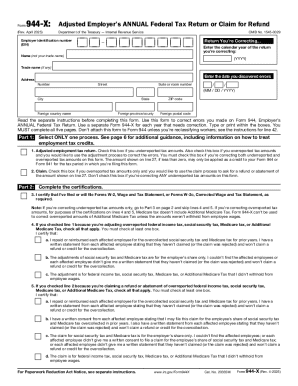

IRS 944-X 2021 free printable template

Instructions and Help about IRS 944-X

How to edit IRS 944-X

How to fill out IRS 944-X

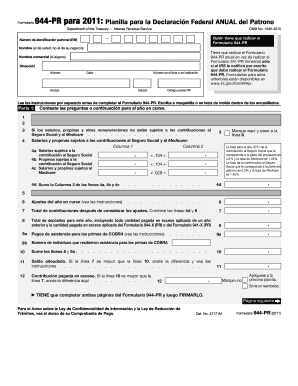

About IRS 944-X 2021 previous version

What is IRS 944-X?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

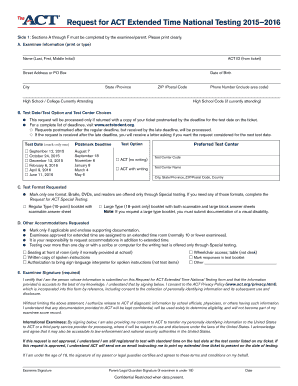

Is the form accompanied by other forms?

FAQ about IRS 944-X

What should I do if I make a mistake on my IRS 944-X?

If you find an error on your IRS 944-X form after submission, you can submit an amended version called IRS 944-X. Ensure that you properly indicate the corrections made and provide accurate information in the amendment section to avoid further issues.

How can I check the status of my filed IRS 944-X?

To verify the status of your submitted IRS 944-X, you can contact the IRS directly or use their online services, if available. Keep your filing details handy to expedite the process and be prepared to discuss any rejection codes if applicable.

What documentation do I need to prepare if I receive an audit notice regarding my IRS 944-X?

If you receive an audit notice related to your IRS 944-X, gather all supporting documents, including your original submission, any amended forms, proof of payment, and related communications. This documentation will help you respond accurately to the IRS's inquiries.

Are there specific errors commonly associated with IRS 944-X filings?

Yes, common errors in IRS 944-X filings include incorrect taxpayer identification numbers, mismatches between reported income and prior filings, and calculation mistakes. To reduce errors, double-check all entries and utilize available software tools for e-filing.

What are the privacy and data security measures I should consider when filing my IRS 944-X?

When filing your IRS 944-X, ensure that you use secure channels, such as authenticated e-filing software, to protect your personal information. Additionally, be mindful of record retention policies to safeguard your documents from unauthorized access.