure program?

The purpose of the OVDP is to encourage taxpayers to disclose their foreign assets and income, thereby increasing compliance with tax regulations and allowing them to avoid or reduce penalties and legal actions.

What information must be reported on offshore voluntary disclosure program?

Taxpayers must report income from foreign sources, account balances, details of foreign accounts, and any foreign assets in the OVDP application, along with their tax returns for the years in question.

Fill out your offshore voluntary disclosure program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Offshore Voluntary Disclosure Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.