Get the free Online Income-Driven Repayment Plan Request ...

Show details

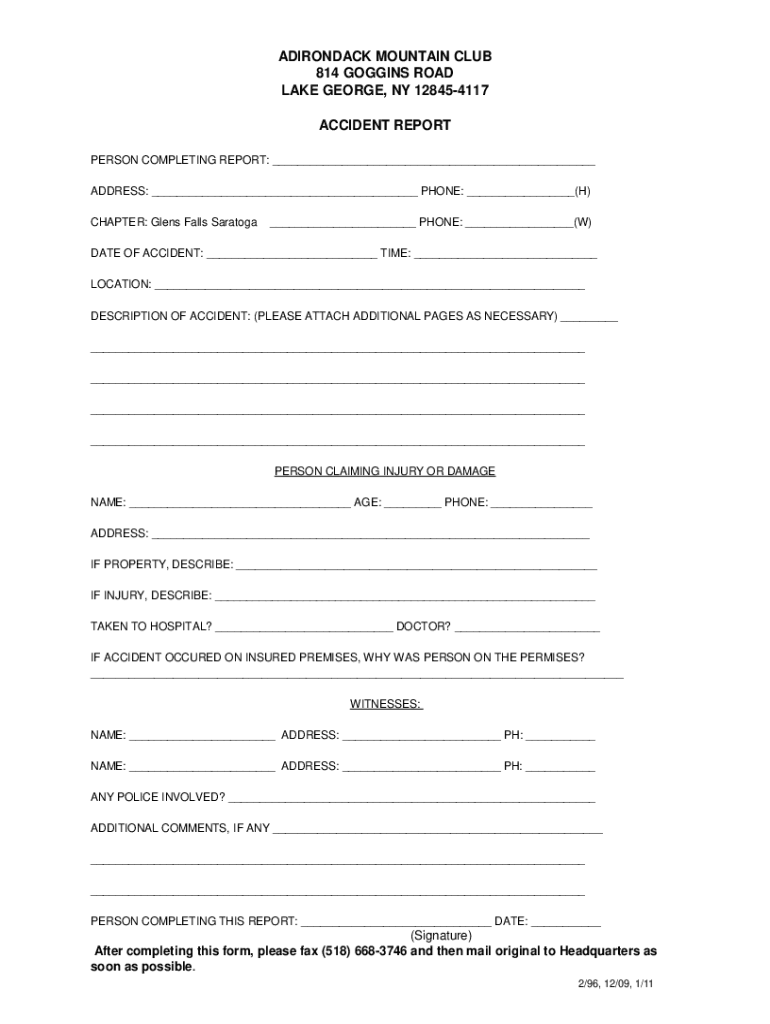

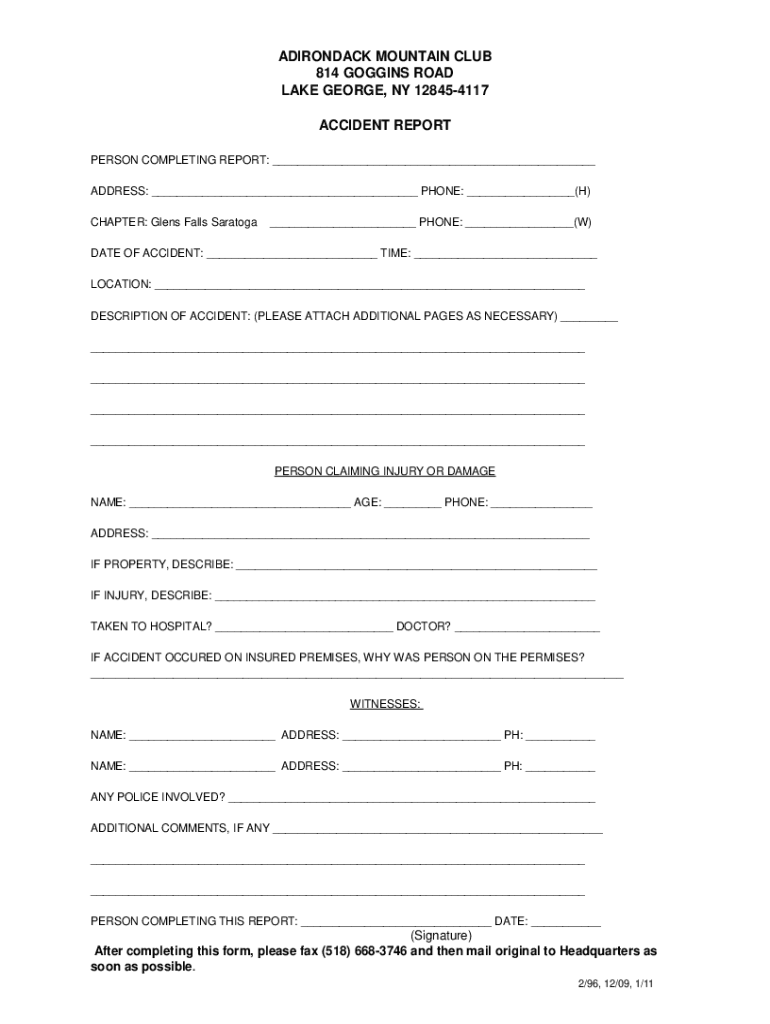

ADIRONDACK MOUNTAIN CLUB 814 NOGGINS ROAD LAKE GEORGE, NY 128454117 ACCIDENT REPORT PERSON COMPLETING REPORT: ADDRESS: PHONE: (H) CHAPTER: Glens Falls Saratoga PHONE: (W)DATE OF ACCIDENT: TIME: LOCATION:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign online income-driven repayment plan

Edit your online income-driven repayment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online income-driven repayment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online income-driven repayment plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit online income-driven repayment plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online income-driven repayment plan

How to fill out online income-driven repayment plan

01

To fill out an online income-driven repayment plan, follow these steps:

02

Visit the website of your loan servicer or the U.S. Department of Education's official student aid website.

03

Log in to your account using your username and password.

04

Navigate to the section related to repayment plans or income-driven repayment options.

05

Select the online income-driven repayment plan application.

06

Provide the necessary personal and financial information as requested, such as your income, family size, and employment details.

07

Upload any required documents, such as proof of income or tax returns.

08

Review the application carefully to ensure all information is accurate and complete.

09

Submit the online application.

10

Wait for a confirmation or approval notification from your loan servicer.

11

If approved, carefully review the terms and conditions of the income-driven repayment plan and start making payments as instructed.

Who needs online income-driven repayment plan?

01

Online income-driven repayment plans are beneficial for individuals with federal student loan debts who are struggling to make their monthly loan payments.

02

Specifically, those who need online income-driven repayment plans include:

03

- Borrowers with high student loan debt-to-income ratios

04

- Individuals with lower income levels

05

- Borrowers facing financial hardships or unstable employment situations

06

- Graduates who have not yet found high-paying jobs

