Get the free Real Property Tax Services - Erie County (New York)

Show details

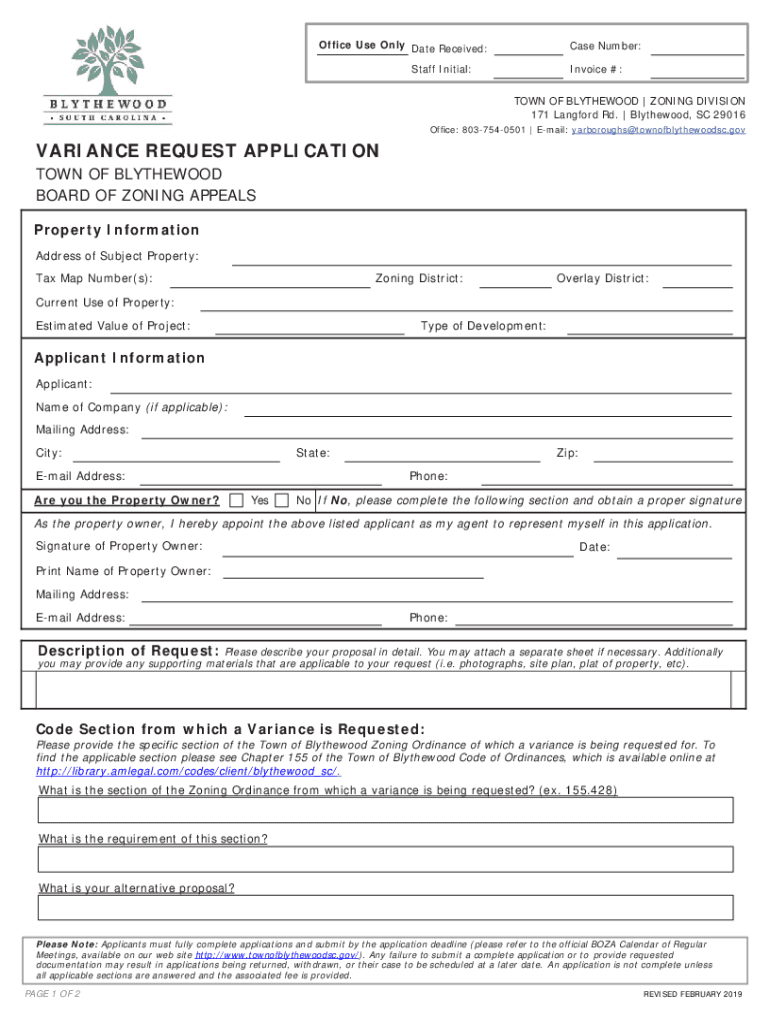

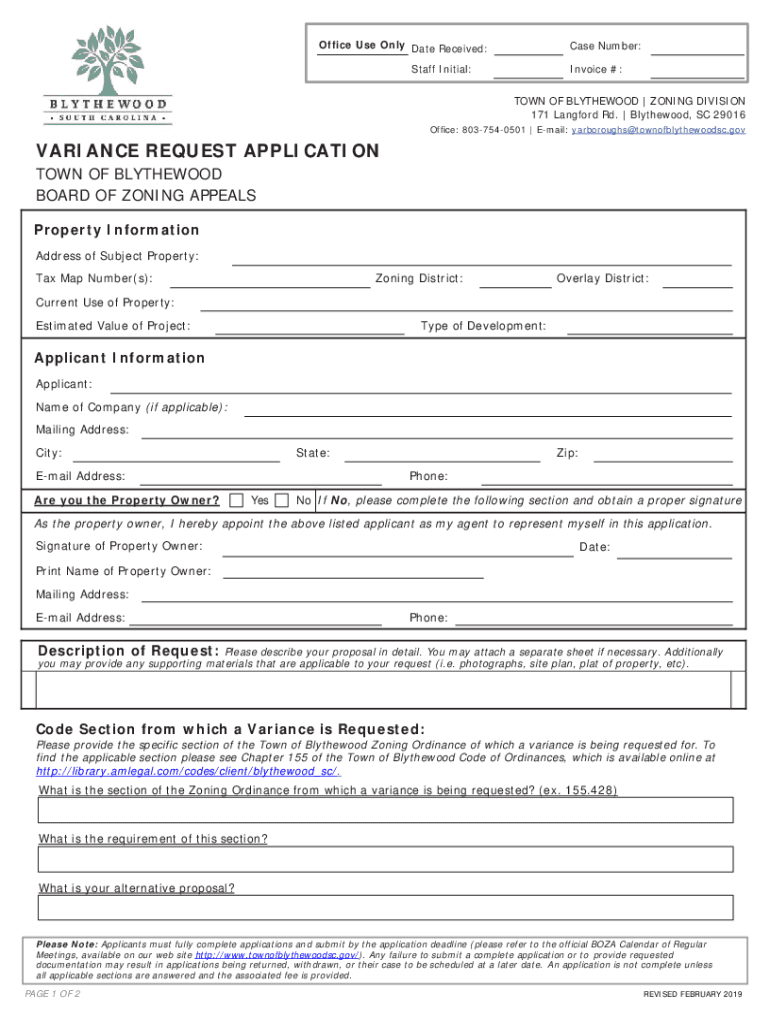

Office Use Only Date Received:Case Number:Staff Initial:Invoice #: TOWN OF BLYTHEWOOD ZONING DIVISION 171 Langford Rd. Blythe wood, SC 29016Office: 8037540501 Email: Yarbrough townofblythewoodsc.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real property tax services

Edit your real property tax services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real property tax services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real property tax services online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit real property tax services. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real property tax services

How to fill out real property tax services

01

Gather all necessary documents, such as property ownership documents, property value assessment information, and any relevant financial records.

02

Familiarize yourself with the specific requirements and guidelines for your jurisdiction's real property tax services. This may include understanding deadlines, forms to be filled out, and any supporting documentation needed.

03

Fill out the real property tax forms accurately and completely. Provide all requested information, including details about the property, its value, and any exemptions or deductions that may apply.

04

Double-check all the information provided to ensure accuracy and correctness. Mistakes or omissions may lead to delays or penalties.

05

Submit the completed forms along with any supporting documents to the appropriate tax authority. Follow any instructions provided regarding submission methods and payment of taxes due.

06

Keep copies of all submitted documents for your records and ensure that you have proof of submission, such as a receipt or confirmation.

07

Stay informed about any updates or changes in real property tax laws or regulations that may affect your property. Regularly review assessment notices and tax bills to verify accuracy and address any discrepancies or concerns.

08

Consider seeking professional assistance from tax professionals or real estate attorneys if you are uncertain about any aspect of filling out real property tax services. They can provide guidance and ensure compliance with all legal requirements.

Who needs real property tax services?

01

