Get the free Contributing Appreciated Non-Cash Assets to Charity: ArtContributing Your Art to Cha...

Show details

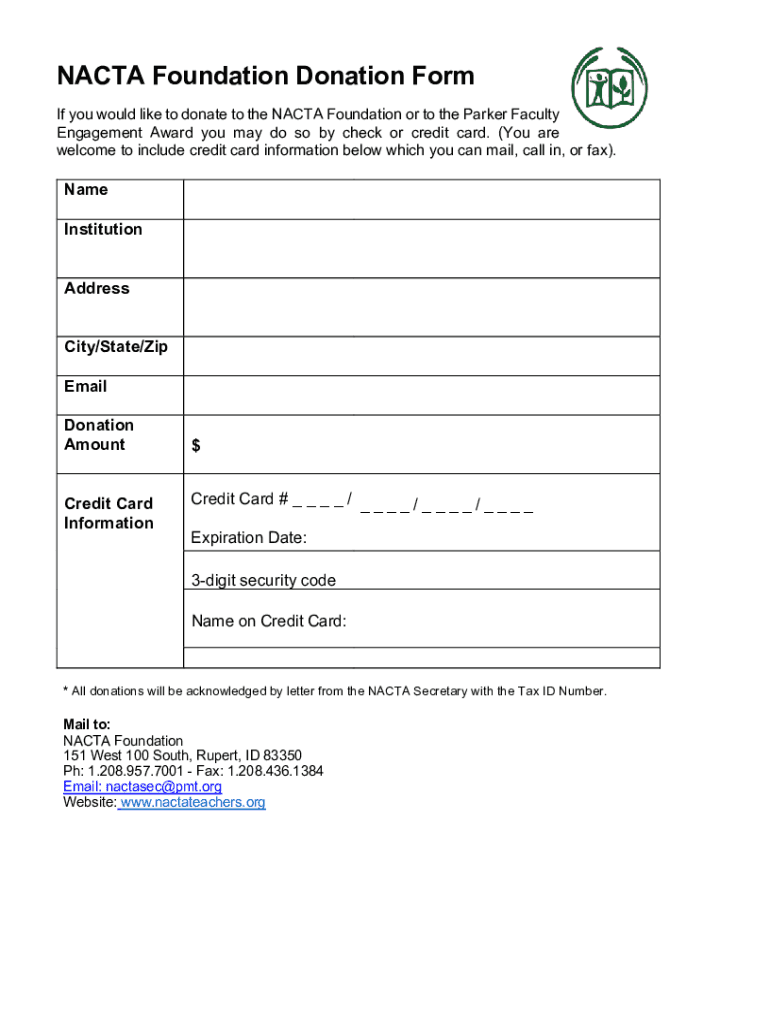

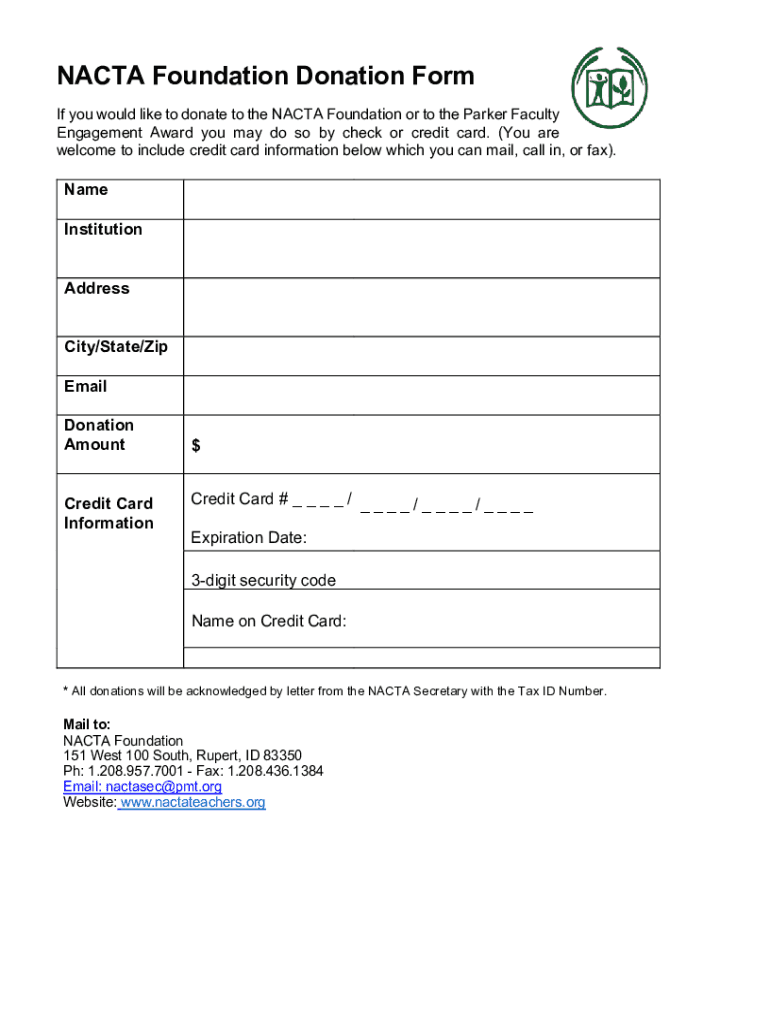

NACA Foundation Donation Form If you would like to donate to the NACA Foundation or to the Parker Faculty Engagement Award you may do so by check or credit card. (You are welcome to include credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contributing appreciated non-cash assets

Edit your contributing appreciated non-cash assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contributing appreciated non-cash assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contributing appreciated non-cash assets online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit contributing appreciated non-cash assets. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contributing appreciated non-cash assets

How to fill out contributing appreciated non-cash assets

01

Identify the appreciated non-cash assets you wish to contribute.

02

Determine the fair market value of these assets. It is recommended to consult a professional appraiser for an accurate valuation.

03

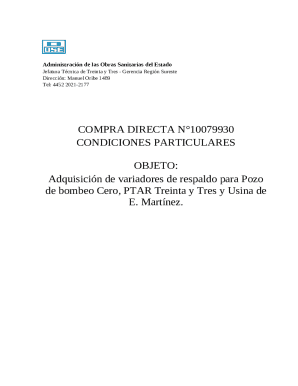

Locate a charitable organization that accepts non-cash asset donations. This can be done by researching different charities and their programs.

04

Contact the chosen charity and inquire about their donation process for appreciated non-cash assets. They may have specific guidelines and requirements.

05

Provide all necessary documentation and information requested by the charity. This may include the appraisal report, proof of ownership, and any supporting documents.

06

Arrange for the transfer of the assets to the charity. This can include physically delivering the assets or transferring ownership through legal means.

07

Obtain a receipt or acknowledgment from the charity confirming the contribution. This will be important for tax purposes.

08

Consult a tax professional to understand the tax implications and benefits of contributing appreciated non-cash assets.

09

Report the donation on your tax return, if applicable, and claim any eligible deductions or credits.

Who needs contributing appreciated non-cash assets?

01

Charitable organizations and non-profit entities are the ones who generally need or accept contributions of appreciated non-cash assets.

02

Individuals who want to support charitable causes while potentially receiving tax benefits also have an interest in contributing appreciated non-cash assets.

03

