Get the free 1 Year Fixed Rate Cash ISA Application Form March 2019 1YFRCISAAPP(03191).indd

Show details

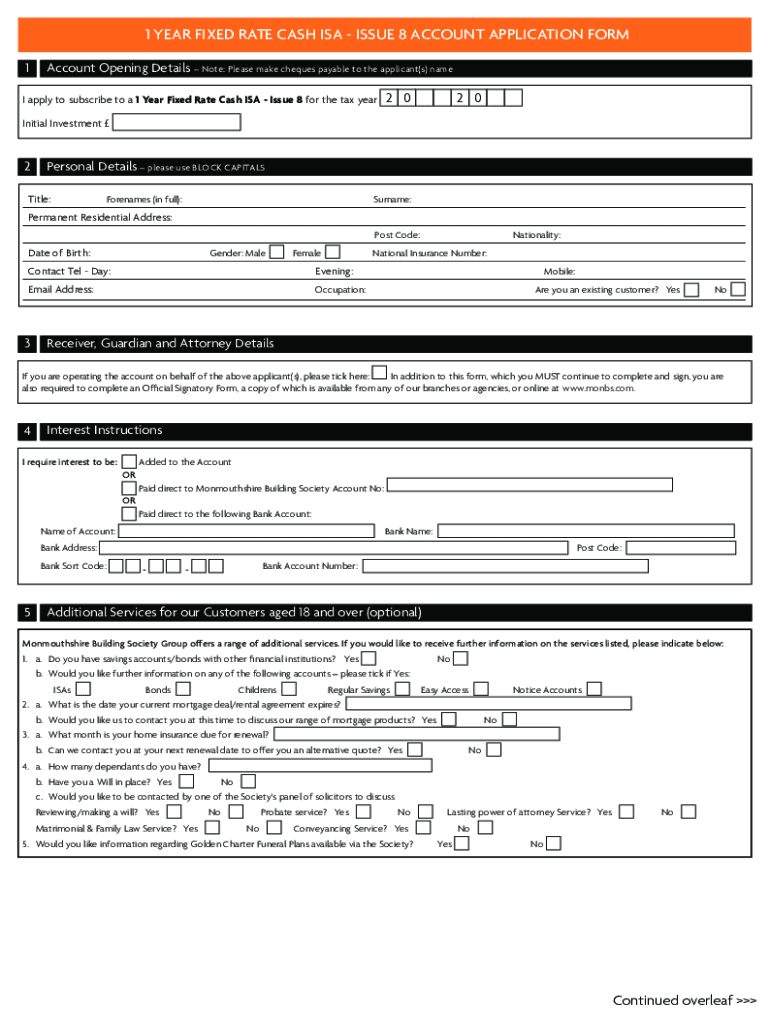

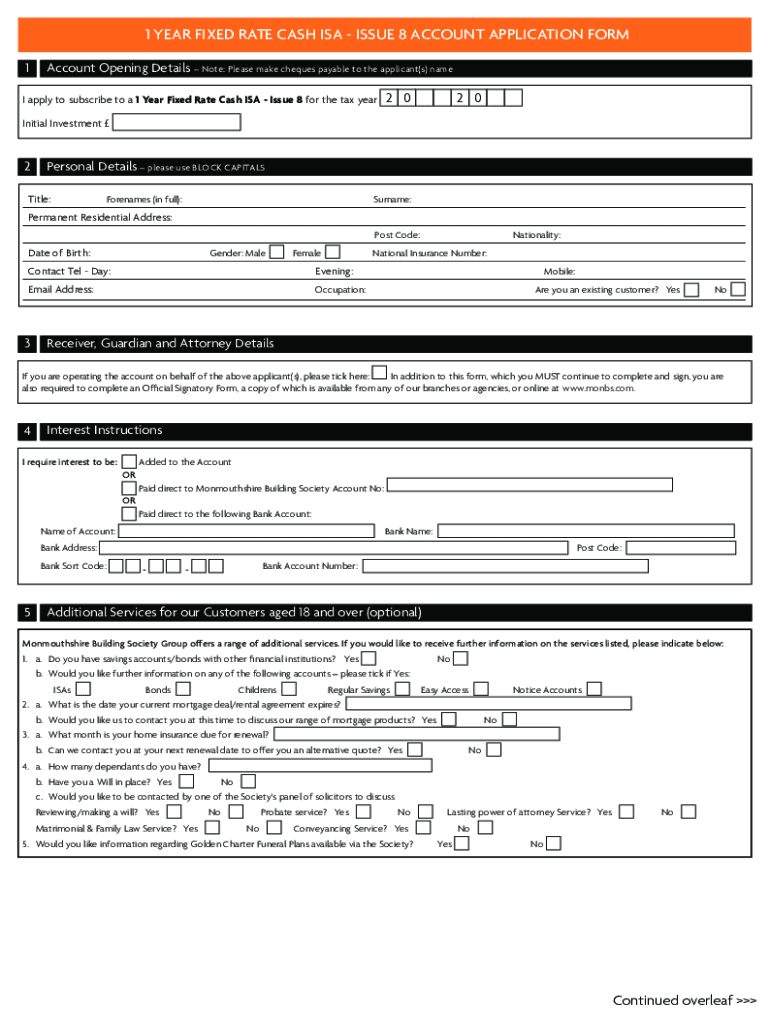

1 YEAR FIXED RATE CASH ISA ISSUE 8 ACCOUNT APPLICATION FORM 1Account Opening Details Note: Please make checks payable to the applicant(s) name apply to subscribe to a 1-Year Fixed Rate Cash ISA Issue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1 year fixed rate

Edit your 1 year fixed rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 year fixed rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1 year fixed rate online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1 year fixed rate. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1 year fixed rate

How to fill out 1 year fixed rate

01

Start by gathering all the necessary documents such as identification proof, income statements, and address proof.

02

Visit the bank or financial institution offering the 1 year fixed rate loan.

03

Approach a bank representative or loan officer and express your interest in applying for the 1 year fixed rate loan.

04

Provide all the required documents for verification and complete the loan application form.

05

Review the terms and conditions of the 1 year fixed rate loan before you sign any agreements.

06

Make sure to accurately fill out all the required information, including the loan amount, interest rate, and repayment schedule.

07

Double-check all the information provided on the application form for any errors or missing details.

08

Submit the completed application form along with the necessary documents to the bank representative or loan officer.

09

Wait for the bank's decision on your loan application.

10

If approved, carefully read and understand the loan agreement before signing it.

11

Fulfill any additional requirements or conditions specified by the bank.

12

Once everything is in order, the bank will disburse the loan amount to you.

13

Start repaying the loan as per the agreed-upon schedule to avoid any penalties or late fees.

14

Periodically monitor your loan account and keep track of the interest payments and outstanding balance.

15

When the loan tenure is completed, ensure all the outstanding dues are cleared and obtain necessary closure documents from the bank.

