Get the free REGISTERED INCOME PLAN PAYMENT FORM

Show details

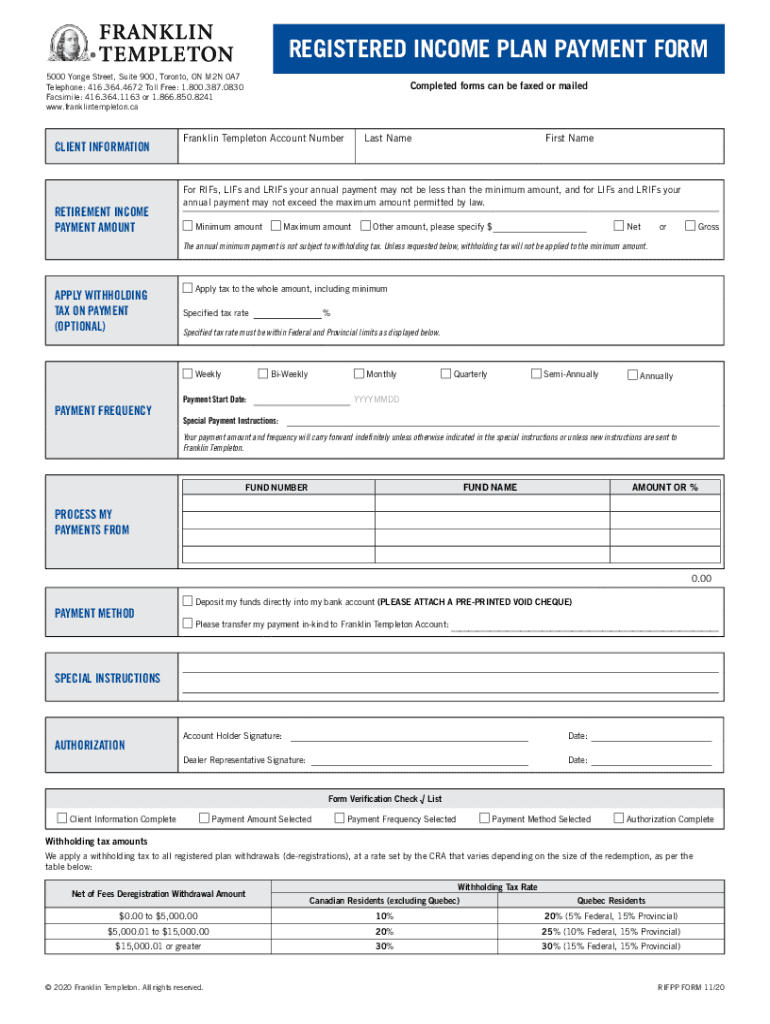

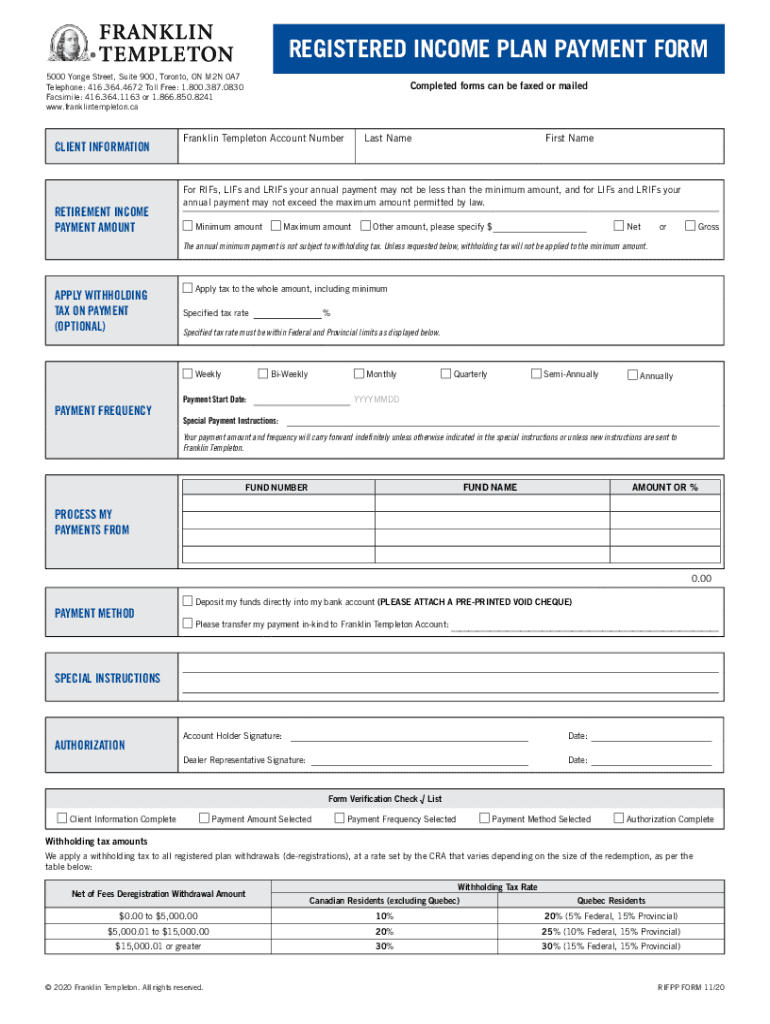

This document contains both information and form fields. To read information, use the Down Grow from a form field. REGISTERED INCOME PLAN PAYMENT FORM

5000 Yong Street, Suite 900, Toronto, ON M2N

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registered income plan payment

Edit your registered income plan payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registered income plan payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registered income plan payment online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit registered income plan payment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registered income plan payment

How to fill out registered income plan payment

01

To fill out a registered income plan payment, follow these steps:

02

Start by gathering all the necessary information and documents, including your personal details, income details, and any supporting documents.

03

Ensure that you have an active registered income plan account.

04

Login to your registered income plan account using the provided credentials.

05

Navigate to the 'Payment' or 'Contribution' section of your account.

06

Select the option to make a new payment or contribution.

07

Enter the amount you wish to contribute or pay into the registered income plan.

08

Choose the payment method that suits you best, such as credit/debit card, bank transfer, or any other available options.

09

Provide any additional information or documents requested during the payment process.

10

Review all the entered details for accuracy and make any necessary adjustments.

11

Once you are satisfied with the information provided, submit the payment or contribution.

12

Wait for a confirmation message or receipt, which will acknowledge the successful completion of your registered income plan payment.

Who needs registered income plan payment?

01

A registered income plan payment is typically needed by individuals who:

02

- Have an active registered income plan account.

03

- Want to contribute or pay money into their registered income plan.

04

- Wish to build up savings for retirement or future use.

05

- Desire to take advantage of tax benefits or incentives provided by registered income plans.

