Get the free Single Member SMSF Establishment and 1st Annual ...

Show details

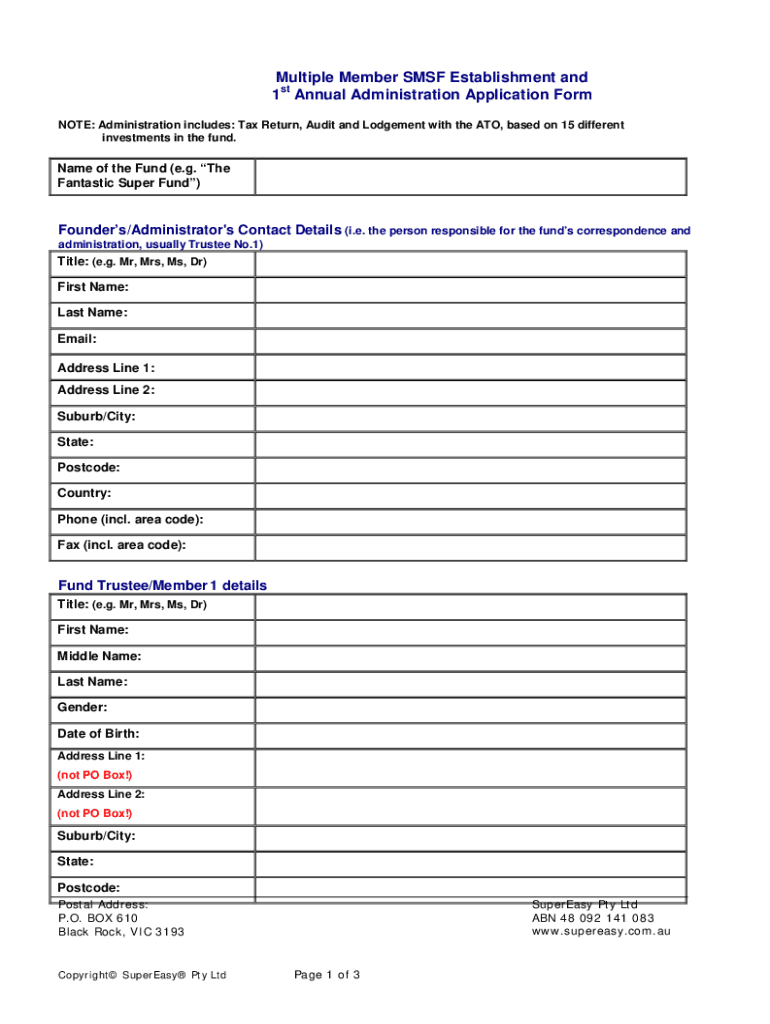

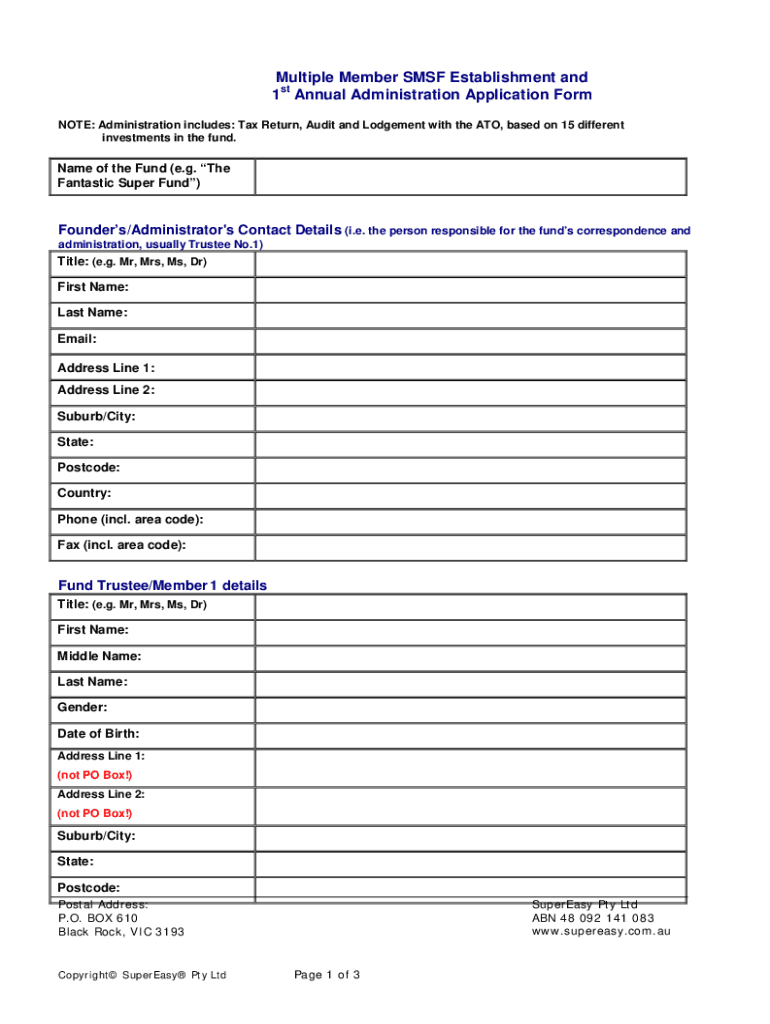

Multiple Member SMS Establishment and

1st Annual Administration Application Form

NOTE: Administration includes: Tax Return, Audit and Judgement with the ATO, based on 15 different

investments in the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single member smsf establishment

Edit your single member smsf establishment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single member smsf establishment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit single member smsf establishment online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit single member smsf establishment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single member smsf establishment

How to fill out single member smsf establishment

01

To fill out a single member SMSF establishment, follow the steps below:

02

Start by gathering all the necessary information and documents, such as the individual's personal details, tax file number, and trust deed.

03

Verify the eligibility criteria for a single member SMSF establishment, including being over 18 years old, not being bankrupt, and being an Australian resident.

04

Complete the SMSF establishment application form, providing accurate and up-to-date information.

05

Prepare and sign the trust deed, ensuring it complies with the relevant legal requirements.

06

Determine the investment strategy for the SMSF, considering the individual's financial goals and risk appetite.

07

Arrange for the establishment expenses to be paid from the SMSF's bank account.

08

Lodge the completed application form, along with the signed trust deed and any required supporting documents, with the Australian Taxation Office (ATO).

09

Wait for the ATO to process the application and issue the Australian Business Number (ABN) and the Tax File Number (TFN) for the SMSF.

10

Once the ABN and TFN are received, open a bank account in the name of the SMSF to manage its finances.

11

Ensure ongoing compliance with SMSF regulations and fulfill reporting obligations to the ATO.

12

Remember to seek professional advice from an SMSF specialist or tax advisor throughout the process.

Who needs single member smsf establishment?

01

Single member SMSF establishment is suitable for individuals who:

02

- Want to have control over their superannuation investments and decisions.

03

- Are looking for greater flexibility in managing their retirement savings.

04

- Have a relatively large superannuation balance to justify the costs associated with setting up and maintaining an SMSF.

