Get the free GIO LIFE PROTECT POLICY ALTERATION FORM

Show details

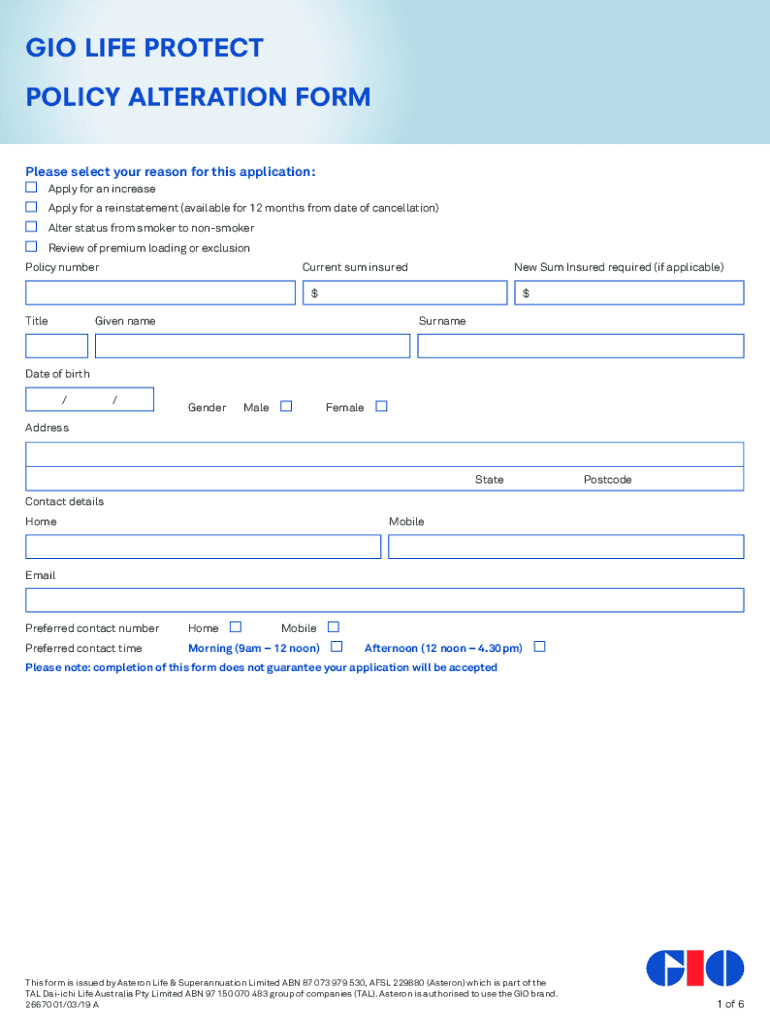

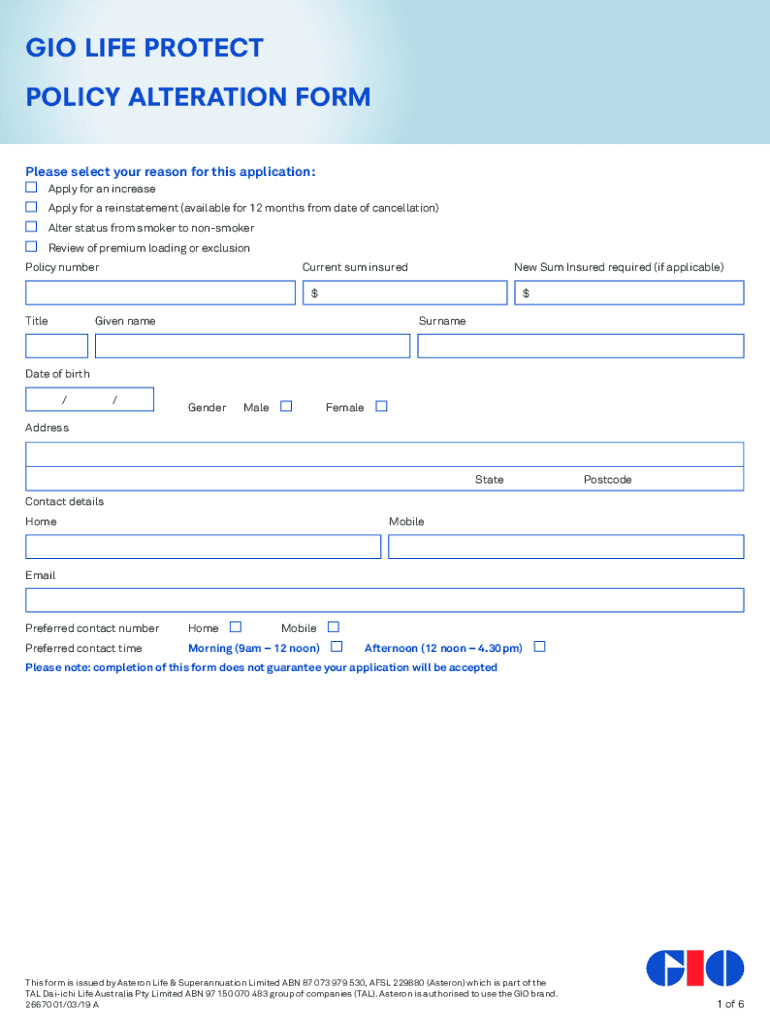

GO LIFE PROTECT POLICY ALTERATION FORM Please select your reason for this application: Apply for an increase Apply for a reinstatement (available for 12 months from date of cancellation) Alter status

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gio life protect policy

Edit your gio life protect policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gio life protect policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gio life protect policy online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gio life protect policy. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gio life protect policy

How to fill out gio life protect policy

01

To fill out gio life protect policy, follow the steps below:

1. Start by gathering the necessary documents such as proof of identity, proof of income, and medical information.

02

Visit the gio life protect policy website or contact a gio life insurance representative to obtain the application form.

03

Fill out the application form with accurate and honest information. Provide details about your personal information, desired coverage amount, beneficiaries, and any additional coverage requirements.

04

Review the filled-out form for any errors or missing information.

05

If required, attach the supporting documents mentioned earlier.

06

Submit the completed application form and supporting documents either online through the gio life protect policy website or by mailing it to the designated address.

07

Wait for the evaluation and approval process to be completed. This may involve additional medical examinations or underwriting procedures.

08

Once approved, review the terms and conditions of the policy and sign the policy documents if you agree with them.

09

Make the necessary premium payments as per the agreed schedule to keep the policy in force.

10

Regularly review and update your gio life protect policy as your circumstances change or as required.

Who needs gio life protect policy?

01

Anyone who wants to protect their loved ones financially in the event of their death may benefit from gio life protect policy.

02

Specifically, individuals with dependents such as spouses, children, or aging parents may find gio life protect policy essential.

