Get the free Designated Roth AccountsInternal Revenue Service

Show details

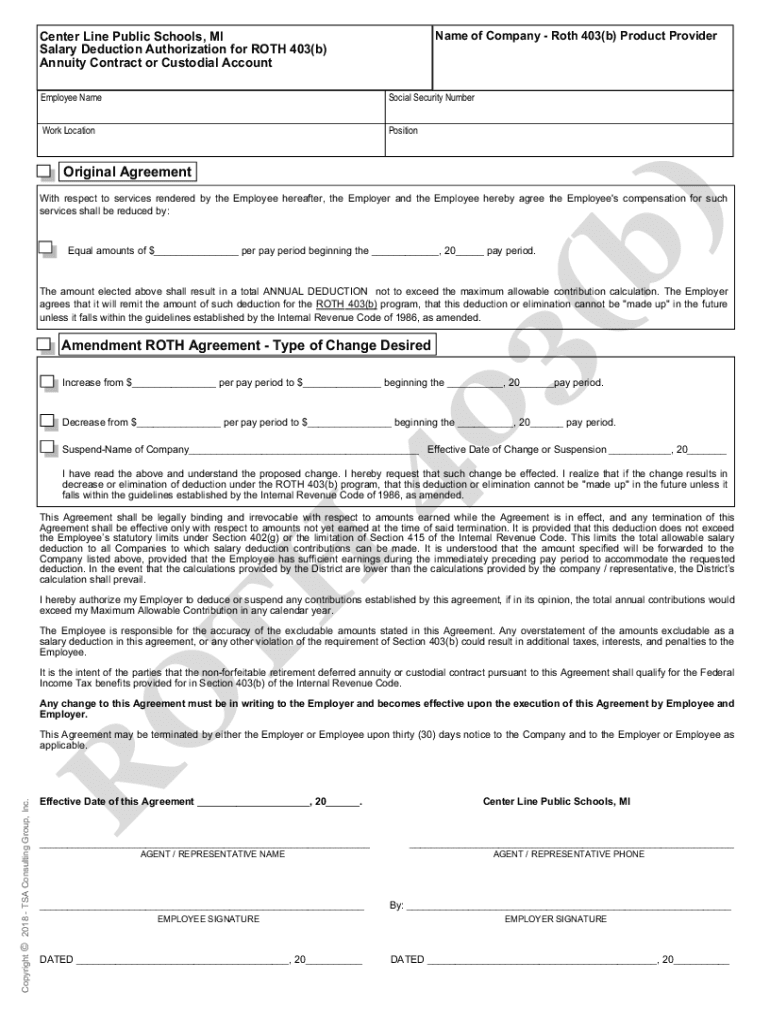

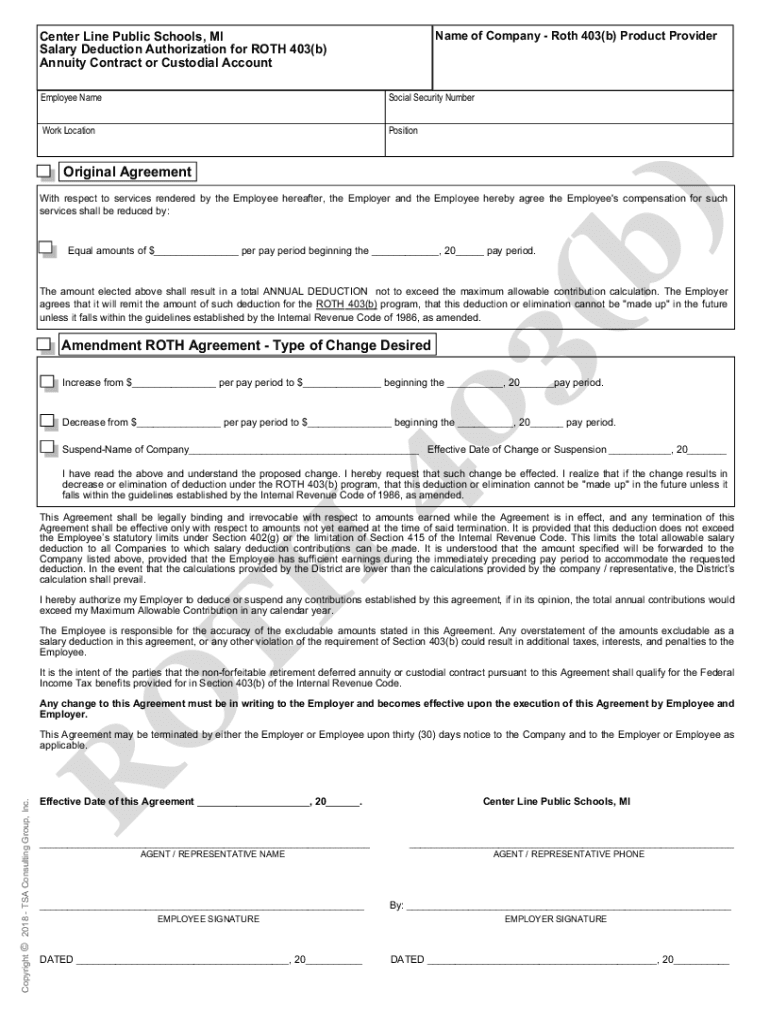

Name of Company Roth 403(b) Product ProviderCenter Line Public Schools, MI Salary Deduction Authorization for ROTH 403(b) Annuity Contract or Custodial Account Employee Asocial Security NumberWork

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign designated roth accountsinternal revenue

Edit your designated roth accountsinternal revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your designated roth accountsinternal revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit designated roth accountsinternal revenue online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit designated roth accountsinternal revenue. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out designated roth accountsinternal revenue

How to fill out designated roth accountsinternal revenue

01

To fill out a designated Roth account with the Internal Revenue Service (IRS), follow these steps:

02

Determine if you are eligible: Check if you meet the requirements to contribute to a designated Roth account. This may include factors like your income level and employment status.

03

Complete the necessary forms: Obtain the appropriate forms from the IRS or your employer to report your designated Roth account contributions. This could include forms such as Form 5498, Roth IRA Contribution Information, or Form 8880, Credit for Qualified Retirement Savings Contributions.

04

Report contributions accurately: Fill out the forms accurately and provide all required information. This may include details about your contributions, such as the amount, date, and any rollover or conversion information.

05

Retain documentation: Keep a copy of all forms and documentation related to your designated Roth account contributions for your records. This is important for future reference or in case of an IRS audit.

06

Submit forms and contributions: Submit the completed forms and any required payments or contributions to the IRS according to the specified deadlines. Be sure to follow any additional instructions provided by the IRS or your employer.

07

Seek professional advice if needed: If you are uncertain about any aspect of filling out designated Roth accounts with the Internal Revenue Service, consider consulting a tax professional or contacting the IRS directly for assistance.

08

Remember to always comply with the IRS guidelines and regulations when filling out designated Roth accounts.

Who needs designated roth accountsinternal revenue?

01

Designated Roth accounts with the Internal Revenue Service may be suitable for individuals who:

02

- Want to contribute after-tax dollars towards their retirement savings

