Get the free US CPA (Certified Public Accountant): Miles CPA - India ...

Show details

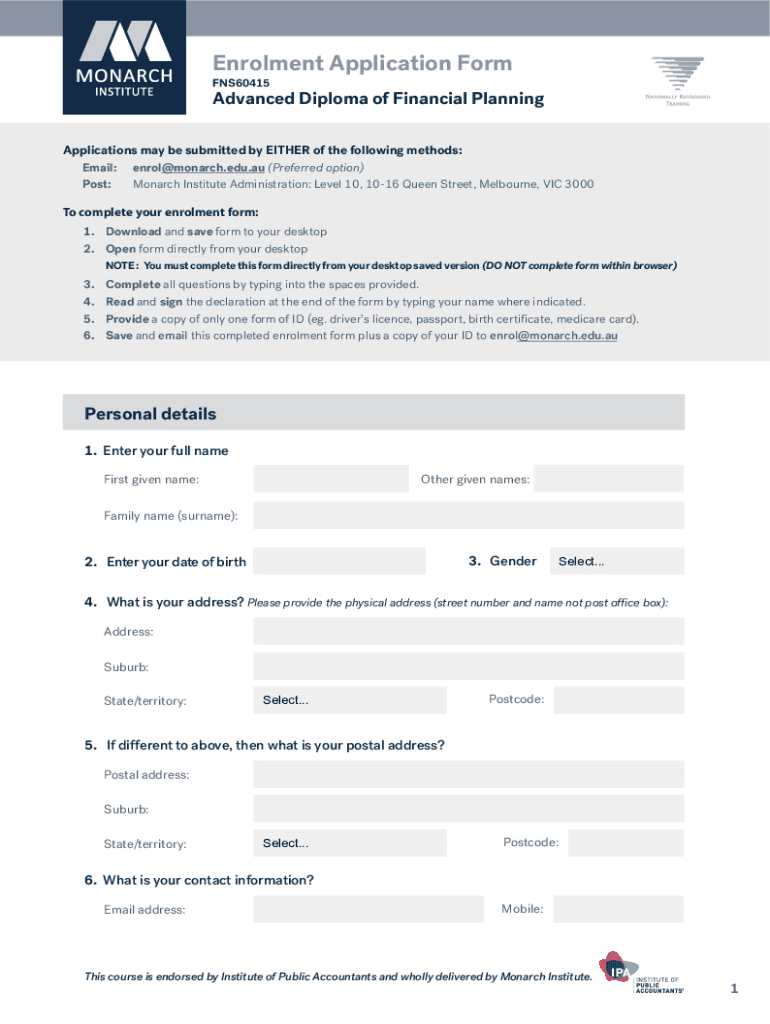

Enrollment Application Form

FNS60415Advanced Diploma of Financial Planning

Applications may be submitted by EITHER of the following methods:

Email:

Post:enrol@monarch.edu.AU (Preferred option)

Monarch

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us cpa certified public

Edit your us cpa certified public form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us cpa certified public form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us cpa certified public online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us cpa certified public. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us cpa certified public

How to fill out us cpa certified public

01

To fill out the US CPA (Certified Public Accountant) application, follow these steps:

02

Determine the eligibility criteria for becoming a CPA in the United States. This usually includes having a bachelor's degree in accounting or a related field, completing a certain number of credit hours in accounting and business courses, and meeting the work experience requirements.

03

Gather the necessary documents, such as transcripts, proof of work experience, and identification.

04

Create an account on the official website of the State Board of Accountancy where you intend to apply.

05

Fill out the application form, providing accurate personal information, educational background, and work experience.

06

Pay the required application fee through the designated payment method.

07

Submit your application online and await confirmation from the State Board of Accountancy.

08

Once your application is approved, schedule and take the CPA exam.

09

After passing the exam, complete any additional requirements, such as obtaining a certain amount of professional work experience or fulfilling ethics requirements.

10

Apply for a CPA license with the State Board of Accountancy.

11

Renew your CPA license periodically as per the state's requirements.

Who needs us cpa certified public?

01

US CPA certification is most useful and necessary for individuals who aspire to work in the field of accounting and finance in the United States.

02

The following individuals typically need a US CPA certification:

03

- Accounting professionals who want to enhance their knowledge and credibility in the industry.

04

- Individuals seeking employment in public accounting firms, where being a CPA is often a requirement for certain positions.

05

- Aspiring auditors who wish to conduct audits of public companies in compliance with the Sarbanes-Oxley Act.

06

- Individuals looking to work in the finance departments of corporations, including roles such as financial analyst, controller, or CFO.

07

- Anyone interested in starting a career in accounting or finance in the United States.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in us cpa certified public?

The editing procedure is simple with pdfFiller. Open your us cpa certified public in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the us cpa certified public in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your us cpa certified public in minutes.

How do I complete us cpa certified public on an Android device?

On an Android device, use the pdfFiller mobile app to finish your us cpa certified public. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is us cpa certified public?

The US CPA (Certified Public Accountant) is a professional designation granted to accountants who have passed the CPA exam and met additional state licensing requirements.

Who is required to file us cpa certified public?

Individuals and organizations that provide accounting services, including auditing, tax preparation, and consulting, are required to be certified public accountants.

How to fill out us cpa certified public?

To fill out the necessary CPA documentation, individuals must complete an application, submit proof of education and experience, pass the CPA exam, and comply with any state-specific requirements.

What is the purpose of us cpa certified public?

The purpose of being a US CPA is to ensure that accountants meet specific educational and professional standards to provide credible and reliable financial services and advice.

What information must be reported on us cpa certified public?

CPAs must report their educational qualifications, professional experience, exam scores, and any continuing education credits to maintain their license.

Fill out your us cpa certified public online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Cpa Certified Public is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.