Get the free Comparison of Tax-Exempt 457(b) Plans and Governmental 457(b ...

Show details

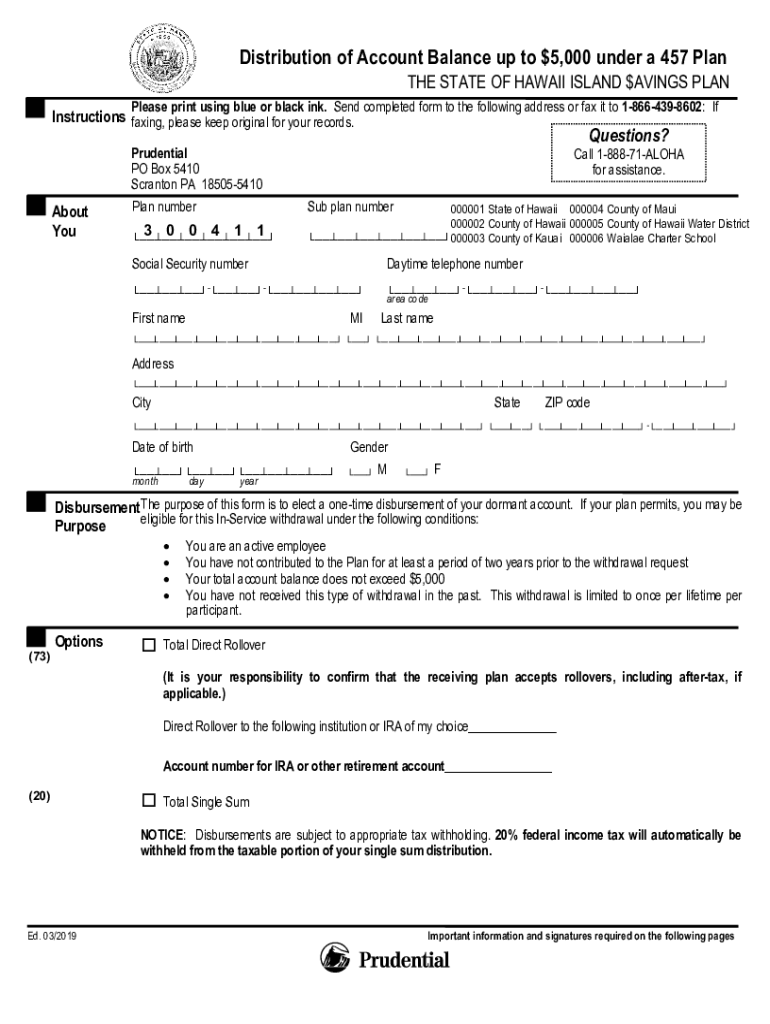

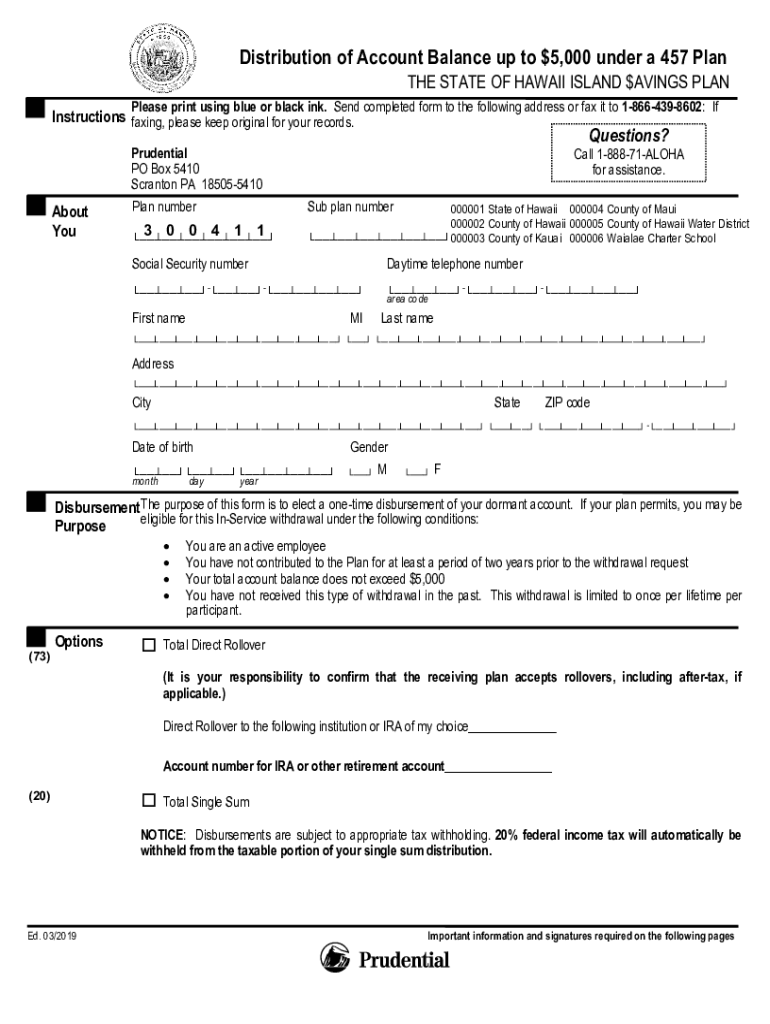

Distribution of Account Balance up to $5,000 under a 457 Plan

THE STATE OF HAWAII ISLAND SAVINGS PLAN

Please print using blue or black ink. Send completed form to the following address or fax it to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comparison of tax-exempt 457b

Edit your comparison of tax-exempt 457b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comparison of tax-exempt 457b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit comparison of tax-exempt 457b online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit comparison of tax-exempt 457b. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comparison of tax-exempt 457b

How to fill out comparison of tax-exempt 457b

01

To fill out a comparison of tax-exempt 457b, follow these steps:

02

Gather all the necessary information such as the details of the different tax-exempt 457b plans you want to compare.

03

Start by listing the key features and benefits of each plan, including the contribution limits, investment options, and any additional perks like employer matching or catch-up contributions.

04

Next, compare the fees and expenses associated with each plan, including administrative fees, investment management fees, and any other charges.

05

Consider the withdrawal options and any penalty fees that may apply if you need to access your funds before retirement.

06

Evaluate the investment performance and historical returns of each plan, considering factors like risk tolerance and investment strategies.

07

Analyze any additional features or services offered by the plan providers, such as financial education resources or personalized advice.

08

Take into account your own financial goals, risk tolerance, and retirement timeline to determine which plan aligns best with your needs.

09

After comparing all the relevant factors, make an informed decision and complete the necessary paperwork to enroll in the tax-exempt 457b plan of your choice.

10

Note: It's always recommended to consult with a financial advisor or tax professional for personalized guidance and to ensure compliance with any applicable regulations.

Who needs comparison of tax-exempt 457b?

01

Anyone who is eligible to participate in a tax-exempt 457b retirement plan can benefit from comparing different options. This includes:

02

- Employees of state and local governments

03

- Employees of certain tax-exempt organizations, such as non-profit organizations and educational institutions

