Get the Free Living Trust Forms - Download Free Living Trust FormsFree Revocable Living Trust For...

Show details

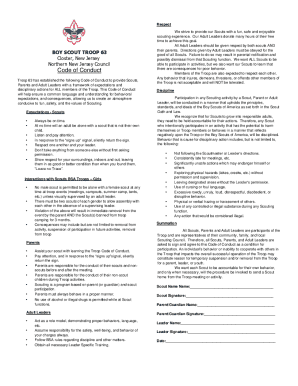

NEW MEXICO IRREVOCABLE TRUST Pursuant chapter 46 Fiduciaries and TrustsThis Irrevocable Trust is made this day of, 20, by and between: Granter with a mailing address of (referred to as the Granter,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign living trust forms

Edit your living trust forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your living trust forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing living trust forms online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit living trust forms. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

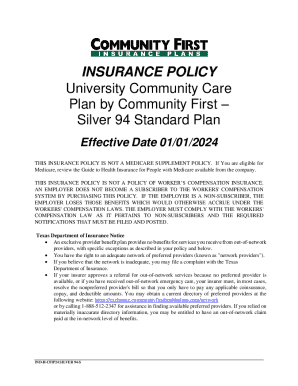

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out living trust forms

How to fill out living trust forms

01

Start by gathering all necessary information such as your personal details, assets, beneficiaries, and a list of desired trustees.

02

Obtain the living trust forms either from an attorney, an online legal service, or your local courthouse.

03

Carefully read the instructions provided with the forms to understand the requirements and guidelines for filling them out.

04

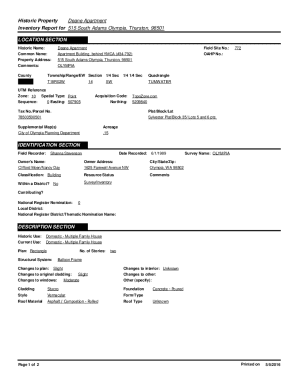

Begin the form by entering your personal information, such as your full name, address, and contact details.

05

Proceed to list all of your assets, including real estate, bank accounts, investments, vehicles, etc. Provide detailed information about each asset, such as its current value and any existing mortgages or loans.

06

Indicate your desired beneficiaries by clearly mentioning their full names, relationship to you, and the percentage of assets they should receive.

07

Name one or more trustees who will manage the trust on your behalf. Include their full names, contact details, and any specific instructions or powers you wish to grant them.

08

Review the completed forms for accuracy and completeness. Make sure you've signed and dated all necessary sections, as required by your jurisdiction.

09

It is highly recommended to have the forms reviewed by an attorney before finalizing them to ensure compliance with local laws and to address any specific concerns or circumstances.

10

Once reviewed and approved, make copies of the completed forms and keep them in a safe and accessible place. Consider notifying your chosen trustees and beneficiaries about the existence and location of the living trust.

Who needs living trust forms?

01

Living trust forms are typically needed by individuals who wish to establish an estate planning document to manage and distribute their assets after death.

02

People who have significant assets, complex family situations, or specific wishes regarding asset distribution often opt for living trust forms.

03

Living trust forms are suitable for individuals who want to avoid probate, maintain privacy, minimize estate taxes, or provide for the ongoing care of dependents or beneficiaries.

04

However, it is recommended to consult with an attorney or a legal professional to assess your specific circumstances and determine if living trust forms are appropriate for your needs.

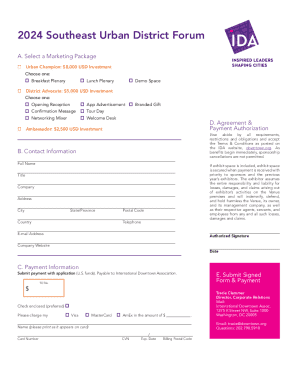

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find living trust forms?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific living trust forms and other forms. Find the template you need and change it using powerful tools.

How do I make changes in living trust forms?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your living trust forms to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out living trust forms on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your living trust forms, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is living trust forms?

Living trust forms are legal documents used to create a living trust, which helps manage and distribute an individual's assets during their lifetime and after death, avoiding probate.

Who is required to file living trust forms?

Individuals who wish to establish a living trust to manage their assets, including those with significant property or financial assets, typically file living trust forms.

How to fill out living trust forms?

To fill out living trust forms, gather all necessary information about your assets, complete the required sections of the form, specify the beneficiaries, and sign it in accordance with state laws.

What is the purpose of living trust forms?

The purpose of living trust forms is to create a legal framework for asset management, allow for easier transfer of assets upon death, and potentially reduce estate taxes.

What information must be reported on living trust forms?

Information that must be reported includes the name of the trust, the trustee, beneficiaries, and a detailed list of the assets placed into the trust.

Fill out your living trust forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Living Trust Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.