Get the free Financial Statements and Federal Single Audit Report Mabton ...

Show details

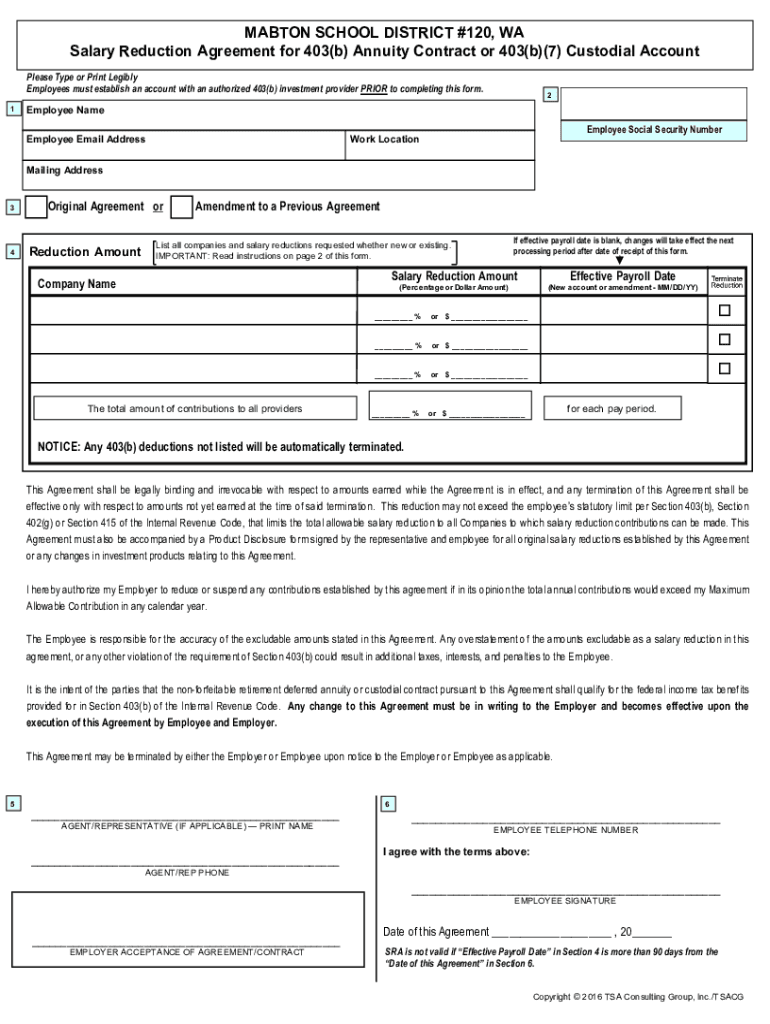

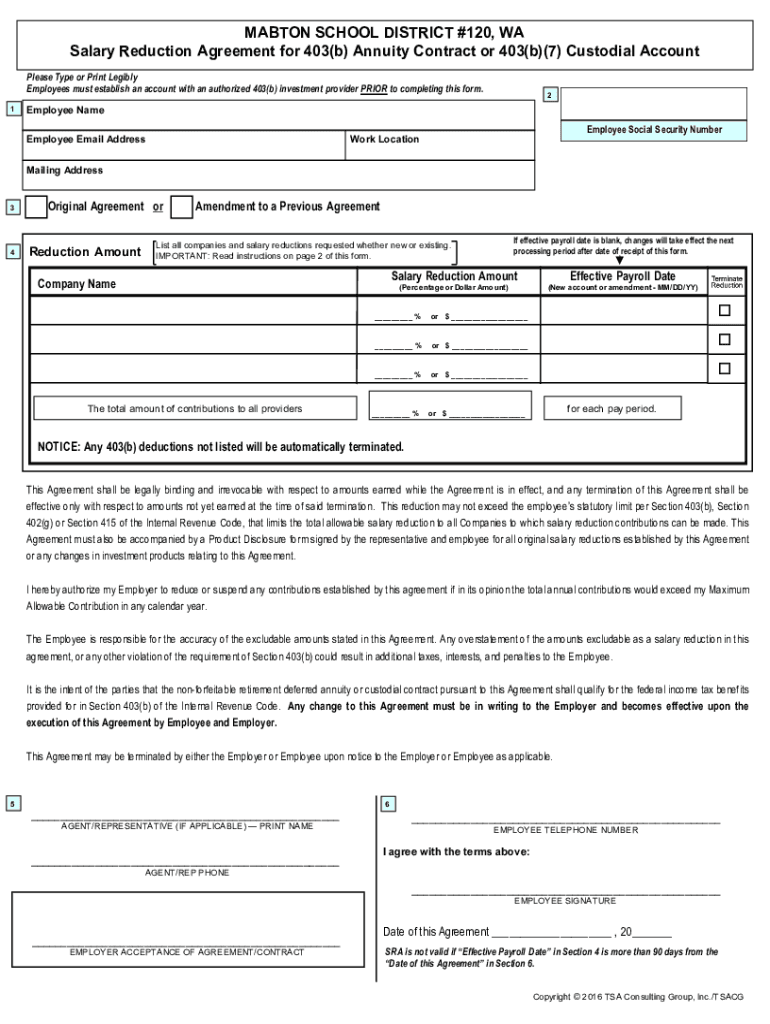

MARTIN SCHOOL DISTRICT #120, WA

Salary Reduction Agreement for 403(b) Annuity Contract or 403(b)(7) Custodial Account

Please Type or Print Legibly

Employees must establish an account with an authorized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements and federal

Edit your financial statements and federal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements and federal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial statements and federal online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial statements and federal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements and federal

How to fill out financial statements and federal

01

To fill out financial statements, follow these steps:

1. Gather all necessary financial documents, such as income statements, balance sheets, and cash flow statements.

2. Review the instructions provided by the regulatory authority or the organization requesting the statements.

3. Begin by entering the business's basic information, such as its name, address, and contact details.

4. Provide the relevant financial data in the designated sections, ensuring accuracy and consistency throughout.

5. Calculate and record key financial ratios, if required.

6. Review and verify the completed statements for any errors or omissions.

7. Sign and date the financial statements before submission.

02

To fill out federal forms, adhere to the following guidelines:

1. Obtain the necessary federal forms from the appropriate government agency or website.

2. Understand the purpose of each form and its specific requirements.

3. Carefully read the instructions accompanying each form to ensure accurate completion.

4. Begin by filling in general information, such as the business's name, address, and taxpayer identification number.

5. Provide the necessary financial data in the specified sections, including income, deductions, and credits.

6. Include supporting documents and attachments, if required.

7. Double-check all entries for accuracy and completeness before submission.

8. Sign and date the forms as required by the regulatory authority.

Who needs financial statements and federal?

01

Financial statements and federal forms are needed by various entities, including:

02

- Businesses: Companies of all sizes require financial statements to assess their financial health, monitor performance, and comply with regulatory reporting requirements.

03

- Banks and lenders: Financial statements help banks and lenders evaluate the creditworthiness of a business and make lending decisions.

04

- Investors: Investors rely on financial statements to analyze the financial performance and stability of a business before making investment decisions.

