Get the free content form - irs

Show details

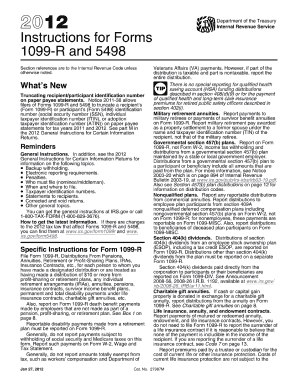

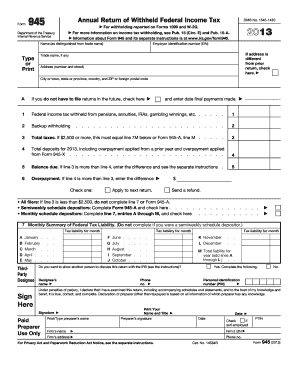

2011 Instructions for Form 945 Annual Return of Withheld Federal Income Tax Section references are to the Internal Revenue Code unless otherwise noted. Department of the Treasury Internal Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign content form - irs

Edit your content form - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your content form - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing content form - irs online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit content form - irs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out content form - irs

01

To fill out a content form, start by reading all the instructions or guidelines provided. This will give you a clear understanding of what information is required and how to structure your responses.

02

Begin by entering your personal details, such as your name, contact information, and any other relevant information that may be requested. Make sure to double-check the accuracy of these details before moving on.

03

Next, you might be asked to provide a brief summary or description of the content you intend to create. This could include specifying the topic, target audience, format, and any specific requirements or objectives.

04

Moving on, you may need to outline the main points or sections you plan to include in your content. This step helps to provide a clear structure and direction for your work. If necessary, you might also be asked to provide a projected word count or duration.

05

Depending on the content form, you may be required to provide supporting materials such as images, videos, or references. Ensure that these are properly labeled and submitted in the requested format.

06

In some cases, you might be asked to include a timeline or schedule for completing the content. This could involve specifying milestones, deadlines, or any other relevant information related to the delivery of your work.

07

Once you have filled out all the necessary sections or fields, review your responses for accuracy, completeness, and clarity. Make any necessary edits or revisions before submitting the form.

Who needs a content form?

01

Content creators who are working on projects that require additional documentation or approval processes may need a content form. This includes writers, bloggers, video producers, graphic designers, and other individuals involved in content creation.

02

Companies or organizations that hire content creators often require a content form to better understand the scope, objectives, and details of the content being produced. This helps them align the expectations and requirements between the client and the content creator.

03

Content managers or editors who are responsible for overseeing a team of content creators may use a content form as a means of organizing, tracking, and managing various content projects. The form serves as a standardized tool to collect and consolidate the necessary information for efficient workflow management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete content form - irs online?

pdfFiller has made it easy to fill out and sign content form - irs. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in content form - irs without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your content form - irs, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out content form - irs using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign content form - irs and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is content form?

Content form is a document used to report the nature and sources of content that is published or distributed by an individual or organization.

Who is required to file content form?

Any individual or organization that publishes or distributes content is required to file content form.

How to fill out content form?

To fill out a content form, you need to provide information about the nature of the content, its sources, and any relevant details requested on the form. It is important to ensure accuracy and completeness of the information.

What is the purpose of content form?

The purpose of the content form is to provide transparency and accountability regarding the nature and sources of published or distributed content. It helps regulatory authorities and the public to understand the origin and nature of content.

What information must be reported on content form?

A content form typically requires information such as the title or description of the content, the sources of the content (including URLs or authors), any funding or sponsorship received for the content, and other relevant details as requested on the form.

Fill out your content form - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Content Form - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.