Who needs 1 year fixed rate?

01

Individuals who prefer stability and predictability in their loan repayments may opt for a 1 year fixed rate.

02

Borrowers who believe that interest rates may rise in the future and want to lock in a favorable rate for a year.

03

Those who have a short-term financial goal or requirement that can be fulfilled within a year.

04

People who have a good credit history and can qualify for a fixed rate loan with favorable terms.

05

Individuals who prefer a straightforward and uncomplicated loan structure without the risk of interest rate fluctuations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 1 year fixed rate?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 1 year fixed rate in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in 1 year fixed rate without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 1 year fixed rate, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit 1 year fixed rate on an Android device?

You can edit, sign, and distribute 1 year fixed rate on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is 1 year fixed rate?

A 1 year fixed rate refers to a financial product, typically a loan or deposit, where the interest rate is fixed for a term of one year. This means the interest rate will not change for that period.

Who is required to file 1 year fixed rate?

Individuals or entities engaging in fixed-rate loans or investments that require reporting for compliance purposes are typically required to file for a 1 year fixed rate.

How to fill out 1 year fixed rate?

To fill out a 1 year fixed rate form, provide all requested information regarding the loan or investment, including personal details, financial information, and any terms associated with the fixed rate agreement.

What is the purpose of 1 year fixed rate?

The purpose of a 1 year fixed rate is to provide predictable interest payments and safeguard against interest rate fluctuations for the duration of that year.

What information must be reported on 1 year fixed rate?

The information that must be reported typically includes the principal amount, fixed interest rate, maturity date, and any relevant borrower or investor information.

Fill out your 1 year fixed rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1 Year Fixed Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.