Get the free 4-OP-D-2-E PayrollPolicies and Procedures

Show details

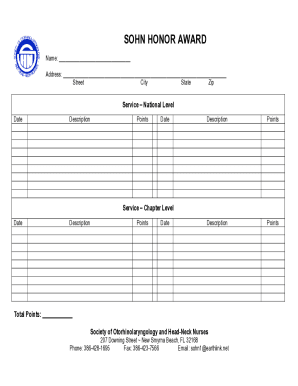

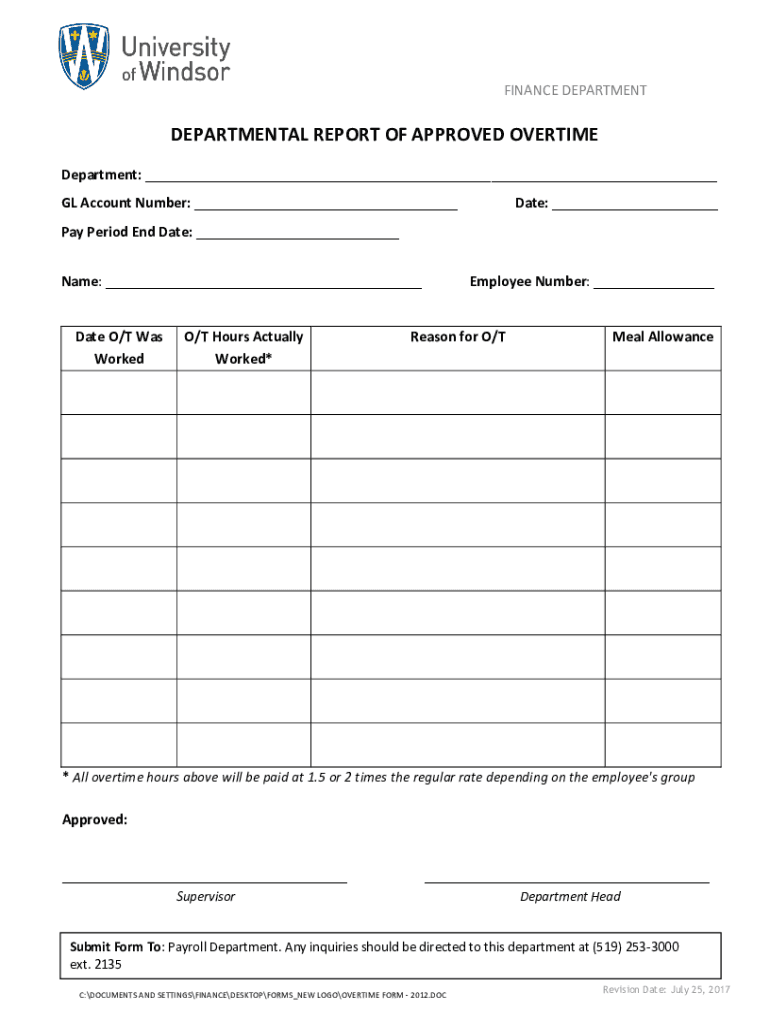

FINANCE DEPARTMENTDEPARTMENTAL REPORT OF APPROVED OVERTIME Department: GL Account Number: Date: Pay Period End Date: Name: Date O/T Was Worked/T Hours Actually Worked×Employee Number: Reason for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 4-op-d-2-e payrollpolicies and procedures

Edit your 4-op-d-2-e payrollpolicies and procedures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 4-op-d-2-e payrollpolicies and procedures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 4-op-d-2-e payrollpolicies and procedures online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 4-op-d-2-e payrollpolicies and procedures. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 4-op-d-2-e payrollpolicies and procedures

How to fill out 4-op-d-2-e payrollpolicies and procedures

01

To fill out 4-op-d-2-e payroll policies and procedures, follow these steps:

02

Begin by understanding the requirements and guidelines set forth by your organization or company.

03

Gather all necessary information related to payroll, including employee data, wage rates, benefits, and deductions.

04

Create a standardized template or form for documenting the policies and procedures. This form should include sections for various aspects of payroll, such as timekeeping, wage calculation, payroll deductions, and reporting.

05

Evaluate and determine the appropriate policies and procedures specific to your organization. This may involve consulting with HR professionals, payroll experts, or legal advisors.

06

Document each step in the payroll process clearly and concisely. Use bullet points or numbered lists for easy readability.

07

Specify any special considerations or exceptions to the standard policies and procedures, if applicable.

08

Review the completed document for accuracy, completeness, and adherence to relevant laws and regulations.

09

Seek approval from the appropriate stakeholders, such as HR managers, finance executives, or legal departments.

10

Distribute the finalized policies and procedures to all relevant parties, including employees, managers, and payroll administrators.

11

Regularly review and update the payroll policies and procedures to ensure they stay current and compliant with any changes in laws or organizational requirements.

Who needs 4-op-d-2-e payrollpolicies and procedures?

01

op-d-2-e payroll policies and procedures are needed by organizations or companies that have employees and need to properly manage payroll processes.

02

This includes businesses of all sizes, from small startups to large corporations.

03

Employers who want to ensure accuracy, consistency, and compliance in their payroll operations can benefit from implementing these policies and procedures.

04

Additionally, organizations that want to establish clear guidelines for employees regarding payroll-related matters can use these policies and procedures as a reference.

05

Human resources departments, payroll administrators, and finance teams often rely on these documents to streamline payroll processes and maintain legal compliance.

06

Overall, anyone responsible for managing payroll or overseeing employee compensation can benefit from utilizing 4-op-d-2-e payroll policies and procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 4-op-d-2-e payrollpolicies and procedures without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 4-op-d-2-e payrollpolicies and procedures. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send 4-op-d-2-e payrollpolicies and procedures for eSignature?

4-op-d-2-e payrollpolicies and procedures is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in 4-op-d-2-e payrollpolicies and procedures?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 4-op-d-2-e payrollpolicies and procedures to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is 4-op-d-2-e payrollpolicies and procedures?

4-op-d-2-e payroll policies and procedures refer to a specific set of guidelines and standards established for managing payroll processes within an organization, ensuring compliance with legal requirements and promoting consistency.

Who is required to file 4-op-d-2-e payrollpolicies and procedures?

Employers with employees subject to payroll regulations are required to file 4-op-d-2-e payroll policies and procedures to ensure proper record-keeping and compliance.

How to fill out 4-op-d-2-e payrollpolicies and procedures?

To fill out the 4-op-d-2-e payroll policies and procedures, employers should gather necessary employee information, calculate payroll accurately, and follow the prescribed format to ensure all required data is included.

What is the purpose of 4-op-d-2-e payrollpolicies and procedures?

The purpose of 4-op-d-2-e payroll policies and procedures is to ensure accurate payroll management, compliance with laws, and to provide clear guidelines for payroll processing and reporting.

What information must be reported on 4-op-d-2-e payrollpolicies and procedures?

Information that must be reported includes employee details, pay rates, hours worked, deductions, and any taxes withheld.

Fill out your 4-op-d-2-e payrollpolicies and procedures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

4-Op-D-2-E Payrollpolicies And Procedures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.