Get the free Connecticut Dressage AssociationA non-profit ...

Show details

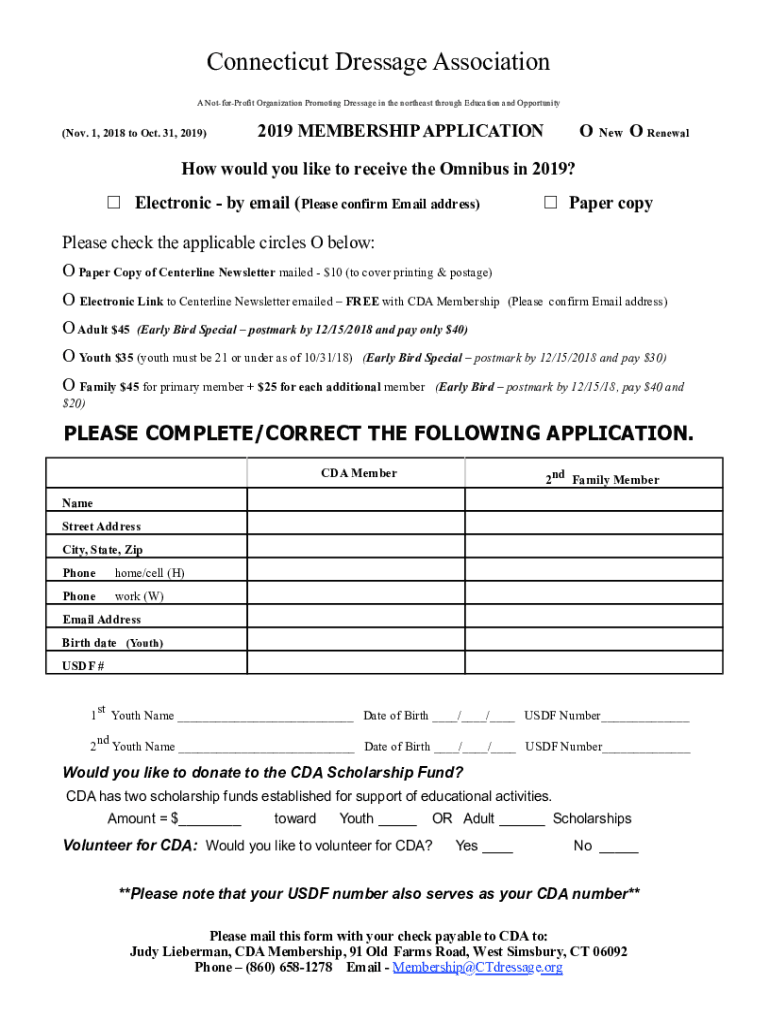

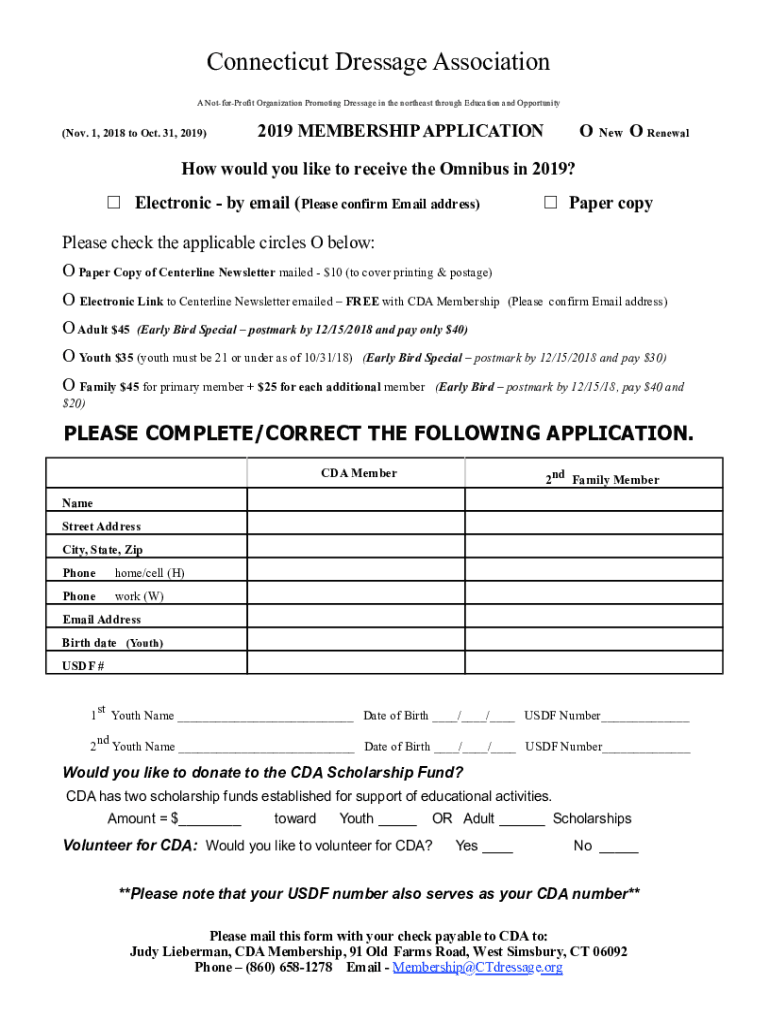

Connecticut Dressage Association A NotforProfit Organization Promoting Dressage in the northeast through Education and Opportunity(Nov. 1, 2018 to Oct. 31, 2019)2019 MEMBERSHIP APPLICATIONONewO Renewal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign connecticut dressage associationa non-profit

Edit your connecticut dressage associationa non-profit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut dressage associationa non-profit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit connecticut dressage associationa non-profit online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit connecticut dressage associationa non-profit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out connecticut dressage associationa non-profit

How to fill out connecticut dressage associationa non-profit

01

Begin by gathering all the necessary information and documents required to establish a non-profit organization in Connecticut.

02

Draft and file the Articles of Incorporation with the Connecticut Secretary of State. This document will outline the purpose of the organization, its name, and other important details.

03

Obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) by completing Form SS-4.

04

Develop the organization's bylaws which will govern its internal operations and decision-making processes.

05

Hold an initial meeting with the board of directors to elect officers, adopt the bylaws, and discuss other important matters regarding the non-profit's formation.

06

Apply for tax-exempt status with the IRS by submitting Form 1023 or Form 1023-EZ, depending on the organization's projected annual gross receipts.

07

Register with the Connecticut Department of Revenue Services to obtain state tax exemptions if applicable.

08

Create a strategic plan and fundraising strategy to sustain and grow the non-profit's operations.

09

Establish financial management systems and procedures to ensure proper accounting and reporting.

10

Promote the non-profit and its mission through marketing and outreach efforts to attract supporters, volunteers, and potential beneficiaries.

11

Regularly review and update the organization's activities and operations to ensure compliance with legal and regulatory requirements.

12

Continuously engage with stakeholders and the community to build relationships and garner support for the non-profit.

13

Maintain proper recordkeeping and file necessary reports with federal and state authorities to maintain the non-profit's legal standing.

14

Seek professional legal and accounting advice throughout the process to ensure compliance and effectiveness.

Who needs connecticut dressage associationa non-profit?

01

