MN Self-Employment Income Cash Accounting 2019-2025 free printable template

Show details

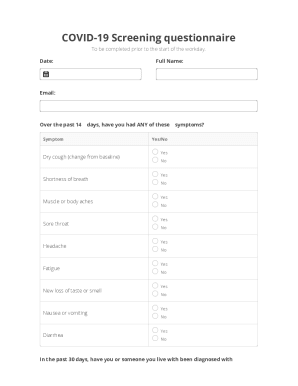

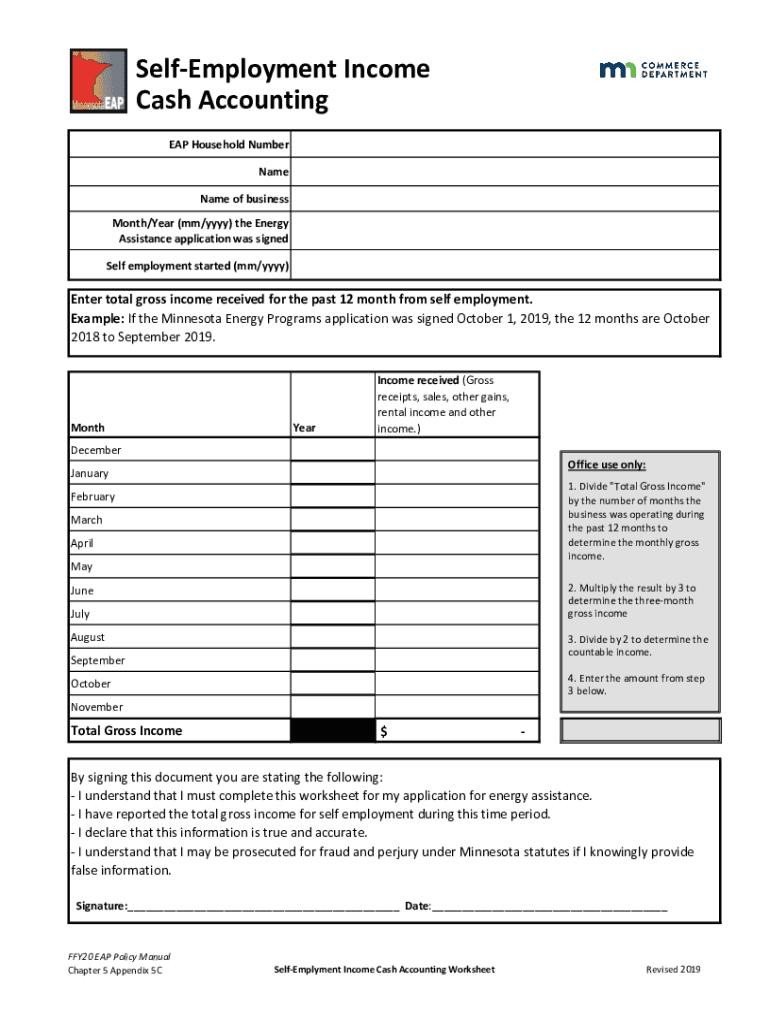

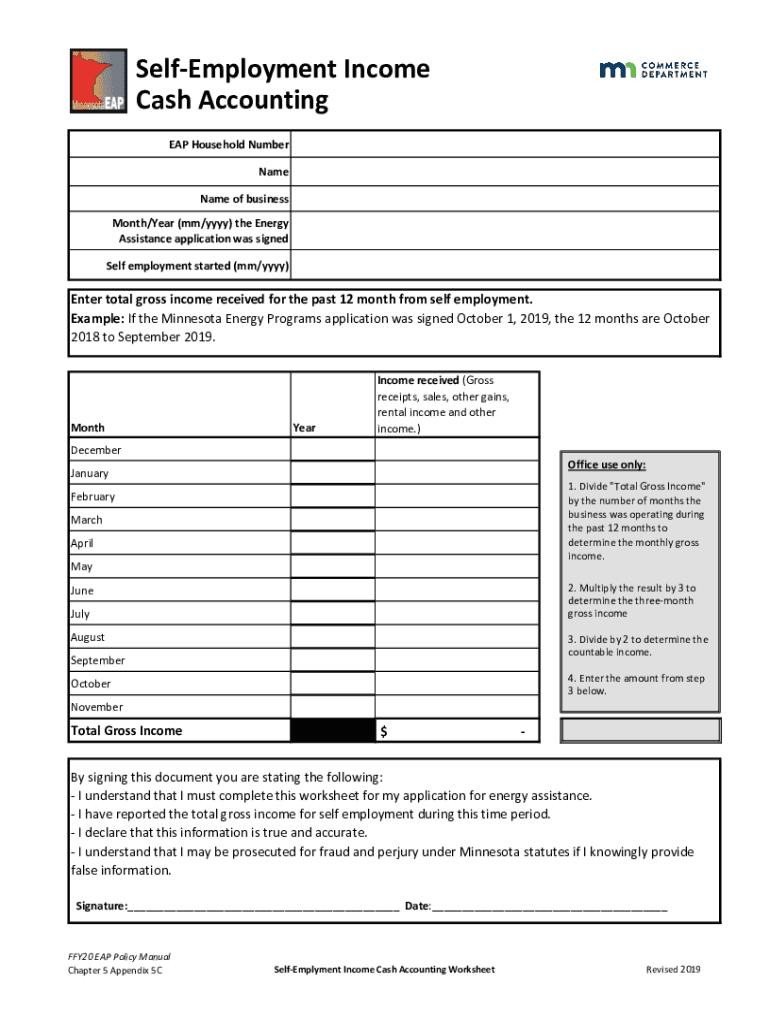

Reemployment Income Cash Accounting EAP Household Number Name of business Month/Year (mm/YYY) the Energy Assistance application was signed Self employment started (mm/YYY)Enter total gross income

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign self employment income worksheet

Edit your self employment income worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment income worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self employment income worksheet online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self employment income worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Self-Employment Income Cash Accounting Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out self employment income worksheet

How to fill out MN Self-Employment Income Cash Accounting

01

Gather necessary financial documents such as income receipts and expense records.

02

Begin with your total cash income for the year, including all cash payments received.

03

List all allowable business expenses that you incurred throughout the year.

04

Subtract total expenses from total income to determine your net profit or loss.

05

Fill out the MN Self-Employment Income Cash Accounting form, entering your total income and expenses in the appropriate sections.

06

Review all entries for accuracy and completeness before submitting the form.

Who needs MN Self-Employment Income Cash Accounting?

01

Self-employed individuals who need to report their income and expenses for tax purposes.

02

Freelancers and independent contractors who operate their own businesses.

03

Business owners who keep cash-based records rather than accrual accounting.

04

Individuals who qualify for or are participating in state assistance programs requiring income verification.

Fill

form

: Try Risk Free

People Also Ask about

What should I put as income when self-employed?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

How much can you make self-employed before paying tax?

You will only owe self employment tax in California if your net earnings are more than $400 for the year. You can calculate your net earnings by subtracting your business expenses from your business income. If your income is above this threshold, you'll be required to pay a fixed California self employment tax rate.

Can I be exempt from self-employment tax?

File Form 4361 to apply for an exemption from self-employment tax if you have ministerial earnings and are: An ordained, commissioned, or licensed minister of a church; A member of a religious order who has not taken a vow of poverty; or. A Christian Science practitioner.

What happens if you are self-employed and don't file taxes?

If you are self-employed and do not file your federal income tax return, any self-employment income you earned will not be reported to the Social Security Administration and you will not receive credits toward Social Security retirement or disability benefits.

