Get the free PROMISSORY NOTE SMALL BUSINESS PANDEMIC RELIEF LOAN

Show details

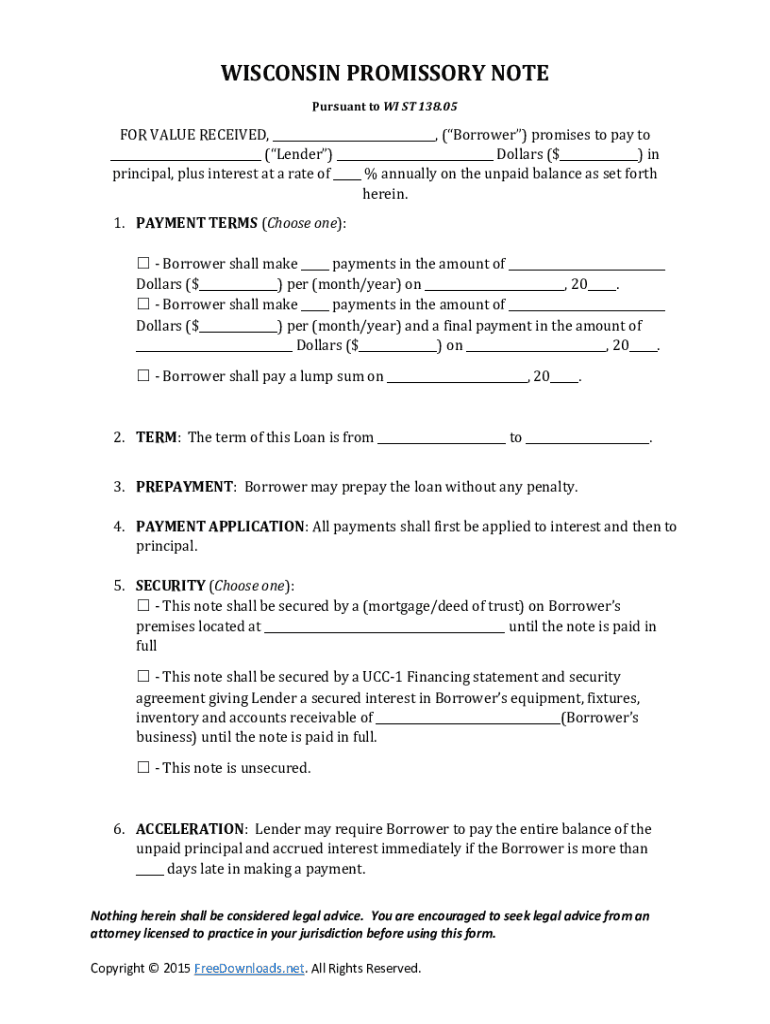

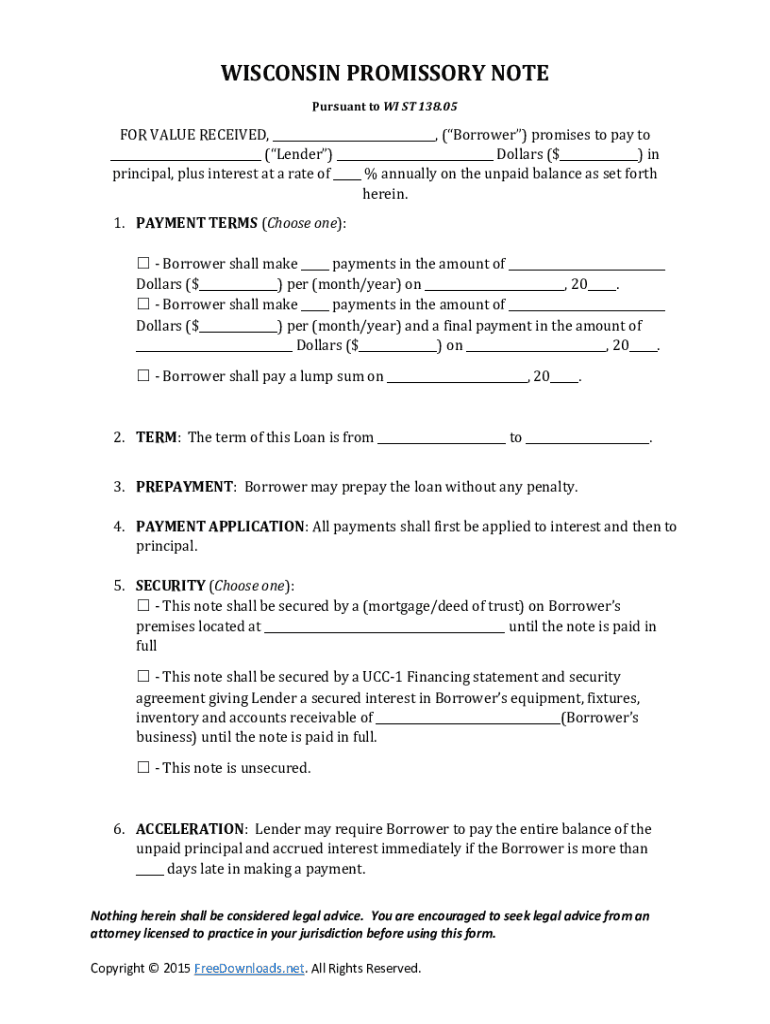

WISCONSIN PROMISSORY NOTE Pursuant to WI ST 138.05FOR VALUE RECEIVED, (Borrower) promises to pay to (Lender) Dollars ($) in principle, plus interest at a rate of % annually on the unpaid balance as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note small business

Edit your promissory note small business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing promissory note small business online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit promissory note small business. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note small business

How to fill out promissory note small business

01

Begin by entering the date at the top of the promissory note. This is the date when the note is being executed.

02

Include the names and contact information of both the lender and borrower. Make sure to include full legal names, addresses, and phone numbers.

03

Specify the principal amount borrowed. This is the initial amount of money that the borrower is receiving from the lender.

04

Determine the interest rate and method of calculation. State whether the interest will be fixed or variable and the frequency at which it will be compounded.

05

Set the repayment terms. Include the duration of the loan, such as the number of months or years, and the specific dates or schedule on which payments are due.

06

Define late payment penalties. Specify the consequences of late or missed payments, such as additional interest, late fees, or potential legal action.

07

Clarify any security or collateral. If the loan is secured by assets or property, describe the details of the collateral and the rights of the lender in case of default.

08

Include a provision for acceleration. This allows the lender to accelerate the loan repayment schedule in the event of default or breach of contract.

09

Add a clause for governing law and jurisdiction. Specify the state or country's laws that will govern the promissory note and the jurisdiction where any legal disputes will be resolved.

10

Finally, both the lender and borrower should sign and date the promissory note to make it legally binding.

Who needs promissory note small business?

01

