Get the free Tax cuts fuel economic boom Robesonian

Show details

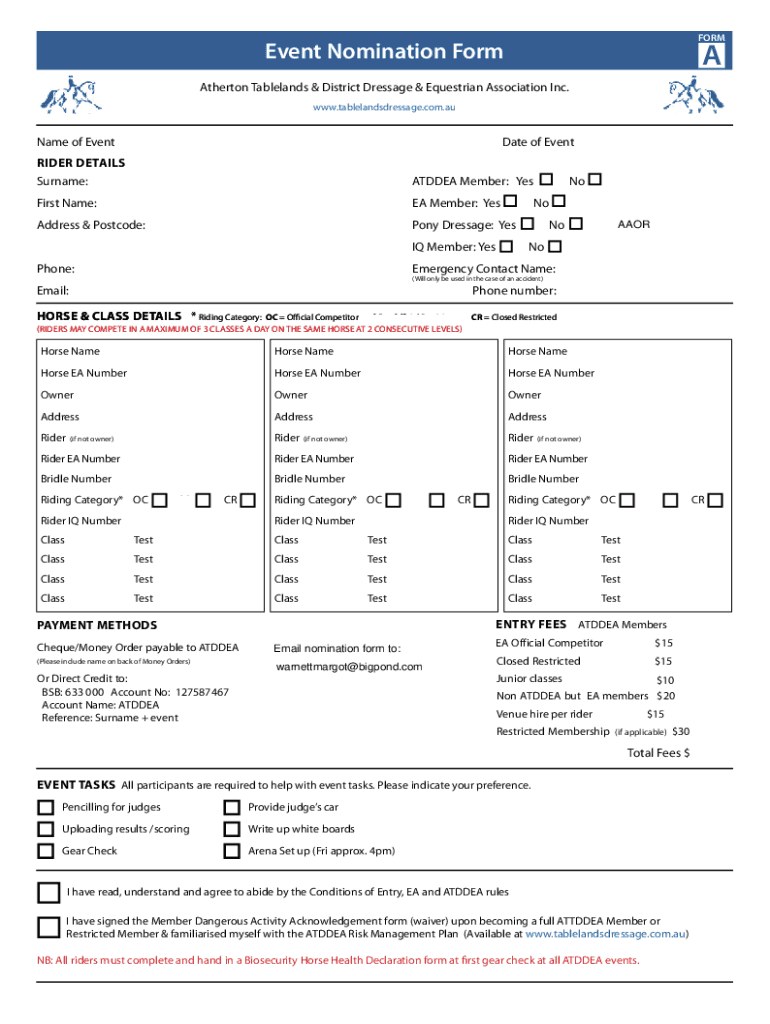

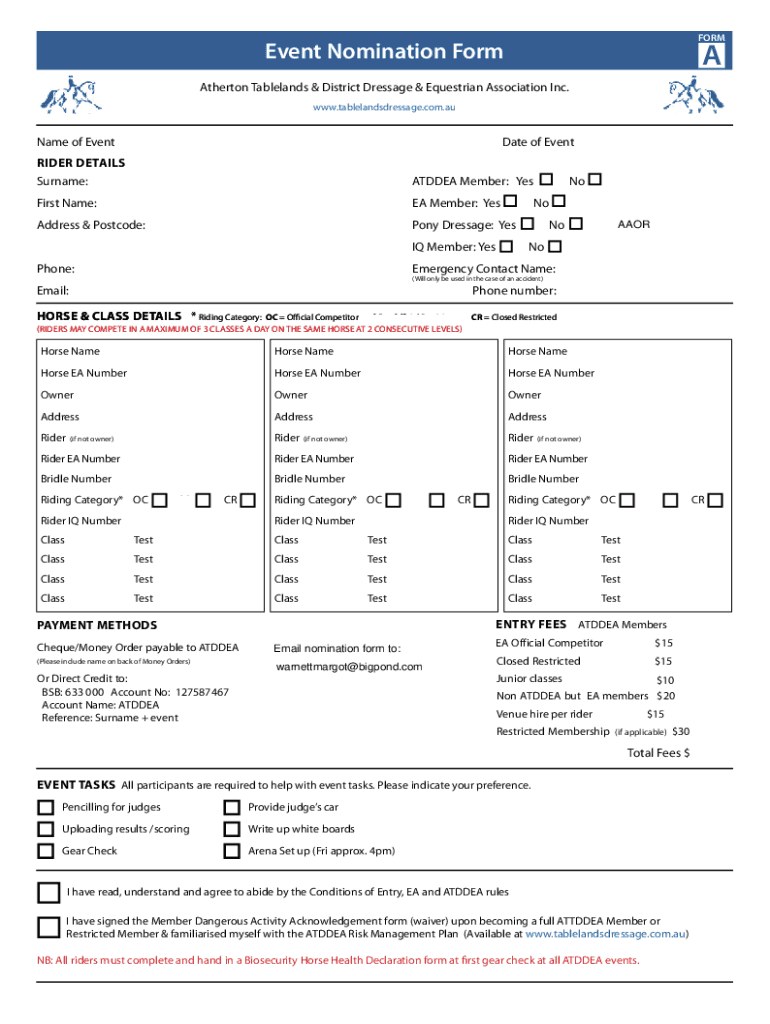

Firmament Nomination Form Atherton Tablelands & District Dressage & Equestrian Association Inc. www.tablelandsdressage.com.auName of Eventuate of Eventide Details Surname:AT DDEA Member: First Name:EA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax cuts fuel economic

Edit your tax cuts fuel economic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax cuts fuel economic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax cuts fuel economic online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax cuts fuel economic. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax cuts fuel economic

How to fill out tax cuts fuel economic

01

To fill out tax cuts that fuel economic growth, follow these steps:

02

Understand the tax cuts: Familiarize yourself with the specific tax cuts that have been implemented or proposed. This may include reductions in income tax rates, corporate tax cuts, or incentives for investment.

03

Gather relevant information: Collect all the necessary information and documents required to fill out your tax returns, such as W-2 forms, 1099s, and receipts for deductible expenses.

04

Determine eligibility: Check if you qualify for any specific tax cuts based on your income level, employment status, or business activities.

05

Consult a tax professional: If you are unsure about how to fill out the tax cuts properly or want to maximize your benefits, it is advisable to consult a professional tax advisor or accountant.

06

Use tax software or forms: Depending on your preference, choose between using tax software like TurboTax or filling out forms manually. The software will guide you through the process, while forms can be obtained from the IRS website or local tax offices.

07

Fill out the required information: Enter the relevant details, such as income, deductions, and credits, in the appropriate sections of the tax forms or software. Pay careful attention to accuracy and completeness.

08

Review and double-check: Review your filled-out tax forms or software-generated return to ensure accuracy and completeness. Check for any errors or missing information that could affect your tax cuts.

09

Submit your tax return: Once you have completed the tax forms or software process, submit your tax return electronically or by mail, following the instructions provided.

10

Keep records: Maintain copies of your tax returns, supporting documents, and any related correspondence for future reference and auditing purposes.

11

Stay informed: Stay updated on any changes or clarifications related to tax cuts or economic stimulus measures to ensure compliance and maximize benefits.

Who needs tax cuts fuel economic?

01

Tax cuts fuel economic growth and can benefit various individuals and entities, including:

