Get the free Professional Indemnity Insurance Proposal Form for IT ...

Show details

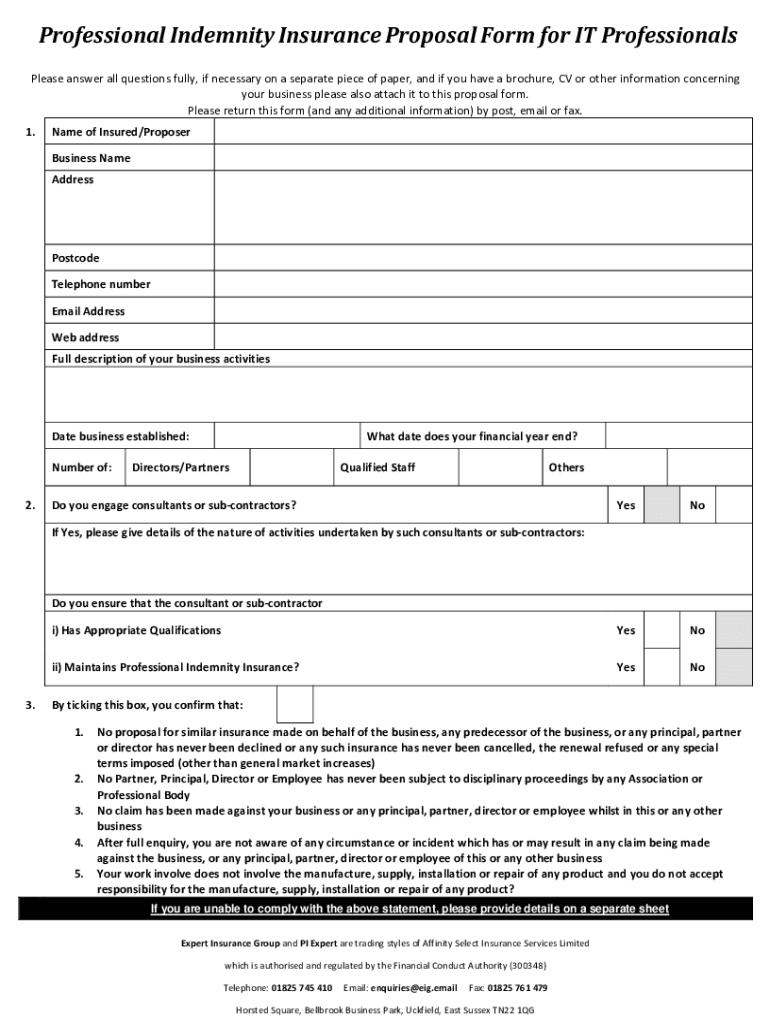

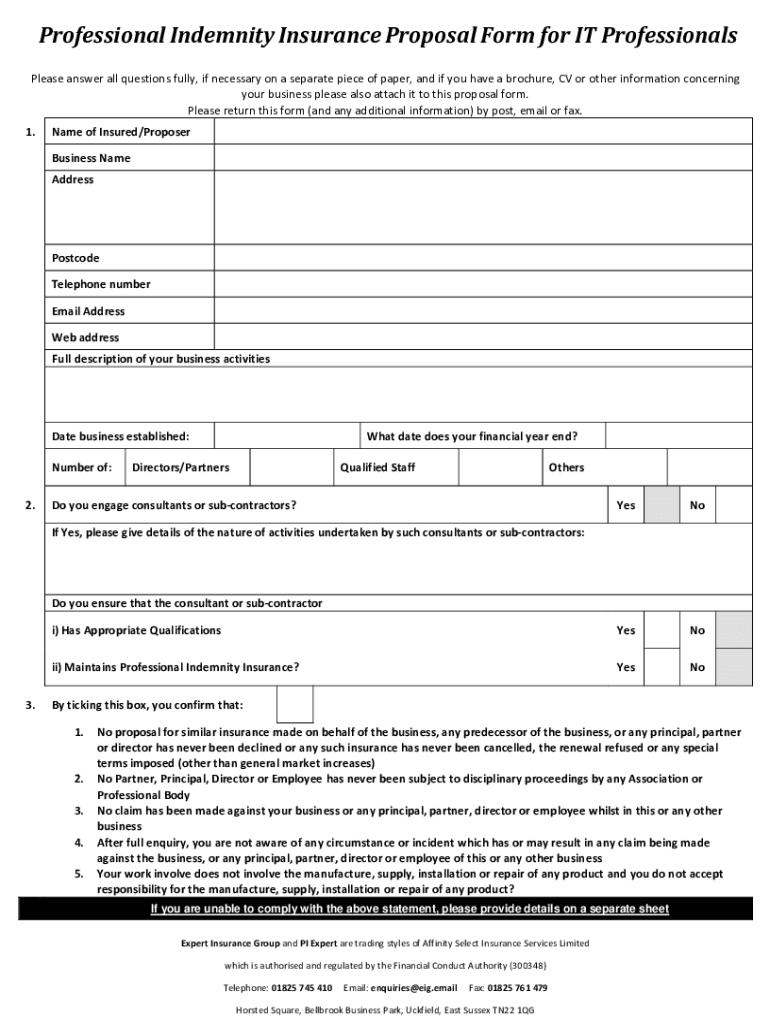

Professional Indemnity Insurance Proposal Form for IT Professionals

Please answer all questions fully, if necessary on a separate piece of paper, and if you have a brochure, CV or other information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional indemnity insurance proposal

Edit your professional indemnity insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional indemnity insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional indemnity insurance proposal online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit professional indemnity insurance proposal. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional indemnity insurance proposal

How to fill out professional indemnity insurance proposal

01

To fill out a professional indemnity insurance proposal, follow these steps:

02

Start by providing your personal information, such as your name, contact details, occupation, and business name (if applicable).

03

Specify the coverage you require by selecting the appropriate options or stating the desired policy limits and deductibles.

04

Provide details about your business activities, including the nature of services you offer and the industries you serve.

05

Outline your claims history, including any past or pending litigation or insurance claims.

06

Disclose any relevant professional qualifications, certifications, or memberships.

07

Submit any supporting documents that might be required, such as proof of professional credentials or financial statements.

08

Review the proposal form thoroughly before submission to ensure accuracy and completeness.

09

Submit the completed form to the insurance provider, either online or through a designated channel.

10

Keep copies of the filled-out proposal form and any supporting documents for your records.

11

Follow up with the insurance provider to confirm receipt of the proposal and to inquire about any additional steps or information needed.

12

Remember, it is recommended to consult with an insurance broker or advisor if you have any specific concerns or require assistance in filling out the professional indemnity insurance proposal.

Who needs professional indemnity insurance proposal?

01

Professional indemnity insurance proposals are necessary for individuals or businesses involved in professional services or providing advice or expertise.

02

This may include professionals such as doctors, lawyers, architects, engineers, consultants, accountants, financial advisors, IT professionals, and many others who offer their services for a fee.

03

Professional indemnity insurance provides protection against claims of negligence, errors, or omissions that may arise from professional advice or services provided.

