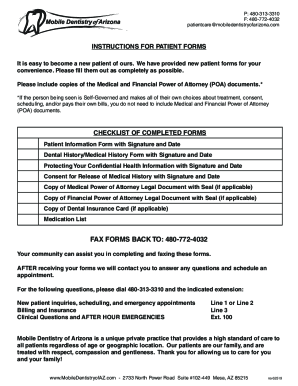

Get the free CARB Early Action Offsets Application, CAOD 0085. remediated using low scrutiny on 2...

Show details

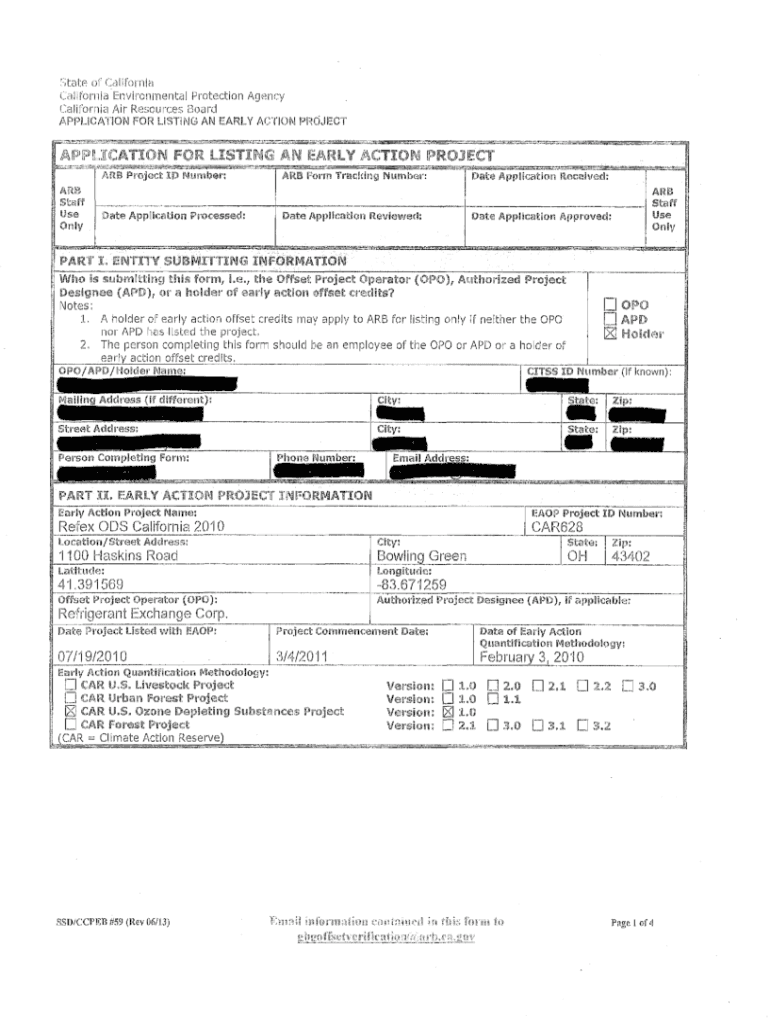

State of CalifarnlaCalifornia Environmental Protection Agency California Air Resource. BoardAPPLICATION FOR LISTING AN EARLY ACTION PROJECTAPPLICATION FOR LISTING AN EARLY ACTION PROJECT ARB Project

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign carb early action offsets

Edit your carb early action offsets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your carb early action offsets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

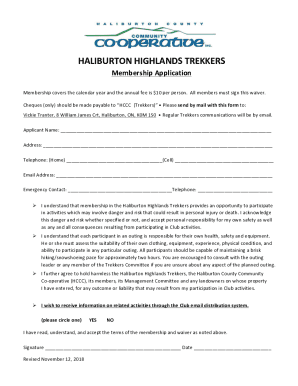

Editing carb early action offsets online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit carb early action offsets. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

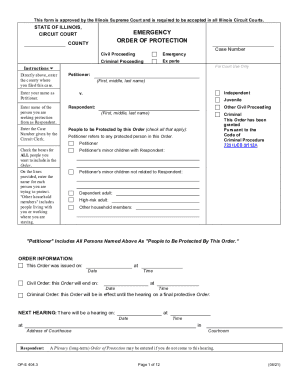

How to fill out carb early action offsets

How to fill out carb early action offsets

01

To fill out CARB early action offsets, follow these steps:

02

Determine your eligibility criteria for early action offsets.

03

Calculate your emissions that can be reduced through early action.

04

Research and select the projects or activities that will help you offset your emissions.

05

Register with the California Air Resources Board (CARB) and obtain the necessary permits or certifications.

06

Track and document your emissions reductions accurately.

07

Submit the required reports and documentation to CARB within the specified deadlines.

08

Maintain records of your offset projects and ensure compliance with ongoing reporting requirements.

09

Periodically review and update your offset strategies as necessary to meet your emission reduction goals.

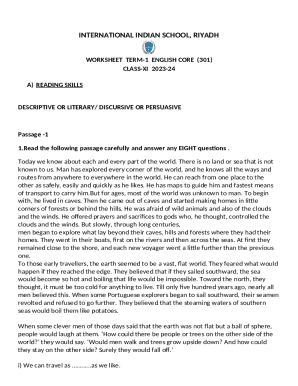

Who needs carb early action offsets?

01

Entities or organizations that have high carbon emissions and want to take voluntary actions to reduce their carbon footprint can benefit from CARB early action offsets.

02

This includes businesses, industries, local governments, and other entities in California.

03

These offsets can help them meet sustainability goals, demonstrate environmental responsibility, and contribute to the state's overall climate change mitigation efforts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my carb early action offsets directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your carb early action offsets along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send carb early action offsets to be eSigned by others?

When you're ready to share your carb early action offsets, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit carb early action offsets on an iOS device?

Create, modify, and share carb early action offsets using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is carb early action offsets?

CARB early action offsets refer to greenhouse gas emission reductions that have occurred before a specified compliance period and can be used to fulfill obligations under California's Cap-and-Trade program.

Who is required to file carb early action offsets?

Entities that generate early action offsets and wish to use them for compliance under California's Cap-and-Trade program are required to file.

How to fill out carb early action offsets?

To fill out CARB early action offsets, an entity must complete the required forms provided by CARB, detailing the emission reduction projects, methodologies used, and verification reports.

What is the purpose of carb early action offsets?

The purpose of CARB early action offsets is to encourage early investments in emission reduction projects and provide flexibility for regulated entities in meeting their greenhouse gas reduction targets.

What information must be reported on carb early action offsets?

The information that must be reported includes the type and location of the project, the amount of GHG emissions reduced, methodologies used for calculation, and verification details.

Fill out your carb early action offsets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Carb Early Action Offsets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.