Real property tax services are needed by individuals or organizations who own real estate properties. This includes residential homeowners, commercial property owners, landlords, real estate developers, and investors.

02

Additionally, professionals in the real estate industry, such as real estate agents, property managers, and appraisers, may also require real property tax services to assist their clients or for their own properties.

03

Government entities, including municipalities, counties, and states, also rely on real property tax services to assess and collect taxes for funding public services and infrastructure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my real property tax services directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign real property tax services and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find real property tax services?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific real property tax services and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out real property tax services using my mobile device?

Use the pdfFiller mobile app to fill out and sign real property tax services. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is real property tax services?

Real property tax services involve the administration, assessment, and collection of property taxes on real estate, ensuring compliance with tax laws and regulations.

Who is required to file real property tax services?

Property owners and entities that own or manage real property are typically required to file real property tax services.

How to fill out real property tax services?

To fill out real property tax services, property owners should gather necessary documentation, access the appropriate forms, and provide accurate information regarding property ownership, assessed value, and any applicable deductions.

What is the purpose of real property tax services?

The purpose of real property tax services is to calculate and collect taxes based on the value of real property, ensuring that local governments have the necessary funding for public services and infrastructure.

What information must be reported on real property tax services?

Information required typically includes property ownership details, assessment values, tax exemptions or deductions claimed, and any changes in property use or ownership.

Fill out your real property tax services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Property Tax Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.