05

- Government agencies: Federal forms are necessary for government agencies to collect tax information, enforce regulations, and ensure compliance.

06

- Auditors and accountants: Professionals in the accounting and auditing field use financial statements to conduct audits, prepare tax returns, and provide financial advice.

07

- Researchers and analysts: Researchers and analysts may require financial statements to perform industry analysis, benchmarking, or financial forecasting.

08

- Potential business partners: When considering partnerships or collaborations, potential business partners often request financial statements to evaluate potential synergies and risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial statements and federal for eSignature?

To distribute your financial statements and federal, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my financial statements and federal in Gmail?

Create your eSignature using pdfFiller and then eSign your financial statements and federal immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit financial statements and federal straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing financial statements and federal right away.

What is financial statements and federal?

Financial statements are formal records of the financial activities and position of a business, person, or entity. Federal financial statements refer specifically to those that are required by federal law and typically include the balance sheet, income statement, and cash flow statement.

Who is required to file financial statements and federal?

Publicly traded companies, large businesses, and non-profit organizations are required to file financial statements at the federal level to ensure transparency and compliance with regulatory requirements.

How to fill out financial statements and federal?

To fill out federal financial statements, ensure accurate record-keeping of all financial transactions, follow standardized formats (such as GAAP or IFRS), and use accounting software or consult with a financial professional if needed.

What is the purpose of financial statements and federal?

The purpose of federal financial statements is to provide stakeholders, including investors, regulators, and the public, with a clear and standardized overview of an entity’s financial health and performance.

What information must be reported on financial statements and federal?

Financial statements must report information such as assets, liabilities, equity, revenue, expenses, and cash flows, along with notes that provide additional context and details.

Fill out your financial statements and federal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements And Federal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.