02

- Individuals: Tax cuts can provide individuals with more disposable income, allowing them to save or spend on goods and services. This increased consumption can stimulate economic growth.

03

- Businesses: Tax cuts can reduce the tax burden on businesses, promoting investment, expansion, and job creation. They can also incentivize companies to repatriate funds held overseas back into the domestic economy.

04

- Investors: Lower tax rates on capital gains and dividends can encourage investment in businesses and financial markets, potentially driving economic activity.

05

- Entrepreneurs: Tax cuts can incentivize entrepreneurs to start new businesses or expand existing ones, spurring innovation and economic development.

06

- Economic sectors: Certain sectors, such as manufacturing, energy, and technology, can benefit from tax cuts that create a more favorable business environment and encourage investment.

07

- Overall economy: Tax cuts can contribute to overall economic growth by boosting consumer spending, business investment, job creation, and GDP.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax cuts fuel economic without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your tax cuts fuel economic into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find tax cuts fuel economic?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific tax cuts fuel economic and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in tax cuts fuel economic without leaving Chrome?

tax cuts fuel economic can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is tax cuts fuel economic?

Tax cuts that fuel the economy refer to reductions in tax rates or tax liabilities aimed at stimulating economic growth by increasing disposable income for individuals and businesses.

Who is required to file tax cuts fuel economic?

Individuals and businesses that benefit from tax cuts or tax incentives may be required to file tax documentation to claim these benefits during tax season.

How to fill out tax cuts fuel economic?

To fill out tax cuts related forms, individuals and businesses should gather necessary financial documents, follow IRS guidelines or state tax authority instructions, and accurately report income and deductions tied to the tax cuts.

What is the purpose of tax cuts fuel economic?

The purpose of tax cuts that fuel the economy is to promote economic growth by encouraging spending and investment, ultimately leading to job creation and increased consumer confidence.

What information must be reported on tax cuts fuel economic?

Taxpayers need to report income, deductions, credits, and any other financial information relevant to the tax cuts they are claiming.

Fill out your tax cuts fuel economic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Cuts Fuel Economic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.