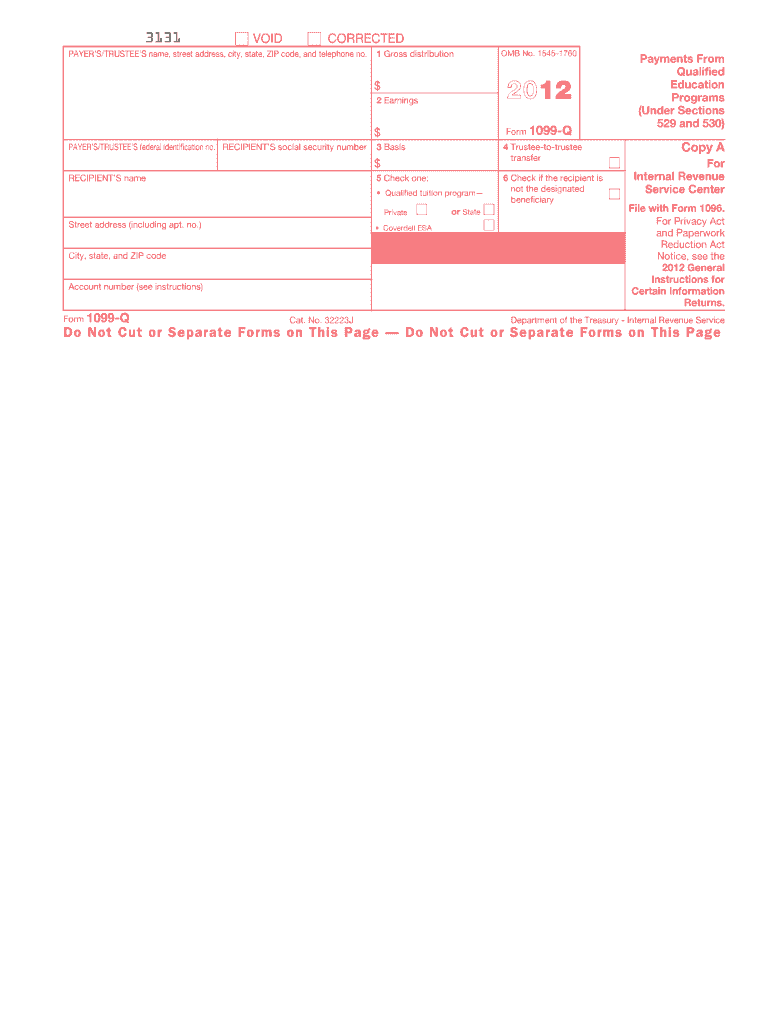

IRS 1099-Q 2012 free printable template

Instructions and Help about IRS 1099-Q

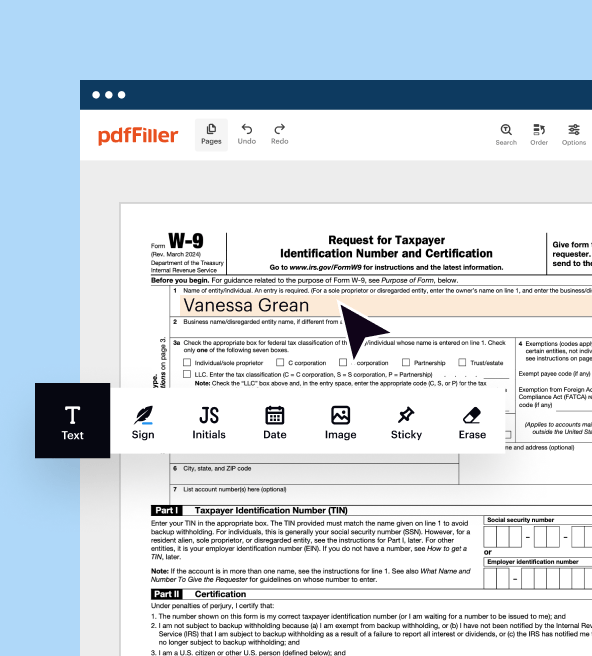

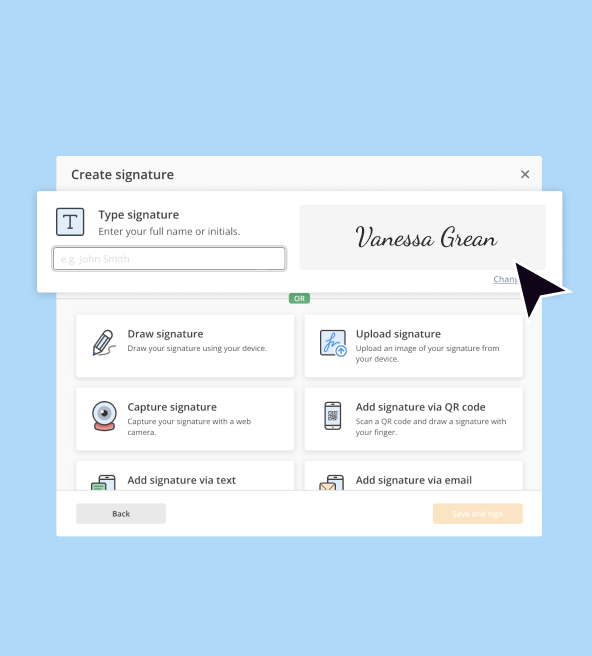

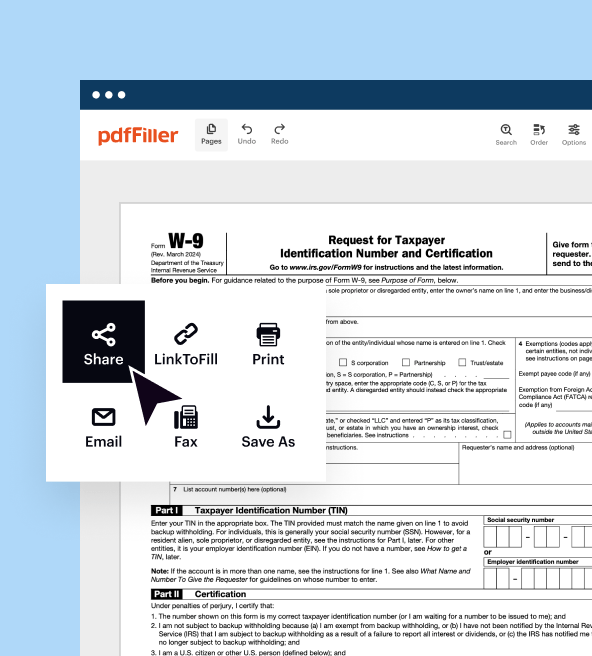

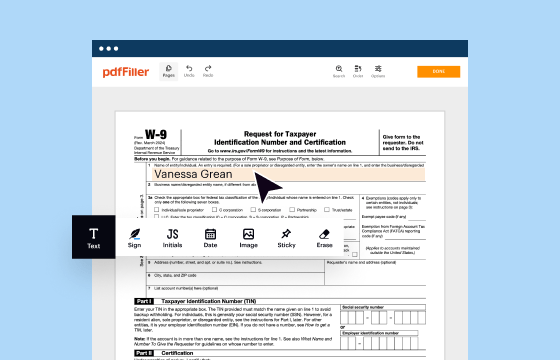

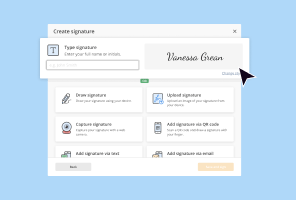

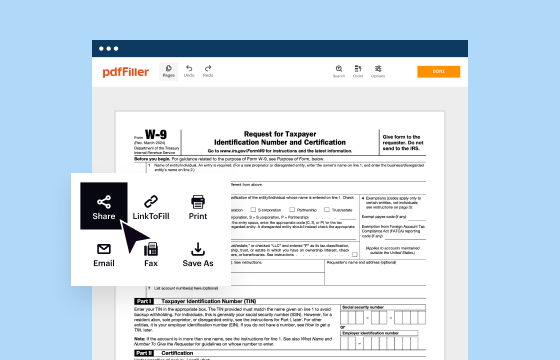

How to edit IRS 1099-Q

How to fill out IRS 1099-Q

About IRS 1099-Q 2012 previous version

What is IRS 1099-Q?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-Q

What should I do if I find an error after filing my 2012 1099 Q form?

If you discover an error after filing your 2012 1099 Q form, you can file a corrected form by using the amended process. Ensure that the corrected form shows the correct information and is marked as 'corrected.' Keep a copy for your records and notify any relevant parties if the error affects their tax situation.

How can I verify the status of my 2012 1099 Q form after submission?

To verify the status of your submitted 2012 1099 Q form, you can check the transmitting software or the service you used to e-file. Additionally, ensuring proper documentation is kept will help streamline your tracking process. Acknowledge common rejection codes if you encounter any issues during e-filing.

What are the privacy concerns related to submitting a 2012 1099 Q form?

When submitting a 2012 1099 Q form, privacy concerns include the secure handling of sensitive information such as Social Security numbers and financial details. Consider utilizing e-signature options compliant with regulations and ensure that your data storage is secure to protect against unauthorized access.

Can a business file a 2012 1099 Q form on behalf of an individual?

Yes, a business can file a 2012 1099 Q form on behalf of an individual, provided that proper authorization is obtained. This usually involves the individual granting permission, potentially through a Power of Attorney (POA) document, to ensure compliance and proper representation during the filing process.