Get the free Donation Form-ART Only. Donation Form-ART Only

Show details

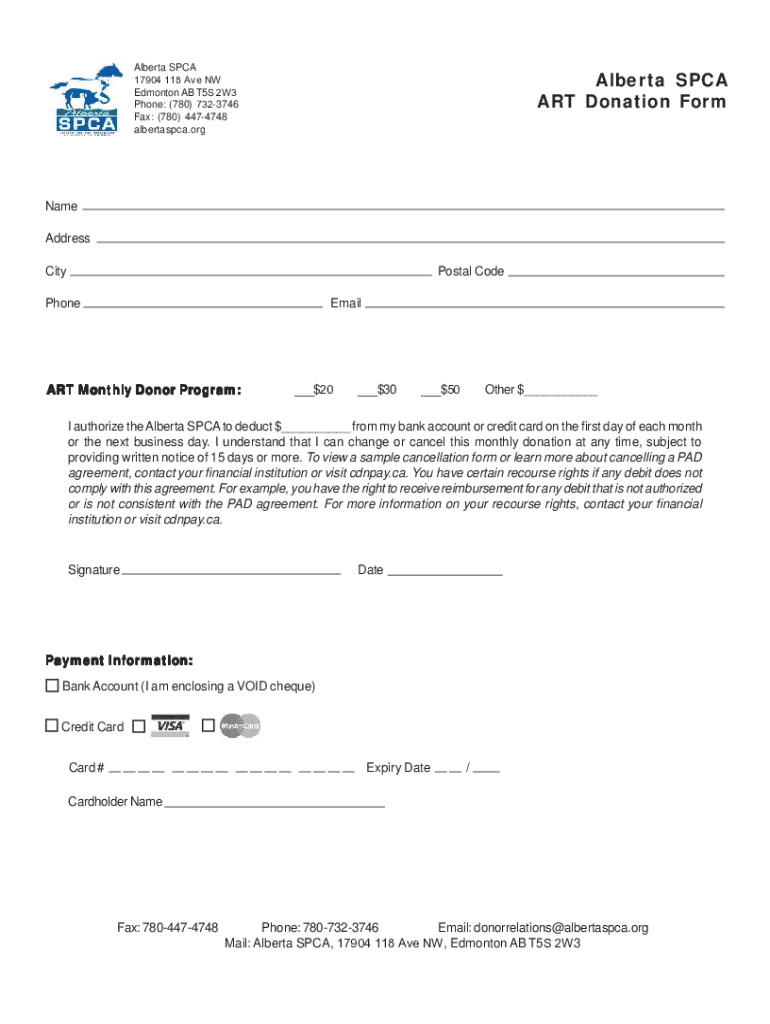

Alberta SPCA 17904 118 Ave NW Edmonton AB T5S 2W3 Phone: (780) 7323746 Fax: (780) 4474748 albertaspca. Oral r t a SPCA ART Donation Form Name Address CityPostal CodePhoneEmailART Mont fly Donor Program

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation form-art only donation

Edit your donation form-art only donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation form-art only donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donation form-art only donation online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donation form-art only donation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donation form-art only donation

How to fill out donation form-art only donation

01

Start by obtaining a donation form specifically for art-only donations from the relevant organization.

02

Fill out your personal information accurately and completely. This may include your name, address, email, and phone number.

03

Provide details about the artwork you are donating. This typically includes the title, artist's name, medium used, dimensions, and any special notes or considerations.

04

Indicate the estimated value of the artwork. It is important to be realistic and transparent about the worth of the donation.

05

If applicable, specify any restrictions or conditions regarding the donation. For example, if the artwork can only be displayed in certain locations or if it should not be sold.

06

Include any additional documentation or materials required. This may involve attaching photographs of the artwork, providing provenance records, or signing a certificate of authenticity.

07

Review the completed form for accuracy and ensure all necessary information is included.

08

Submit the donation form as instructed by the organization. This may involve mailing it, submitting it online, or delivering it in person.

Who needs donation form-art only donation?

01

Art organizations, museums, galleries, and charities that are focused on supporting and promoting art can benefit from donation forms specifically designed for art-only donations.

02

Art collectors, artists, and individuals who wish to contribute their artwork to these organizations can also make use of donation forms to ensure the proper documentation and transfer of ownership.

03

These forms help facilitate the process of accepting and managing art donations, allowing organizations to showcase and preserve donated artworks while complying with legal and administrative requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send donation form-art only donation for eSignature?

Once you are ready to share your donation form-art only donation, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in donation form-art only donation?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your donation form-art only donation to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in donation form-art only donation without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your donation form-art only donation, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is donation form-art only donation?

The donation form-art only donation is a specific form used by individuals or organizations to report donations of artwork or similar items for tax purposes.

Who is required to file donation form-art only donation?

Individuals or organizations that donate art valued above a certain threshold and wish to claim a tax deduction for their donation must file the donation form-art only donation.

How to fill out donation form-art only donation?

To fill out the donation form-art only donation, you need to provide details about the donor, the recipient, a description of the artwork, its value, and any relevant appraisals or documentation supporting the donation.

What is the purpose of donation form-art only donation?

The purpose of the donation form-art only donation is to provide a standardized way for individuals and organizations to report and claim tax deductions for donated artwork.

What information must be reported on donation form-art only donation?

The form requires reporting information such as the donor's and recipient's names, descriptions of the artwork, the fair market value, and any relevant appraisals.

Fill out your donation form-art only donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Form-Art Only Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.