04

By having a professional indemnity insurance proposal in place, professionals can safeguard their businesses and reputations, and potentially mitigate financial losses due to legal liabilities.

05

It is important to note that the specific requirements for professional indemnity insurance may vary depending on the industry, location, and legal regulations, so consulting with an insurance provider or broker is advisable to determine the exact needs and coverage options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find professional indemnity insurance proposal?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the professional indemnity insurance proposal in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in professional indemnity insurance proposal?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your professional indemnity insurance proposal to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the professional indemnity insurance proposal in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your professional indemnity insurance proposal right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is professional indemnity insurance proposal?

A professional indemnity insurance proposal is a formal application document submitted by professionals to an insurance provider to obtain coverage against claims for negligence, errors, or omissions in the performance of their professional services.

Who is required to file professional indemnity insurance proposal?

Professionals such as lawyers, architects, accountants, consultants, and healthcare providers are typically required to file a professional indemnity insurance proposal to protect themselves against potential claims from clients.

How to fill out professional indemnity insurance proposal?

To fill out a professional indemnity insurance proposal, applicants should provide accurate information regarding their professional qualifications, business practices, claims history, client details, and other relevant factors that may affect their risk assessment.

What is the purpose of professional indemnity insurance proposal?

The purpose of a professional indemnity insurance proposal is to evaluate the applicant's eligibility for coverage and to determine the appropriate premium for providing protection against claims made as a result of professional negligence.

What information must be reported on professional indemnity insurance proposal?

Information such as the nature of the services provided, any past claims or disputes, financial history, professional qualifications, and client details must be reported on a professional indemnity insurance proposal.

Fill out your professional indemnity insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Indemnity Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.