Get the free Non-Governmental 457(b) Deferred Compensation PlansNon-Governmental 457(b) Deferred ...

Show details

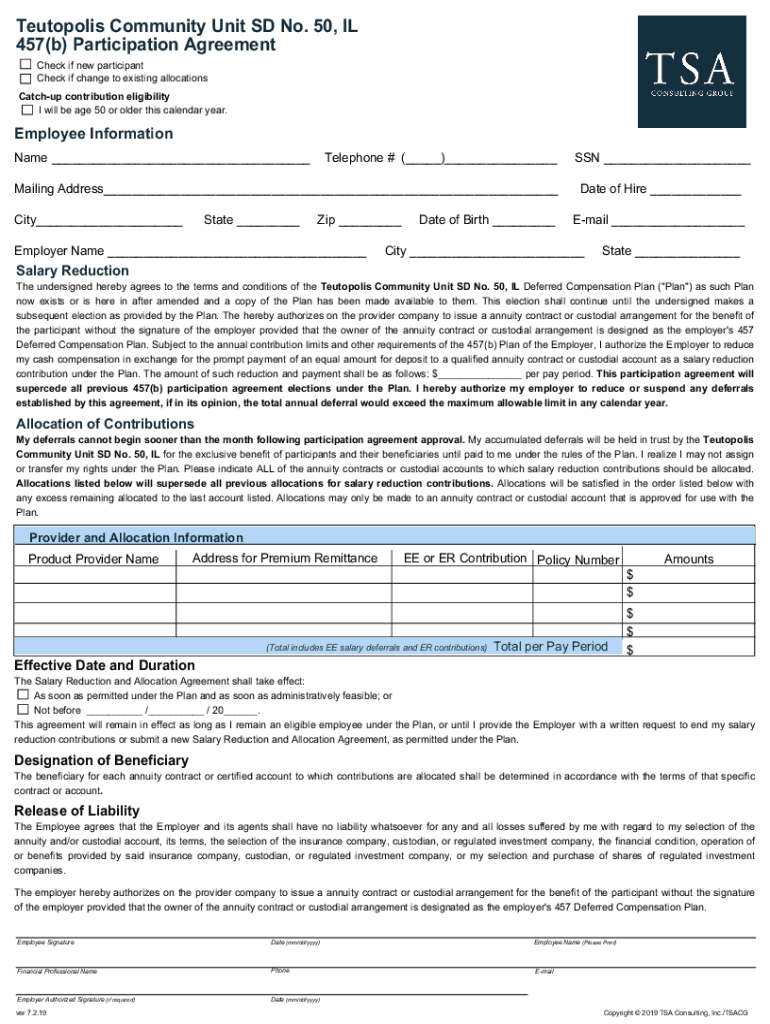

Metropolis Community Unit SD No. 50, IL 457(b) Participation Agreement Check if new participant Check if change to existing allocations Catch up contribution eligibility I will be age 50 or older

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-governmental 457b deferred compensation

Edit your non-governmental 457b deferred compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-governmental 457b deferred compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-governmental 457b deferred compensation online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit non-governmental 457b deferred compensation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-governmental 457b deferred compensation

How to fill out non-governmental 457b deferred compensation

01

Obtain the necessary paperwork from your employer or from the organization managing your non-governmental 457b deferred compensation plan.

02

Fill out the personal information section of the form, including your full name, address, date of birth, and social security number.

03

Provide details about your employment status, such as your job title, date of hire, and annual salary.

04

Indicate the amount you wish to contribute to your non-governmental 457b deferred compensation plan on a regular basis.

05

Choose your investment options based on the offerings provided by the plan administrator.

06

Specify any beneficiaries you wish to designate for your non-governmental 457b deferred compensation plan.

07

Review the completed form for accuracy and sign and date it to finalize your enrollment in the plan.

08

Submit the filled out form to your employer or the plan administrator as instructed.

Who needs non-governmental 457b deferred compensation?

01

Non-governmental 457b deferred compensation is typically designed for employees of tax-exempt organizations and some state and local governments.

02

Those who commonly benefit from this type of plan are high-income earners who want to supplement their retirement savings with additional tax advantages.

03

It is also suitable for those who anticipate having a lower tax bracket in retirement and can take advantage of tax deferral benefits.

04

Furthermore, individuals who have maxed out contributions to other retirement plans, such as 401(k)s or IRAs, may find non-governmental 457b deferred compensation as a valuable option to further increase their retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get non-governmental 457b deferred compensation?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific non-governmental 457b deferred compensation and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit non-governmental 457b deferred compensation straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing non-governmental 457b deferred compensation right away.

How do I fill out non-governmental 457b deferred compensation using my mobile device?

Use the pdfFiller mobile app to fill out and sign non-governmental 457b deferred compensation on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is non-governmental 457b deferred compensation?

Non-governmental 457b deferred compensation is a type of retirement savings plan available for employees of non-profit organizations and certain tax-exempt entities. It allows employees to defer compensation on a pre-tax basis, which can grow tax-deferred until withdrawal.

Who is required to file non-governmental 457b deferred compensation?

Employers who offer non-governmental 457b deferred compensation plans are required to file information regarding the plans, including reporting contributions, distributions, and account balances of participants.

How to fill out non-governmental 457b deferred compensation?

To fill out non-governmental 457b deferred compensation forms, employers must provide accurate information regarding the plan details, contributions made, and participant information, following the guidelines set by the IRS or the plan's administration requirements.

What is the purpose of non-governmental 457b deferred compensation?

The purpose of non-governmental 457b deferred compensation is to provide a retirement savings vehicle that allows employees to save money on a tax-deferred basis while also providing flexibility in withdrawal options compared to other retirement plans.

What information must be reported on non-governmental 457b deferred compensation?

Employers must report information such as total contributions made, distributions to participants, account balances, and any other relevant data that reflects the activity within the non-governmental 457b plan.

Fill out your non-governmental 457b deferred compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Governmental 457b Deferred Compensation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.