Donors who have accumulated non-cash assets with significant appreciation in value may choose to contribute these assets rather than liquidating them and incurring capital gains taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contributing appreciated non-cash assets to be eSigned by others?

Once your contributing appreciated non-cash assets is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete contributing appreciated non-cash assets online?

pdfFiller has made it simple to fill out and eSign contributing appreciated non-cash assets. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit contributing appreciated non-cash assets in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing contributing appreciated non-cash assets and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is contributing appreciated non-cash assets?

Contributing appreciated non-cash assets refers to the donation of assets such as stocks, real estate, or other investments that have increased in value since their purchase, allowing the donor to potentially receive a tax deduction for the fair market value of the assets at the time of the contribution.

Who is required to file contributing appreciated non-cash assets?

Individuals and organizations that donate non-cash assets valued over a certain threshold to charities or non-profit organizations are required to file appropriate tax forms to report their contributions.

How to fill out contributing appreciated non-cash assets?

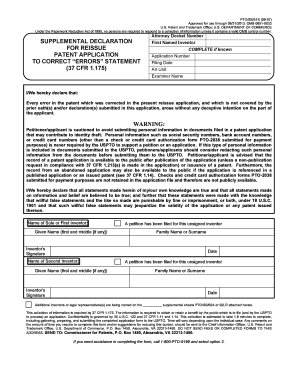

To fill out contributing appreciated non-cash assets, donors typically need to complete IRS Form 8283 for non-cash contributions, itemizing the details of the donation, including the description of the asset, date acquired, date donated, fair market value, and any required appraisals if the value exceeds $5,000.

What is the purpose of contributing appreciated non-cash assets?

The purpose of contributing appreciated non-cash assets is to provide financial support to charitable organizations while allowing donors to receive potential tax benefits based on the fair market value of the donated assets, rather than their original purchase price.

What information must be reported on contributing appreciated non-cash assets?

Donors must report detailed information such as the type of asset, a description, date of acquisition, fair market value at the time of donation, method used to determine value, and whether an appraisal was obtained on the IRS Form 8283.

Fill out your contributing appreciated non-cash assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contributing Appreciated Non-Cash Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.