05

- Understand and are willing to fulfill the responsibilities and obligations of being an SMSF trustee.

06

- Are interested in exploring a wider range of investment options compared to traditional superannuation funds.

07

- Wish to include specific assets, such as direct property or collectibles, within their superannuation portfolio.

08

It is important to note that establishing and managing an SMSF requires time, knowledge, and ongoing commitment. Therefore, individuals considering a single member SMSF should carefully weigh the advantages and disadvantages before proceeding.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my single member smsf establishment in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign single member smsf establishment and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit single member smsf establishment online?

With pdfFiller, it's easy to make changes. Open your single member smsf establishment in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out single member smsf establishment using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign single member smsf establishment and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is single member smsf establishment?

A single member self-managed superannuation fund (SMSF) establishment refers to the creation of a retirement savings fund where only one individual is the member and trustee, allowing them to manage their superannuation investments independently.

Who is required to file single member smsf establishment?

Individuals who establish a single member SMSF are required to file the necessary documents and comply with regulatory obligations set by the Australian Taxation Office (ATO).

How to fill out single member smsf establishment?

To fill out the single member SMSF establishment, an individual must complete and submit the appropriate form to the ATO, usually including personal details, fund details, and appointing themselves as the trustee.

What is the purpose of single member smsf establishment?

The purpose of establishing a single member SMSF is to allow individuals to have more control over their retirement savings, investment choices, and to potentially achieve better fund performance.

What information must be reported on single member smsf establishment?

Information that must be reported includes the fund's name, the member’s details, trustee information, and any investment strategies or objectives.

Fill out your single member smsf establishment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Member Smsf Establishment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.