04

- Individuals who want to maximize their retirement savings and take advantage of potential tax advantages

05

- Individuals who value flexibility in their retirement planning, as tax-exempt 457b plans offer a wide range of investment options and withdrawal features

06

However, it's important to note that the suitability of a tax-exempt 457b plan depends on individual circumstances and financial goals. It's recommended to seek advice from a qualified financial professional to determine if it is the right retirement savings option for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my comparison of tax-exempt 457b directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign comparison of tax-exempt 457b and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send comparison of tax-exempt 457b for eSignature?

Once you are ready to share your comparison of tax-exempt 457b, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit comparison of tax-exempt 457b on an iOS device?

You certainly can. You can quickly edit, distribute, and sign comparison of tax-exempt 457b on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is comparison of tax-exempt 457b?

The comparison of tax-exempt 457b refers to an analysis of different tax-exempt 457b retirement plans, highlighting their features, benefits, and limitations compared to other retirement accounts.

Who is required to file comparison of tax-exempt 457b?

Individuals who work for non-profit organizations or governmental entities that offer tax-exempt 457b plans may need to file a comparison if they are assessing their retirement options or making changes to their contributions.

How to fill out comparison of tax-exempt 457b?

To fill out a comparison of tax-exempt 457b, gather necessary documentation from each plan, such as contribution limits, employer matches, withdrawal rules, and tax implications, and then input this information into a comparative format or spreadsheet.

What is the purpose of comparison of tax-exempt 457b?

The purpose of the comparison is to help individuals understand the differences between various 457b plans, enabling them to make informed decisions regarding their retirement savings.

What information must be reported on comparison of tax-exempt 457b?

Information that must be reported includes contribution limits, qualifying employer contributions, distribution options, tax implications, and any fees associated with the plan.

Fill out your comparison of tax-exempt 457b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comparison Of Tax-Exempt 457b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.