06

- Are seeking a secure and regulated investment option for their income.

07

- Aim to receive regular income payments from their registered income plan.

08

Note that specific eligibility criteria, rules, and regulations may vary depending on the jurisdiction and type of registered income plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit registered income plan payment from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your registered income plan payment into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit registered income plan payment on an Android device?

The pdfFiller app for Android allows you to edit PDF files like registered income plan payment. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete registered income plan payment on an Android device?

Use the pdfFiller mobile app and complete your registered income plan payment and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is registered income plan payment?

A registered income plan payment is a payment made into a registered income plan, which is a type of financial instrument designed to provide tax advantages and ensure steady income for individuals, often during retirement.

Who is required to file registered income plan payment?

Individuals who contribute to a registered income plan, such as RRSPs (Registered Retirement Savings Plans) in Canada, are required to file registered income plan payments.

How to fill out registered income plan payment?

To fill out a registered income plan payment, individuals should provide their personal information, the amount being contributed, and any required account details on the designated form or application.

What is the purpose of registered income plan payment?

The purpose of registered income plan payments is to enable individuals to invest for retirement in a tax-advantaged way, thus promoting saving and financial security for the future.

What information must be reported on registered income plan payment?

Information required typically includes the contributor's name, social security number or equivalent, the payment amount, and the account to which the payment is being made.

Fill out your registered income plan payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registered Income Plan Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.