Get the free Gifts in Kind: What Nonprofits Should KnowFor Purpose Law ...

Show details

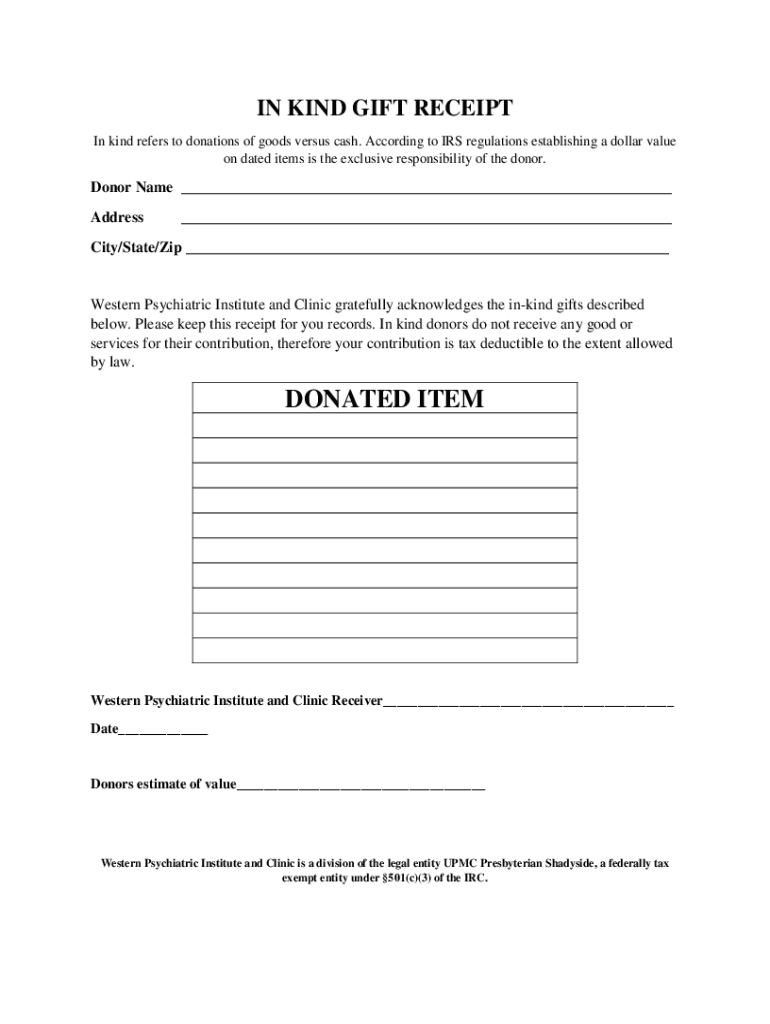

IN KIND GIFT RECEIPT In kind refers to donations of goods versus cash. According to IRS regulations establishing a dollar value on dated items is the exclusive responsibility of the donor. Donor Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts in kind what

Edit your gifts in kind what form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts in kind what form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts in kind what online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gifts in kind what. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts in kind what

How to fill out gifts in kind what

01

To fill out gifts in kind form, follow these steps:

02

Start by obtaining the gifts in kind form from the organization or agency requesting the donations.

03

Read the instructions and guidelines provided on the form carefully.

04

Begin filling out the form by entering your personal information, including your name, address, and contact details.

05

Specify the type of gift you intend to donate, such as clothing, toys, or household items.

06

Provide a detailed description of the items you are donating, including their current condition and approximate value.

07

If applicable, mention any special instructions or conditions related to your donation.

08

Sign and date the form, indicating your consent to donate the items as specified.

09

If required, attach any supporting documents or receipts for the donated items.

10

Submit the completed form to the organization or agency according to their instructions.

11

Keep a copy of the filled-out form and any supporting documents for your records.

Who needs gifts in kind what?

01

Various individuals and organizations may need gifts in kind, including:

02

- Non-profit organizations that support underprivileged communities or specific causes.

03

- Schools, orphanages, and shelters that cater to children or individuals in need.

04

- Disaster relief organizations that provide assistance to affected areas or communities.

05

- Community centers and churches that organize outreach programs for the less fortunate.

06

- Social service agencies and welfare organizations that help individuals facing financial difficulties.

07

- Medical facilities, nursing homes, and hospices that care for patients with limited resources.

08

- Animal shelters and rescue organizations that rely on donations to support their operations.

09

By donating gifts in kind, you can help make a positive impact and support those in need.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gifts in kind what for eSignature?

To distribute your gifts in kind what, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the gifts in kind what form on my smartphone?

Use the pdfFiller mobile app to complete and sign gifts in kind what on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete gifts in kind what on an Android device?

Complete gifts in kind what and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is gifts in kind what?

Gifts in kind refer to non-cash donations of goods or services made to an organization, which can include items such as clothing, furniture, and equipment.

Who is required to file gifts in kind what?

Organizations and entities that receive gifts in kind valued above a certain threshold are required to file reports detailing these donations, usually nonprofit organizations.

How to fill out gifts in kind what?

To fill out gifts in kind, organizations must list each item received, its fair market value, a description of the goods, and relevant donor information on the designated reporting forms.

What is the purpose of gifts in kind what?

The purpose of gifts in kind is to provide valuable resources to organizations that can use these items effectively to further their mission without having to expend cash.

What information must be reported on gifts in kind what?

Organizations must report the description of the gift, its fair market value, the donor's name and address, and the date of the donation.

Fill out your gifts in kind what online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts In Kind What is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.