Connecticut Dressage Association non-profit is needed by individuals and groups who are passionate about dressage and want to promote and advance this equestrian discipline in Connecticut.

02

It is also beneficial for dressage enthusiasts, riders, trainers, and professionals who seek to establish a community where they can collaborate, learn, and participate in dressage-related activities.

03

Additionally, individuals or organizations who want to contribute to the growth and development of dressage as a sport and support educational programs, competitions, and other initiatives may also find value in the Connecticut Dressage Association non-profit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit connecticut dressage associationa non-profit online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your connecticut dressage associationa non-profit and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the connecticut dressage associationa non-profit electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your connecticut dressage associationa non-profit in minutes.

How do I edit connecticut dressage associationa non-profit straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing connecticut dressage associationa non-profit.

What is Connecticut Dressage Association non-profit?

The Connecticut Dressage Association is a non-profit organization dedicated to promoting and supporting the discipline of dressage in Connecticut through educational programs, competitions, and community engagement.

Who is required to file Connecticut Dressage Association non-profit?

Non-profit organizations operating in Connecticut, including the Connecticut Dressage Association, are required to file with the state for tax-exempt status and annual reports to maintain their non-profit designation.

How to fill out Connecticut Dressage Association non-profit?

To fill out the Connecticut Dressage Association non-profit forms, you typically need to complete the appropriate application forms provided by the state, including details about your organization's mission, financial statements, and board member information.

What is the purpose of Connecticut Dressage Association non-profit?

The purpose of the Connecticut Dressage Association non-profit is to encourage the development of dressage skills, promote horse welfare, and support the goals of riders and trainers within the discipline.

What information must be reported on Connecticut Dressage Association non-profit?

The Connecticut Dressage Association must report financial information, details of board members, annual program activities, and compliance with state and federal regulations in their filings.

Fill out your connecticut dressage associationa non-profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Connecticut Dressage Associationa Non-Profit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.