03

- Are eligible and meet the requirements outlined by the IRS for contributing to designated Roth accounts

04

- Prefer tax-free withdrawals during retirement rather than having to pay taxes on distributions

05

- Seek alternative options to traditional retirement accounts like a Roth IRA

06

- Are looking for potential tax advantages and future financial security through designated Roth accounts

07

It is advisable to consult with a financial advisor or tax professional to determine if a designated Roth account is suitable for your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute designated roth accountsinternal revenue online?

Easy online designated roth accountsinternal revenue completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit designated roth accountsinternal revenue on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share designated roth accountsinternal revenue from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete designated roth accountsinternal revenue on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your designated roth accountsinternal revenue by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is designated roth accountsinternal revenue?

Designated Roth accounts refer to a type of retirement account that allows individuals to make after-tax contributions, with qualified distributions being tax-free in retirement. This includes Roth 401(k)s and certain other employer-sponsored plans.

Who is required to file designated roth accountsinternal revenue?

Employers who offer designated Roth accounts as part of their retirement plans are required to report information about these accounts to the Internal Revenue Service (IRS) and plan participants.

How to fill out designated roth accountsinternal revenue?

To fill out the designated Roth accounts report, employers should include plan details, participant contributions, earnings, and any distributions. This information is typically reported on Form 5500 or Form 1099-R, depending on the specific situation.

What is the purpose of designated roth accountsinternal revenue?

The purpose of designated Roth accounts is to allow individuals to save for retirement with after-tax contributions, enabling tax-free withdrawals in retirement, which can be beneficial for long-term financial planning.

What information must be reported on designated roth accountsinternal revenue?

Information that must be reported includes participant contributions, the total value of the account, distributions made during the year, and any rollovers into or out of the account.

Fill out your designated roth accountsinternal revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Designated Roth Accountsinternal Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.