Get the free Getting tax advice - Citizens Advice

Show details

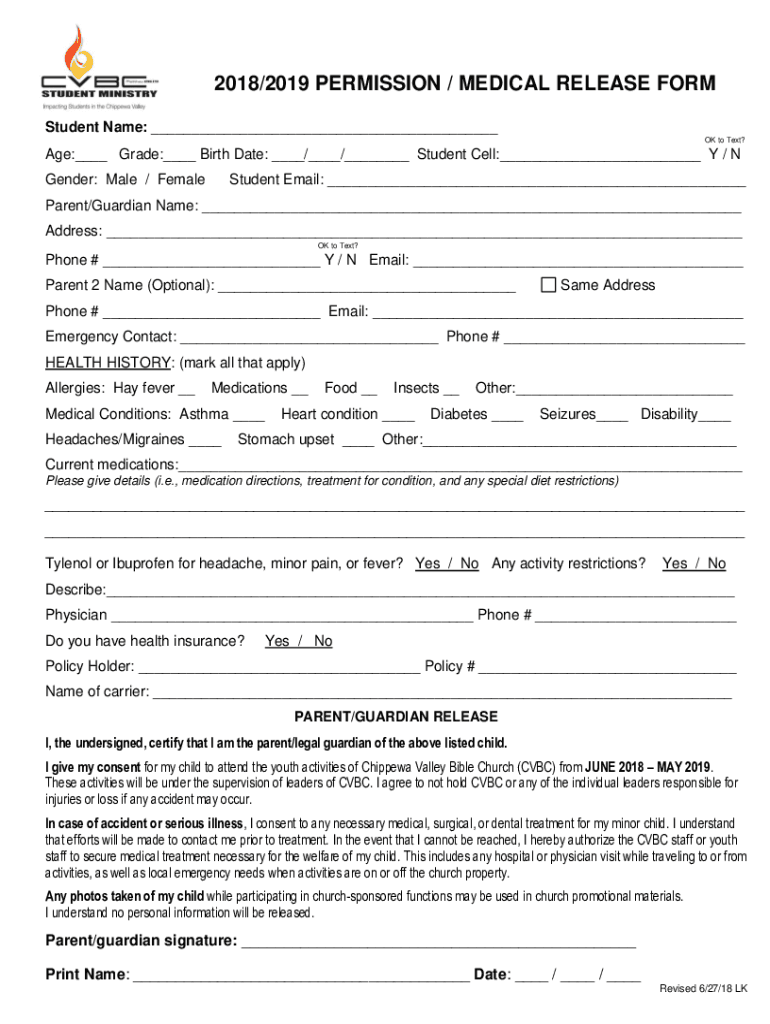

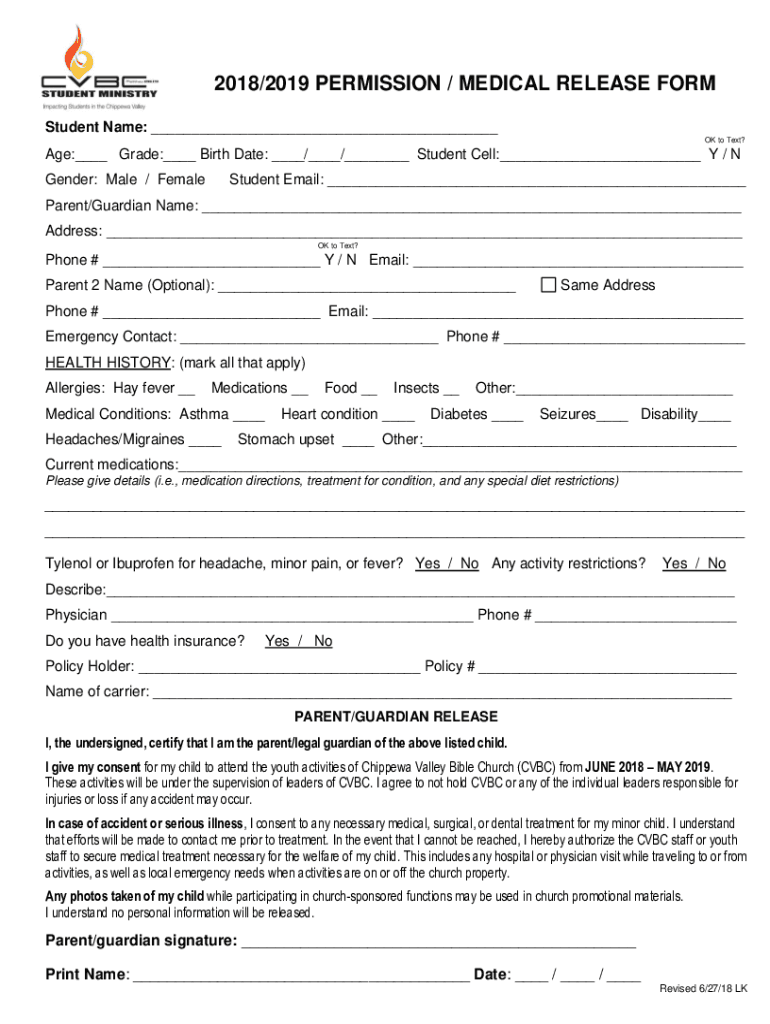

2018/2019 PERMISSION / MEDICAL RELEASE FORM Student Name: OK to Text? Age: Grade: Birth Date: / / Student Cell: Y / N Gender: Male / FemaleStudent Email: Parent/Guardian Name: Address: OK to Text?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign getting tax advice

Edit your getting tax advice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your getting tax advice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing getting tax advice online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit getting tax advice. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out getting tax advice

How to fill out getting tax advice

01

Gather all necessary financial documents, such as income statements, expense records, and previous tax returns.

02

Identify the type of tax advice you need - whether it's for personal income taxes, business taxes, tax planning, or other specific areas.

03

Research and identify credible sources for tax advice, such as licensed tax professionals, certified public accountants (CPAs), or reputable tax advisory websites.

04

Schedule an appointment or consultation with a tax advisor to discuss your specific tax situation.

05

Prepare a list of questions or concerns you have regarding your taxes to ensure you gather all the necessary information during your consultation.

06

Provide all relevant financial and personal information to the tax advisor during the meeting or consultation.

07

Listen carefully to the advice given by the tax advisor and ask for clarification if needed.

08

Take notes during the consultation and ask for a summary or written documentation of the advice provided.

09

Implement the recommended tax strategies or actions as discussed with the tax advisor.

10

Keep copies of all documents and correspondence related to the tax advice received for future reference or auditing purposes.

Who needs getting tax advice?

01

Individuals who have complex tax situations and need assistance in understanding tax laws and regulations.

02

Business owners who want to ensure they are compliant with tax obligations and want to optimize their tax planning strategies.

03

