Get the free Export-import theory, practices, and procedures 3rd ...

Show details

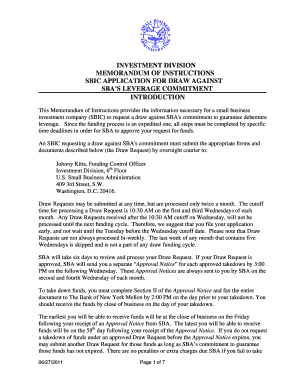

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8KCURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of the earliest

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign export-import formory practices and

Edit your export-import formory practices and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your export-import formory practices and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing export-import formory practices and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit export-import formory practices and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out export-import formory practices and

How to fill out export-import formory practices and

01

To fill out an export-import formulary, follow these steps:

02

Start by gathering all the necessary information about the shipment, including the product details, quantity, value, and destination country.

03

Identify the correct form or document required for the specific type of export-import transaction. This may include customs declaration forms, bill of lading, or other relevant documents.

04

Fill out the form accurately and completely. Provide all the requested details, ensuring accuracy and consistency of information.

05

Ensure compliance with all applicable laws, regulations, and trade requirements, including any specific documentation or licensing requirements.

06

Verify the information provided before submitting the form. Double-check for any errors or omissions that could lead to delays or non-compliance.

07

Submit the filled-out form to the relevant authorities or stakeholders as instructed. This may include customs authorities, shipping companies, or trade agents.

08

Keep copies of all submitted forms and supporting documents for record-keeping and future reference.

09

Monitor the progress of the shipment and address any issues or inquiries from the authorities or stakeholders promptly.

10

By following these steps, you can effectively fill out export-import formulary practices and ensure a smooth and compliant international trade transaction.

Who needs export-import formory practices and?

01

Export-import formulary practices are needed by individuals, businesses, and organizations involved in international trade.

02

Exporters: Exporters need to fill out export-import forms to comply with customs and trade regulations of the destination country, declare the goods being shipped, and facilitate the smooth movement of goods across borders.

03

Importers: Importers also need to fill out these forms to provide information about the imported goods to customs authorities, calculate import duties and taxes, and ensure compliance with import regulations at the destination country.

04

Customs Authorities: Customs authorities require export-import formularies to monitor and control the movement of goods across borders, assess import duties and taxes, and enforce trade regulations.

05

Shipping Companies and Freight Forwarders: These stakeholders require export-import formularies to document and manage international shipments, ensure compliance with shipping and trade requirements, and facilitate the logistics of the goods.

06

Trade Agents and Consultants: Trade agents and consultants assist exporters and importers in navigating the complexities of international trade. They help in filling out export-import formularies accurately and ensuring compliance with applicable laws and regulations.

07

By implementing export-import formulary practices, these stakeholders can streamline their international trade operations, ensure legal compliance, and minimize potential risks and delays.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit export-import formory practices and from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including export-import formory practices and, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete export-import formory practices and online?

pdfFiller makes it easy to finish and sign export-import formory practices and online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete export-import formory practices and on an Android device?

On Android, use the pdfFiller mobile app to finish your export-import formory practices and. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is export-import formory practices and?

Export-import formory practices refer to the procedures and documentation required for the legal trade of goods between countries, ensuring compliance with regulations.

Who is required to file export-import formory practices and?

Businesses and individuals involved in exporting or importing goods are required to file export-import formory practices.

How to fill out export-import formory practices and?

To fill out export-import formory practices, one must complete the relevant forms accurately, providing details about the goods, value, shipping information, and comply with the applicable regulations.

What is the purpose of export-import formory practices and?

The purpose of export-import formory practices is to monitor and regulate international trade, ensure compliance with trade laws, and collect data for economic analysis.

What information must be reported on export-import formory practices and?

The information that must be reported includes the description of goods, their value, origin and destination, shipping methods, and any applicable tariffs or duties.

Fill out your export-import formory practices and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Export-Import Formory Practices And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.