Do I have to pay taxes on self-employment income?

Self-employed people are responsible for paying the same federal income taxes as everyone else. The difference is that they don't have an employer to withhold money from their paycheck and send it to the IRS—or to share the burden of paying Social Security and Medicare taxes.

How much can you make self-employed without paying taxes?

You will only owe self employment tax in California if your net earnings are more than $400 for the year. You can calculate your net earnings by subtracting your business expenses from your business income. If your income is above this threshold, you'll be required to pay a fixed California self employment tax rate.

What qualifies you as self-employed?

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business or a gig worker).

How much taxes do you pay on self-employment?

The self-employment tax rate is 15.3%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my self employment income worksheet directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your self employment income worksheet and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute self employment income worksheet online?

Filling out and eSigning self employment income worksheet is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out self employment income worksheet on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your self employment income worksheet by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is MN Self-Employment Income Cash Accounting?

MN Self-Employment Income Cash Accounting is a method of accounting used to report self-employment income and expenses in Minnesota, where income is recorded when received and expenses are recorded when paid.

Who is required to file MN Self-Employment Income Cash Accounting?

Individuals engaged in self-employment in Minnesota who meet certain income thresholds are required to file using the MN Self-Employment Income Cash Accounting method.

How to fill out MN Self-Employment Income Cash Accounting?

To fill out MN Self-Employment Income Cash Accounting, individuals need to report their total income received from self-employment, any allowable business expenses paid, and then calculate the net profit or loss.

What is the purpose of MN Self-Employment Income Cash Accounting?

The purpose of MN Self-Employment Income Cash Accounting is to provide a clear and straightforward method for self-employed individuals to report their income and expenses, ensuring accurate tax reporting.

What information must be reported on MN Self-Employment Income Cash Accounting?

The information that must be reported includes total cash income received from self-employment, detailed business expenses incurred, and any other relevant financial data related to the self-employment activity.

Fill out your self employment income worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employment Income Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.