Get the free Supervised Lender’s Branch Office License Application - coloradoattorneygeneral

Show details

This memorandum outlines the application process for obtaining a supervised lender branch office license under the Colorado Uniform Consumer Credit Code. It includes necessary documentation, fees,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supervised lenders branch office

Edit your supervised lenders branch office form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supervised lenders branch office form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supervised lenders branch office online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit supervised lenders branch office. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

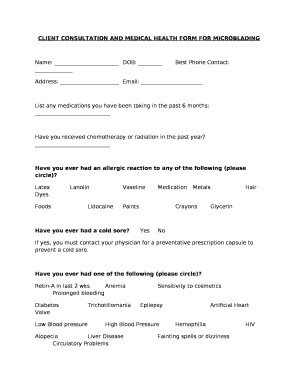

How to fill out supervised lenders branch office

How to fill out Supervised Lender’s Branch Office License Application

01

Obtain the Supervised Lender's Branch Office License Application form from the relevant regulatory authority's website.

02

Fill out the application form with accurate details about your branch office, including its address and contact information.

03

Provide information about the parent lending institution, including its licensing details and financial stability.

04

Include the names and backgrounds of the management staff who will be overseeing the branch operations.

05

Attach required supporting documents such as proof of financial stability, a business plan, and any other relevant information as specified by the authority.

06

Review the completed application for any errors or missing information.

07

Submit the application along with the necessary application fees to the appropriate regulatory authority.

08

Wait for the application to be processed and be prepared to respond to any additional inquiries from the licensing authority.

Who needs Supervised Lender’s Branch Office License Application?

01

All financial institutions that wish to establish a branch office for supervised lending operations in a specific jurisdiction.

02

Companies that offer consumer loans, mortgage loans, or other types of lending services and are required to be licensed under state or federal laws.

Fill

form

: Try Risk Free

People Also Ask about

Which of the following is responsible for approval of mortgage loan originator license applications?

The Commissioner or state regulator for financial institutions determines licensing eligibility.

How to get a mortgage broker license in NY?

Get Your Mortgage License in New York Step 1Request your personal NMLS account. Step 2Complete Your New York NMLS Pre-License Education. Step 3Pass the NMLS Mortgage licensing exam. Step 4Apply for your NMLS license. Step 5Background Checks, Credit Check, and Fees. Step 6Get Hired.

How to get a financial services license?

To earn specific licenses, financial advisors have to complete the following steps: Take the Securities Industry Essentials (SIE) exam. Find a sponsor for Series 6 or 7 exams. Consider Series 3 license option. Take the Series 63 or Series 65 exams. Explore additional certifications.

Is it hard to start as a mortgage broker?

It takes a long time & a lot of experience to know everything there is know about loans, getting into the industry with the aid of someone who has ``been there & done that'' will be paramount to having quick success.

How much does it cost to get a mortgage license in NY?

Applicants for an MLO license are required to pay the following non-refundable fees: Investigation fee: $125. License fee: $254. NMLS processing fee: $30.

How hard is the mortgage broker exam?

Mortgage Loan Originators must act ethically, and understand the business for both clients and larger financial systems as a whole. With that said, the NMLS licensing exam is purposely designed to be difficult. Did you know that only 56% of NMLS test takers pass the exam on their first attempt?

How do I become a mortgage broker in NY?

To implement the provisions of the Secure and Fair Enforcement Mortgage Licensing Act (SAFE Act), the Department requires MLOs to: Submit an application through the Nationwide Mortgage Licensing System (NMLS) Complete 20 hours of NMLS approved Pre-licensing Education Courses, including 3 hours of New York law;

How do I get a broker's license in New York?

Become A Real Estate Broker In NY in 4 Simple Steps Complete 75 Hours of Approved Broker Pre-Licensing Education. Pass Your Course Final Exam. Pass Your New York State Real Estate Broker Examination. Apply For Your Real Estate Broker License in NY.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supervised Lender’s Branch Office License Application?

The Supervised Lender’s Branch Office License Application is a formal request submitted by financial institutions seeking to operate a branch office that engages in supervised lending activities, ensuring compliance with regulatory requirements.

Who is required to file Supervised Lender’s Branch Office License Application?

Any financial entity that wishes to establish a branch office for supervised lending purposes must file the Supervised Lender’s Branch Office License Application.

How to fill out Supervised Lender’s Branch Office License Application?

To fill out the Supervised Lender’s Branch Office License Application, applicants must provide detailed information about their business, including branch location, compliance measures, and financial data, as required by the specific regulatory authority.

What is the purpose of Supervised Lender’s Branch Office License Application?

The purpose of the Supervised Lender’s Branch Office License Application is to ensure that lending practices at the branch comply with applicable laws, protect consumers, and promote responsible lending.

What information must be reported on Supervised Lender’s Branch Office License Application?

The application must include information such as the lender's license details, branch address, ownership structure, financial statements, compliance policies, and any relevant background information about key personnel.

Fill out your supervised lenders branch office online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supervised Lenders Branch Office is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.