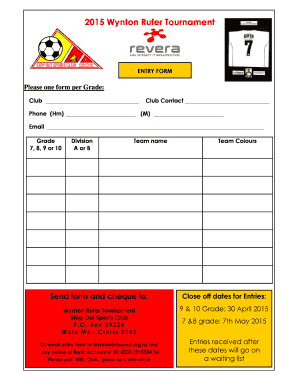

Get the free Primary vs. Secondary Insurance: What's The Difference ...

Show details

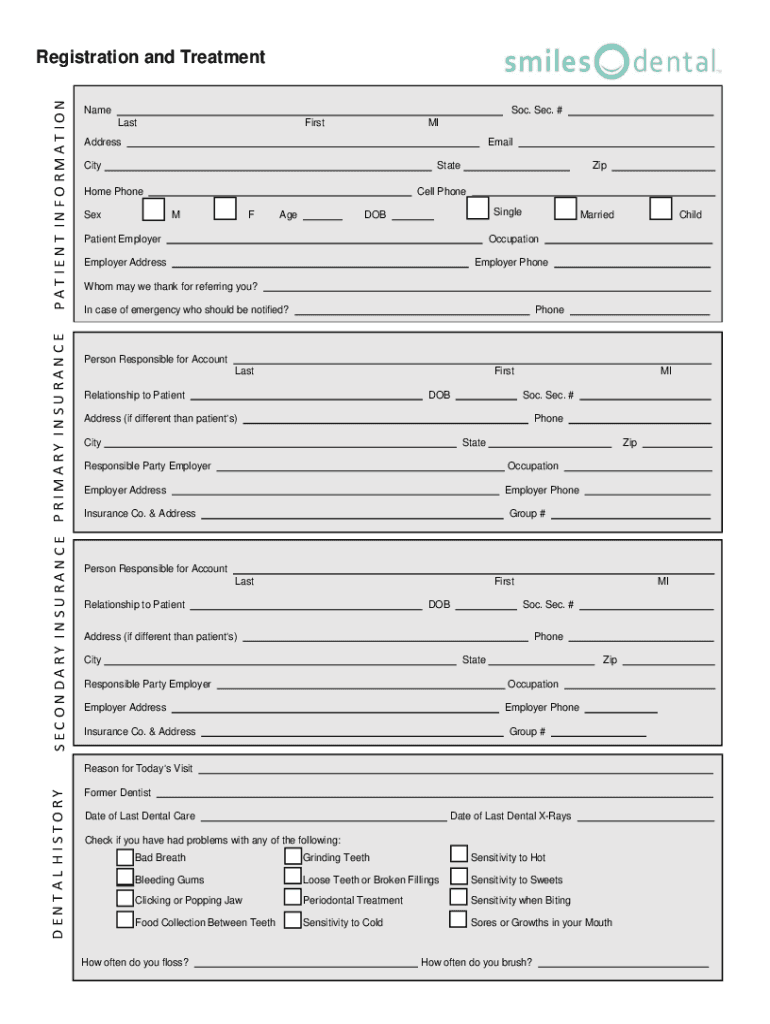

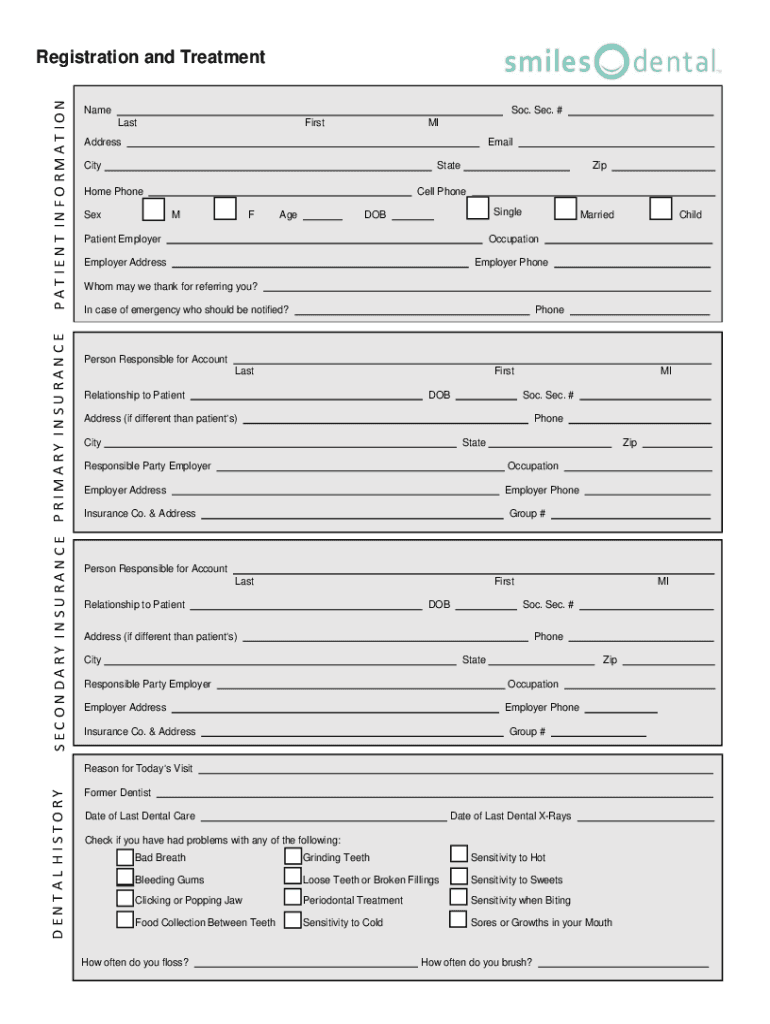

SECONDARY INSURANCE PRIMARY INSURANCEPATIENT INFORMATIONRegistration and Treatment

Name Soc. Sec. #

LastFirstMIAddressEmailCityStateHome Phone

SexZipCell Phone

MFAgeSingleDOBMarriedPatient EmployerOccupationEmployer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign primary vs secondary insurance

Edit your primary vs secondary insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your primary vs secondary insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit primary vs secondary insurance online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit primary vs secondary insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out primary vs secondary insurance

How to fill out primary vs secondary insurance

01

Start by understanding the difference between primary and secondary insurance. Primary insurance is the first payer for your medical expenses, while secondary insurance acts as a backup or supplementary coverage.

02

Collect all necessary insurance information, including the policy numbers and contact details for both your primary and secondary insurance providers.

03

When receiving healthcare services, present your primary insurance information first. This will ensure that your primary insurance provider is billed initially for the expenses.

04

After your primary insurance processes the claim, they will send you an Explanation of Benefits (EOB) which shows what portion of the expenses they covered.

05

If there are any remaining out-of-pocket expenses, or certain expenses that your primary insurance does not cover, submit a claim to your secondary insurance provider.

06

Provide your secondary insurance provider with the necessary documentation, such as the EOB from your primary insurer, medical bills, and any other required forms.

07

Your secondary insurance will then review the claim and determine the amount they will cover. They may cover the remaining expenses in full or only a portion depending on the terms and coverage of your policy.

08

Once your secondary insurance processes the claim, they will send you a separate EOB outlining what portion of the expenses they covered.

09

If there are still any outstanding expenses after both your primary and secondary insurance have processed the claims, you will be responsible for paying those out-of-pocket.

10

It is important to keep track of all insurance communication, including EOBs, bills, and receipts, for future reference and disputes if necessary.

Who needs primary vs secondary insurance?

01

Different individuals or situations may require primary or secondary insurance:

02

- Individuals who have multiple insurance policies may need both primary and secondary insurance to cover their medical expenses.

03

- People who have access to a primary insurance plan, such as through an employer, may not need secondary insurance as their primary coverage should be sufficient.

04

- Individuals with high medical expenses or chronic conditions may benefit from having secondary insurance to help cover any costs not covered by their primary insurance.

05

- Certain healthcare providers or facilities may require patients to have both primary and secondary insurance to receive services.

06

- Those who frequently travel abroad may need both primary and secondary insurance to ensure coverage in different countries or regions.

07

- It is recommended to consult with insurance providers or a knowledgeable healthcare professional to determine the specific insurance needs based on individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit primary vs secondary insurance on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing primary vs secondary insurance right away.

How do I edit primary vs secondary insurance on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign primary vs secondary insurance. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete primary vs secondary insurance on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your primary vs secondary insurance, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is primary vs secondary insurance?

Primary insurance is the first policy that pays for healthcare costs, while secondary insurance helps cover additional expenses not paid by the primary insurance.

Who is required to file primary vs secondary insurance?

The insured individual is typically required to file claims with their primary insurance first, and then the remaining balance can be filed with the secondary insurance.

How to fill out primary vs secondary insurance?

Fill out the primary insurance claim form first, providing all necessary details. Then, complete the secondary insurance form with the primary insurance's payment details and any remaining balances.

What is the purpose of primary vs secondary insurance?

The purpose is to ensure that healthcare costs are covered efficiently, where primary insurance addresses initial costs, and secondary insurance helps to reduce out-of-pocket expenses.

What information must be reported on primary vs secondary insurance?

You must provide personal information, details of the medical services received, primary insurance payment information, and the total amount due for the secondary insurance claim.

Fill out your primary vs secondary insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Primary Vs Secondary Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.