07

- Self-employed individuals with unpredictable income

08

By opting for an income-driven repayment plan, borrowers can potentially lower their monthly loan payments based on their income and family size, making it more manageable to repay their student loans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the online income-driven repayment plan in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your online income-driven repayment plan and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit online income-driven repayment plan on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share online income-driven repayment plan from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete online income-driven repayment plan on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your online income-driven repayment plan, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is online income-driven repayment plan?

An online income-driven repayment plan is a federal student loan repayment option that adjusts your monthly payments based on your income and family size, making payments more manageable for borrowers.

Who is required to file online income-driven repayment plan?

Borrowers with federal student loans who wish to benefit from reduced monthly payments based on their income and family size are required to file for an online income-driven repayment plan.

How to fill out online income-driven repayment plan?

To fill out the online income-driven repayment plan, borrowers must log into their federal student loan account, navigate to the repayment section, and provide necessary financial information including income, family size, and number of dependents.

What is the purpose of online income-driven repayment plan?

The purpose of the online income-driven repayment plan is to help borrowers manage their federal student loan payments by reducing the monthly amount based on their income, thereby preventing default and making repayment more feasible.

What information must be reported on online income-driven repayment plan?

Borrowers must report their income, family size, tax return information, and any dependents when filing for an online income-driven repayment plan.

Fill out your online income-driven repayment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Income-Driven Repayment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.