Get the free CFP: Insurance Planning and Risk Management Flashcards ...

Show details

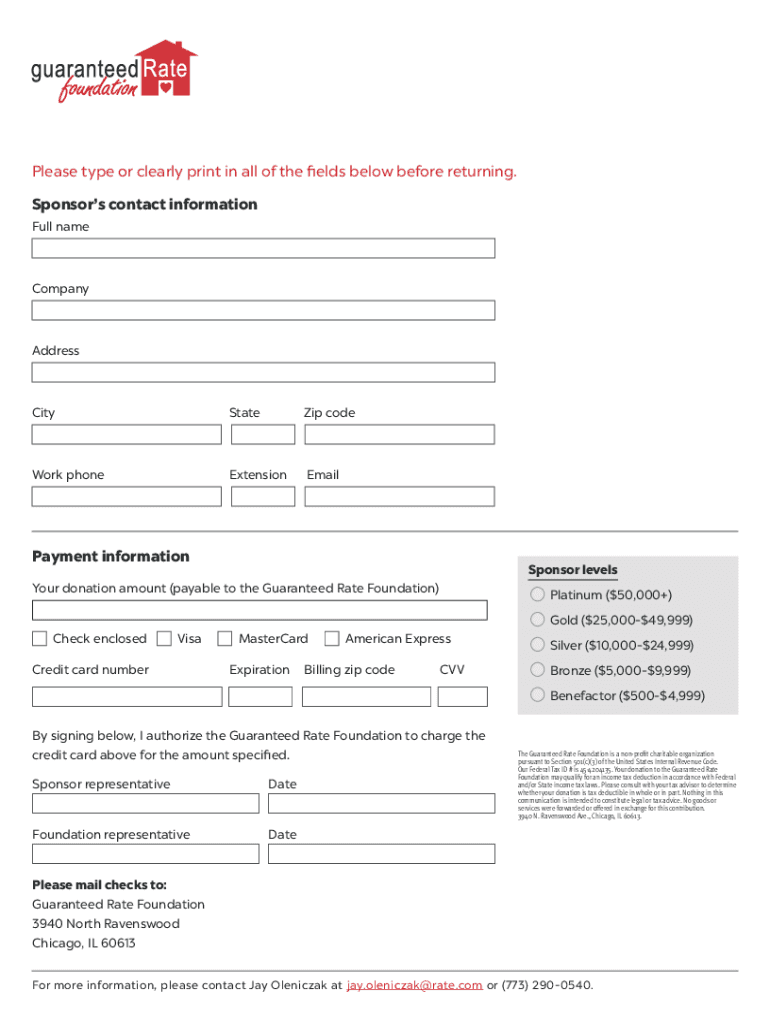

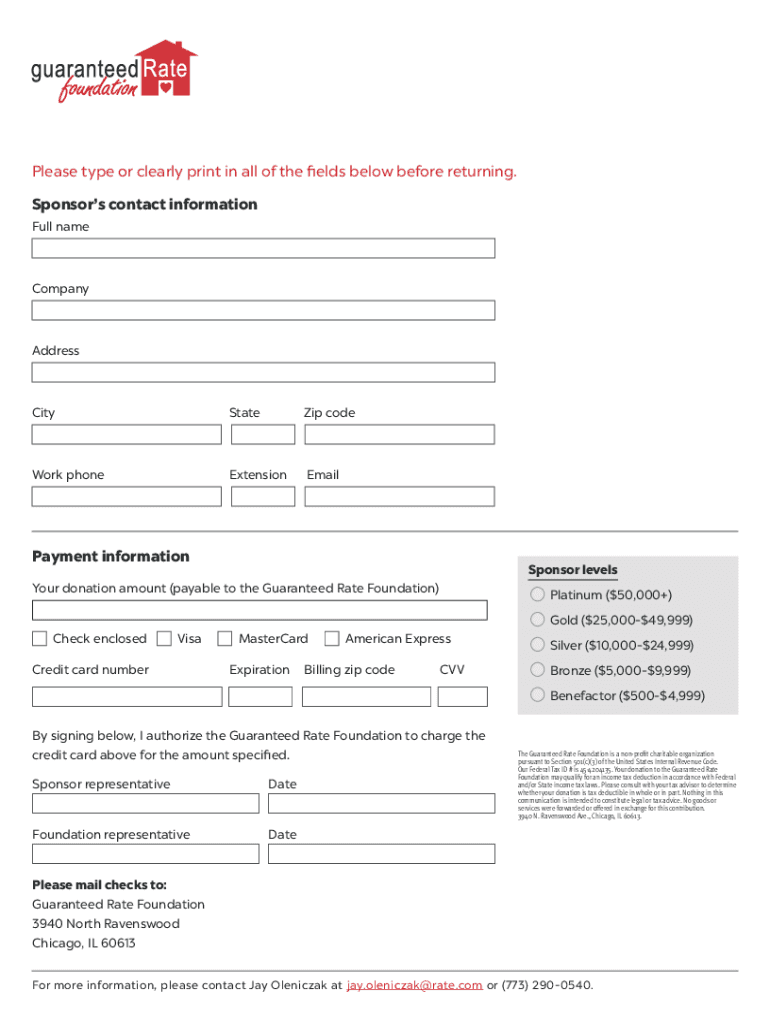

Guaranteed Rate FoundationSponsorship Opportunities

Our mission

The Guaranteed Rate Foundation was established with one simple objective: Impact the lives of

employees, their families and their communities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cfp insurance planning and

Edit your cfp insurance planning and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cfp insurance planning and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cfp insurance planning and online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cfp insurance planning and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cfp insurance planning and

How to fill out cfp insurance planning and

01

To fill out a CFP insurance planning form, follow these steps:

02

Start by providing your personal information such as your name, address, contact number, and email.

03

Specify the type of insurance coverage you are seeking, whether it is life insurance, health insurance, property insurance, etc.

04

Provide details about your current financial situation, including your income, expenses, assets, and liabilities.

05

Evaluate your insurance needs and determine the amount of coverage required based on your financial goals and responsibilities.

06

Consider any existing insurance policies and provide information about them, including policy numbers and coverage details.

07

Disclose any pre-existing medical conditions or other factors that may affect the insurance application and coverage.

08

Review the terms and conditions of the insurance policy carefully before signing and submitting the form.

09

If you have any questions or require assistance, contact a certified financial planner or insurance agent for guidance.

10

Keep a copy of the completed form for your records.

Who needs cfp insurance planning and?

01

CFP insurance planning is beneficial for individuals or families who want to protect their financial well-being and secure their future.

02

It is particularly useful for those who:

03

- Have dependents and want to ensure their loved ones are financially protected in the event of an untimely death or disability.

04

- Own valuable assets that need to be safeguarded against potential risks such as fire, theft, or natural disasters.

