Get the free Zakat with Perdaus

Show details

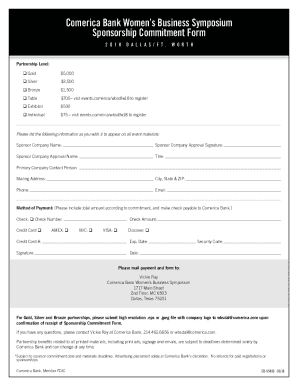

AKA PAYMENT FORM

Please attach your check to this form.

Please do not include cash with this form.

Please send the complete form to this address:Attn: Aka Bulk 364 Bukit Batok St 31 #01259 Singapore

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign zakat with perdaus

Edit your zakat with perdaus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zakat with perdaus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing zakat with perdaus online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit zakat with perdaus. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out zakat with perdaus

How to fill out zakat with perdaus

01

Begin by gathering all the necessary information and documents. You will need details of your income, savings, investments, and any other assets.

02

Identify the eligible categories for zakat with perdaus. This typically includes the poor and needy, debtors, the stranded traveler, those striving in the cause of Allah, and individuals who are unable to meet their basic needs.

03

Calculate the value of your zakat. This can be done by determining your zakatable assets and subtracting any liabilities.

04

Once you have determined the value of your zakat, allocate the appropriate percentage. In the case of zakat with perdaus, the percentage is typically 2.5%.

05

Visit the official website of Perdaus or any authorized zakat institution to fill out the zakat form.

06

Provide accurate and honest information in the zakat form. Ensure that all fields are filled correctly.

07

Submit the zakat form online or at the designated collection centers.

08

Pay the zakat amount through the available payment methods, such as bank transfer, online payment, or in-person at the collection centers.

09

Keep a record of your zakat payment for future reference and accountability.

10

Finally, continue to fulfill your zakat obligations on an annual basis, as zakat is a recurring obligation in Islam.

Who needs zakat with perdaus?

01

Zakat with Perdaus is specifically targeted towards those in need within the Muslim community. This includes individuals and families who are facing financial hardship, struggling to meet their basic needs, burdened with debt, or stranded travelers without adequate resources. Additionally, zakat can also be allocated to organizations and initiatives striving in the cause of Allah or providing support for the needy. It is important to consult with authorized zakat institutions or religious scholars to ensure proper distribution of zakat funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify zakat with perdaus without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including zakat with perdaus, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete zakat with perdaus online?

pdfFiller makes it easy to finish and sign zakat with perdaus online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete zakat with perdaus on an Android device?

On Android, use the pdfFiller mobile app to finish your zakat with perdaus. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is zakat with perdaus?

Zakat with perdaus refers to the charitable giving prescribed in Islam, which is calculated based on savings and wealth, aimed at providing assistance to those in need.

Who is required to file zakat with perdaus?

Muslims who possess wealth above a certain threshold, known as Nisab, are required to file zakat with perdaus.

How to fill out zakat with perdaus?

To fill out zakat with perdaus, one must gather their financial information, calculate the zakat amount based on their wealth, and complete the zakat declaration forms provided by the respective authorities.

What is the purpose of zakat with perdaus?

The purpose of zakat with perdaus is to ensure wealth circulation and provide financial assistance to the underprivileged, fostering social welfare in the community.

What information must be reported on zakat with perdaus?

Information that must be reported includes total savings, types of wealth (such as cash, gold, and property), liabilities, and the calculated zakat amount.

Fill out your zakat with perdaus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Zakat With Perdaus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.