Investors and high-net-worth individuals who may benefit from specialized tax advice for managing their investments and assets.

04

Non-residents or expatriates who may have tax obligations in multiple jurisdictions.

05

Individuals or businesses facing tax audits or disputes with tax authorities and need professional representation and advice.

06

People who want to minimize their tax liabilities and maximize their tax deductions.

07

Anyone who wants to stay updated on changing tax laws and regulations and plan their finances accordingly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute getting tax advice online?

Completing and signing getting tax advice online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit getting tax advice on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing getting tax advice.

How do I complete getting tax advice on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your getting tax advice. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is getting tax advice?

Getting tax advice involves consulting with a qualified professional to understand tax laws, regulations, and strategies that can help individuals or businesses make informed decisions regarding their taxes.

Who is required to file getting tax advice?

Individuals and businesses that need guidance on tax matters or are subject to complex tax situations may seek tax advice. However, no one is specifically required to file for tax advice.

How to fill out getting tax advice?

Filling out for tax advice typically involves providing relevant financial documentation and information to a tax advisor, who will then analyze it and offer guidance based on the details provided.

What is the purpose of getting tax advice?

The purpose of getting tax advice is to ensure compliance with tax laws, minimize tax liabilities, take advantage of deductions and credits, and plan for future financial situations.

What information must be reported on getting tax advice?

Key information such as income sources, expenses, tax deductions, prior tax returns, and current financial situations must be reported when seeking tax advice.

Fill out your getting tax advice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Getting Tax Advice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.