IRS SS-4 2010 free printable template

Show details

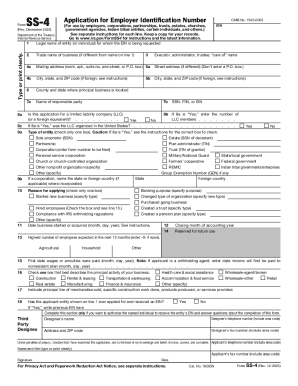

Cat. No. 16055N Rev. 1-2010 Form SS-4 Rev. 1-2010 Page Do I Need an EIN File Form SS-4 if the applicant entity does not already have an EIN but is required to show an EIN on any return statement or other document. Form SS-4 Rev. January 2010 Department of the Treasury Internal Revenue Service Application for Employer Identification Number For use by employers corporations partnerships trusts estates churches government agencies Indian tribal entities certain individuals and others. Note Form...SS-4 begins on the next page of this document. Attention Limit of one 1 Employer Identification Number EIN Issuance per Business Day Effective May 21 2012 to ensure fair and equitable treatment for all taxpayers the Internal Revenue Service IRS will limit Employer Identification Number EIN issuance to one per responsible party per day. For trusts the limitation is applied to the grantor owner or trustor. For estates the limitation is applied to the decedent decedent estate or the debtor...bankruptcy estate. This limitation is applicable to all requests for EINs whether online or by phone fax or mail* We apologize for any inconvenience this may cause. See separate instructions for each line. OMB No* 1545-0003 EIN Keep a copy for your records. 8a 8c 9a Legal name of entity or individual for whom the EIN is being requested Trade name of business if different from name on line 1 Executor administrator trustee care of name 4a Mailing address room apt. suite no. and street or P. O....box 5a Street address if different Do not enter a P. O. box. 4b City state and ZIP code if foreign see instructions 5b County and state where principal business is located 7a Type or print clearly. Name of responsible party 7b Is this application for a limited liability company LLC or a foreign equivalent 8b Yes SSN ITIN or EIN If 8a is Yes enter the number of LLC members No If 8a is Yes was the LLC organized in the United States Type of entity check only one box. Caution* If 8a is Yes see...the instructions for the correct box to check. Sole proprietor SSN Estate SSN of decedent Partnership Plan administrator TIN Corporation enter form number to be filed Trust TIN of grantor Personal service corporation 9b National Guard State/local government Church or church-controlled organization Farmers cooperative Federal government/military Other nonprofit organization specify Other specify If a corporation name the state or foreign country if applicable where incorporated Reason for...applying check only one box Started new business specify type State REMIC Indian tribal governments/enterprises Group Exemption Number GEN if any Foreign country Banking purpose specify purpose Changed type of organization specify new type Purchased going business Hired employees Check the box and see line 13. Created a trust specify type Compliance with IRS withholding regulations Created a pension plan specify type Date business started or acquired month day year. See instructions. 12 Closing...month of accounting year Highest number of employees expected in the next 12 months enter -0- if none.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

Instructions and Help about IRS SS-4

How to edit IRS SS-4

You can edit the IRS SS-4 form using a PDF editor like pdfFiller, which enables users to modify text, add signatures, or update other fields easily. To begin editing, upload your existing form to the platform, then utilize the tools to make necessary adjustments. Once completed, save your edits to ensure you have the most up-to-date version of the form.

How to fill out IRS SS-4

Filling out the IRS SS-4 form involves several critical steps. First, download the form from the IRS website or access it through platforms like pdfFiller. Next, carefully enter your business information, ensuring that all sections are accurately completed. Pay close attention to the sections that require your legal business name, trade name, and the reason for obtaining an Employer Identification Number (EIN). For assistance, utilize the guidelines provided by the IRS or consult a tax professional.

About IRS SS-4 2010 previous version

What is IRS SS-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS SS-4 2010 previous version

What is IRS SS-4?

IRS SS-4 is the Application for Employer Identification Number (EIN). This form is utilized by businesses and individuals to apply for an EIN, which is necessary for tax administration, reporting employee income, and other business functions. Completing this form is essential for new businesses and those seeking to obtain a federal tax identification number.

What is the purpose of this form?

The primary purpose of the IRS SS-4 form is to allow businesses or organizations to apply for an Employer Identification Number (EIN). An EIN is required for various tax-related purposes, including filing employment tax returns, opening a business bank account, and hiring employees. By submitting the SS-4, entities can legally operate and fulfill their tax obligations.

Who needs the form?

The IRS SS-4 form is necessary for several types of entities, including sole proprietorships, partnerships, corporations, and non-profit organizations. Additionally, individuals intending to hire employees or operate certain types of businesses must also complete this form. If your business will engage in activities that require reporting to the IRS, an EIN is essential.

When am I exempt from filling out this form?

Some organizations may be exempt from filing IRS SS-4 if they do not require an EIN for tax purposes. Single-member LLCs or sole proprietors without employees may not need an EIN and can use their Social Security Number (SSN) for tax identification instead. However, it is advisable to consult a tax professional to confirm your specific situation.

Components of the form

The IRS SS-4 consists of several key components that require specific information. Essential sections include the legal name of the applicant, the mailing address, the type of entity, and the reason for applying for an EIN. Additional details such as dates of establishment, number of employees expected, and the principal business activity also need to be accurately filled in to ensure proper processing of the application.

Due date

The IRS SS-4 form does not have a fixed due date because it is submitted as needed whenever a business is being formed or requires a new EIN. However, it’s recommended to submit the form prior to starting any business operations that will require the EIN. Timely submission can help avoid delays in compliance and tax reporting.

What are the penalties for not issuing the form?

Failing to obtain an EIN may result in various penalties, including difficulties in filing taxes, potential fines, and delays in legal business operations. Moreover, businesses that do not report employee wages correctly due to the absence of an EIN may face additional IRS scrutiny and penalties. It is critical to ensure that you apply for and receive your EIN in a timely manner to avoid these issues.

What information do you need when you file the form?

When filing the IRS SS-4, you will need specific information, including the legal name of the business, trade name (if applicable), mailing address, the name and Social Security Number (SSN) of the principal officer, and the nature of the business or organization. Ensure that all provided details are accurate and complete to facilitate a smooth processing of your application.

Is the form accompanied by other forms?

The IRS SS-4 form typically does not need to be accompanied by additional forms during submission. However, if you are applying for an EIN as part of a bankruptcy process, additional documentation may be required. Always verify with the IRS or a tax professional based on your individual circumstances.

Where do I send the form?

After completion, the IRS SS-4 form can be submitted via mail, fax, or online through the IRS website. The submission method may depend on your business structure and preference. For mail submissions, refer to the latest IRS guidelines to determine the correct address based on your location or use pdfFiller for electronic submission.

See what our users say