05

- Want to plan for their retirement and ensure they have sufficient income and resources to maintain their lifestyle.

06

- Have specific financial goals such as saving for a child's education or purchasing a home.

07

- Have complex financial situations that require comprehensive insurance coverage and risk management strategies.

08

CFP insurance planning can provide peace of mind and financial security by offering appropriate coverage tailored to individual needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cfp insurance planning and directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign cfp insurance planning and and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send cfp insurance planning and for eSignature?

Once your cfp insurance planning and is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit cfp insurance planning and on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as cfp insurance planning and. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is cfp insurance planning and?

CFP insurance planning refers to the comprehensive process of assessing an individual's or family's insurance needs as part of a broader financial plan, ensuring adequate protection against risks.

Who is required to file cfp insurance planning and?

Individuals seeking to secure their financial future and those with complex financial situations, such as families, business owners, or high-net-worth individuals, generally engage in CFP insurance planning.

How to fill out cfp insurance planning and?

Filling out CFP insurance planning typically involves gathering personal financial information, assessing risk exposure, determining insurance needs, and selecting appropriate insurance products or strategies.

What is the purpose of cfp insurance planning and?

The purpose of CFP insurance planning is to protect individuals and families from unforeseen financial losses due to risks such as illness, disability, or premature death, ensuring financial security.

What information must be reported on cfp insurance planning and?

Information to be reported includes personal details, financial situation, existing insurance coverage, risk exposure, and specific insurance needs.

Fill out your cfp insurance planning and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cfp Insurance Planning And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.