Get the free GIFT-IN-KIND DONATION ITEM(s) - Friends of Historic Forest Grove

Show details

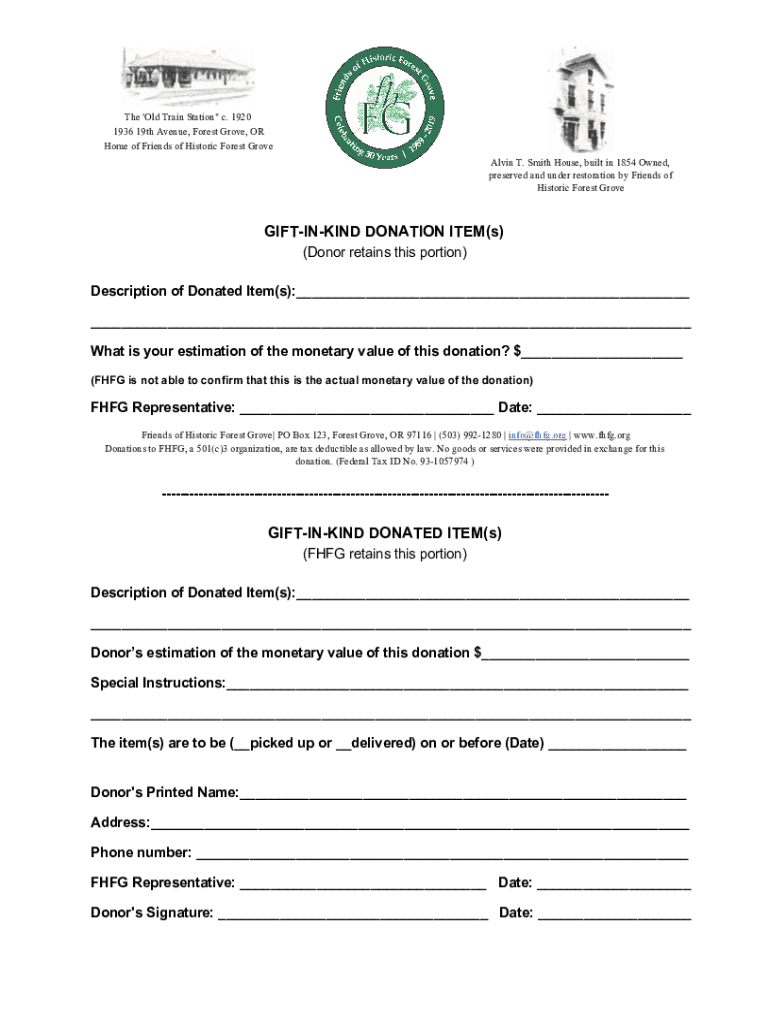

The 'Old Train Station c. 1920 1936 19th Avenue, Forest Grove, OR Home of Friends of Historic Forest Grove Alvin T. Smith House, built in 1854 Owned, preserved and under restoration by Friends of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift-in-kind donation items

Edit your gift-in-kind donation items form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift-in-kind donation items form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift-in-kind donation items online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gift-in-kind donation items. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift-in-kind donation items

How to fill out gift-in-kind donation items

01

Start by gathering all the necessary information about the gift-in-kind donation items, such as their description, value, and condition.

02

Make sure to accurately document and describe each item in detail.

03

Determine the fair market value of the donation items.

04

Attach any supporting documentation, such as appraisals or receipts, if available.

05

Consult with the recipient organization or charity to understand their guidelines and requirements for accepting gift-in-kind donations.

06

Fill out the donation form provided by the recipient organization, ensuring all required fields are completed accurately.

07

Double-check the information on the form before submitting it.

08

Consider keeping a copy of the completed donation form for your records.

09

Deliver the gift-in-kind donation items to the designated drop-off location or arrangement for pick-up, as agreed upon with the recipient organization.

10

Obtain a receipt or acknowledgement of the donation from the recipient organization for your records and tax purposes.

Who needs gift-in-kind donation items?

01

Various organizations and individuals may need gift-in-kind donation items, including:

02

- Non-profit organizations and charities that rely on donations to support their programs and services.

03

- Shelter homes and organizations working with homeless individuals and families.

04

- Schools, colleges, and educational institutions in need of supplies, books, or equipment.

05

- Hospitals and healthcare facilities in need of medical supplies or equipment.

06

- Animal shelters and wildlife rehabilitation centers in need of food, supplies, or bedding for animals.

07

- Community centers or organizations conducting drives or events to support marginalized or underprivileged communities.

08

- Disaster relief organizations providing aid and support during natural disasters or emergencies.

09

- Families or individuals facing financial hardship who may benefit from essential items or resources.

10

- Environmental organizations or conservation groups in need of materials or equipment for their projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gift-in-kind donation items without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your gift-in-kind donation items into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the gift-in-kind donation items electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your gift-in-kind donation items and you'll be done in minutes.

How do I edit gift-in-kind donation items straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing gift-in-kind donation items.

What is gift-in-kind donation items?

Gift-in-kind donation items are non-cash contributions of goods or services provided to a nonprofit organization, which can include items like clothing, food, or professional services.

Who is required to file gift-in-kind donation items?

Organizations that receive gift-in-kind donations are typically required to report these items as part of their financial statements, especially if they exceed a certain value.

How to fill out gift-in-kind donation items?

To fill out gift-in-kind donation items, you should provide a detailed description of the item, its fair market value, the donor's information, and how the item will be used by the organization receiving it.

What is the purpose of gift-in-kind donation items?

The purpose of gift-in-kind donation items is to support nonprofit organizations by providing necessary goods or services that can reduce operational costs and enhance their ability to serve their communities.

What information must be reported on gift-in-kind donation items?

Information that must be reported includes the description of the item, fair market value, date received, and the name and address of the donor.

Fill out your gift-in-kind donation items online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift-In-Kind Donation Items is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.