03

Those who have financial responsibilities like mortgage payments, debts, or family expenses should consider gio life protect policy to ensure their loved ones are financially supported even if they are not there.

04

Additionally, people with high-risk jobs or those with pre-existing health conditions may have a greater need for gio life protect policy to provide financial security in case of unexpected events.

05

It is important to assess personal circumstances and financial goals to determine if gio life protect policy is suitable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gio life protect policy?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the gio life protect policy. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the gio life protect policy form on my smartphone?

Use the pdfFiller mobile app to complete and sign gio life protect policy on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit gio life protect policy on an Android device?

You can edit, sign, and distribute gio life protect policy on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is gio life protect policy?

The Gio Life Protect Policy is a life insurance policy designed to provide financial security and protection to the policyholder's beneficiaries in the event of their death.

Who is required to file gio life protect policy?

Individuals or entities that have taken out a Gio Life Protect Policy are required to file it with the relevant insurance authority.

How to fill out gio life protect policy?

To fill out the Gio Life Protect Policy, the policyholder must provide personal information, designate beneficiaries, and outline the type and amount of coverage desired.

What is the purpose of gio life protect policy?

The purpose of the Gio Life Protect Policy is to provide financial protection to the insured's family or beneficiaries to help cover expenses and maintain their standard of living after the policyholder's death.

What information must be reported on gio life protect policy?

Information that must be reported includes the policyholder's personal details, beneficiary information, health history, and details regarding the coverage amount.

Fill out your gio life protect policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gio Life Protect Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.