Get the free RENT-A-BANK PAYDAY LENDING - consumerfed

Show details

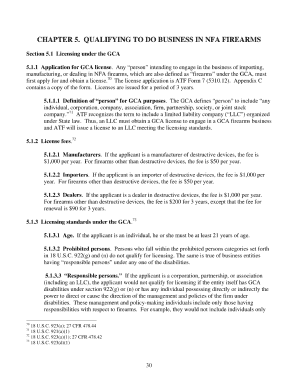

RENTRENT-A-BANK PAYDAY LENDING How Banks Help Payday Lenders Evade State Consumer Protections The 2001 Payday Lender Survey And Report Consumer Federation of America (CFA) and the U. S. Public Interest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rent-a-bank payday lending

Edit your rent-a-bank payday lending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rent-a-bank payday lending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rent-a-bank payday lending online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rent-a-bank payday lending. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rent-a-bank payday lending

How to fill out rent-a-bank payday lending:

01

Research and gather information on rent-a-bank payday lending regulations and requirements.

02

Contact a bank or lending institution that offers rent-a-bank payday lending services.

03

Complete the application form provided by the lending institution, providing accurate and necessary information about yourself or your business.

04

Provide all the required supporting documents such as identification, financial statements, and any other relevant paperwork.

05

Review the terms and conditions of the loan agreement carefully and ensure you understand all the terms, including interest rates, repayment terms, and any additional fees.

06

Sign the loan agreement if you agree to the terms and conditions outlined.

07

Receive the loan amount in your designated bank account after the approval process.

08

Use the loan funds for the intended purpose and make timely payments according to the repayment schedule.

Who needs rent-a-bank payday lending:

01

Individuals or businesses facing urgent and temporary financial needs.

02

Those who cannot secure traditional loans due to poor credit history or other reasons.

03

Borrowers who require quick access to funds, often with a relatively short repayment period.

04

People who prefer the convenience and ease of applying for a loan online or through a lending institution.

05

Individuals who are confident in their ability to repay the loan within the agreed timeframe.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rent-a-bank payday lending for eSignature?

Once you are ready to share your rent-a-bank payday lending, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in rent-a-bank payday lending?

The editing procedure is simple with pdfFiller. Open your rent-a-bank payday lending in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete rent-a-bank payday lending on an Android device?

Use the pdfFiller mobile app and complete your rent-a-bank payday lending and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is rent-a-bank payday lending?

Rent-a-bank payday lending is a practice where non-bank entities partner with federally chartered banks to offer payday loans at high interest rates, using the bank's legal authority to overcome state payday loan regulations.

Who is required to file rent-a-bank payday lending?

Entities engaged in rent-a-bank payday lending are required to file the necessary documents and reports. This includes both the non-bank entities and the federally chartered banks involved in the arrangement.

How to fill out rent-a-bank payday lending?

To fill out rent-a-bank payday lending, entities need to gather the relevant financial and transactional data related to the loans offered through this practice. This includes details on loan amounts, interest rates, repayment terms, and borrower information. The specific filing process can vary, and it is advisable to consult the regulatory guidelines and instructions provided by the respective authorities.

What is the purpose of rent-a-bank payday lending?

The purpose of rent-a-bank payday lending is to bypass state regulations on payday loans by leveraging the legal authority and exemptions enjoyed by federally chartered banks. This allows non-bank entities to offer high-interest loans to borrowers, often exploiting vulnerable individuals who have limited access to traditional banking services.

What information must be reported on rent-a-bank payday lending?

The information that must be reported on rent-a-bank payday lending includes details about the loans issued, such as loan amounts, interest rates, loan terms, borrower demographics, repayment history, and any fees charged. Additionally, entities may be required to submit financial statements and disclosures related to their lending practices.

Fill out your rent-a-bank payday lending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rent-A-Bank Payday Lending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.