Small businesses that need to borrow money from individuals or other entities may use promissory notes. It provides a legal document that outlines the terms of the loan, including repayment schedule, interest rate, and any collateral or security. Both lenders and borrowers benefit from having a promissory note as it establishes clear expectations and protects their rights in case of default or dispute.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit promissory note small business straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing promissory note small business right away.

How do I fill out promissory note small business using my mobile device?

Use the pdfFiller mobile app to fill out and sign promissory note small business on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out promissory note small business on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your promissory note small business from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is promissory note small business?

A promissory note for small business is a financial document in which one party promises in writing to pay a determinate sum of money to another party at a specified time or on demand.

Who is required to file promissory note small business?

Typically, individuals or entities that engage in borrowing or lending money through promissory notes for business purposes are required to file these documents, particularly if they are seeking financing or making loans.

How to fill out promissory note small business?

To fill out a promissory note for small business, include the names of the borrower and lender, the principal amount, the interest rate, the repayment schedule, and any necessary terms and conditions.

What is the purpose of promissory note small business?

The purpose of a promissory note for small business is to establish a legal obligation for repayment, providing security to the lender and clarity to the borrower regarding their repayment terms.

What information must be reported on promissory note small business?

Essential information includes the names and addresses of the parties involved, the amount borrowed, interest rates, payment schedule, maturity date, and any collateral if applicable.

Fill out your promissory note small business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Small Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.