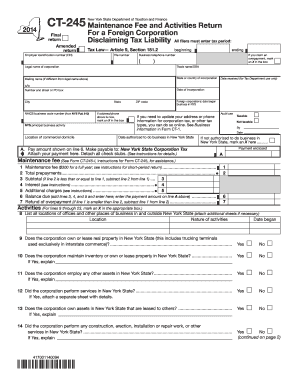

What is form?

As a result of corporate tax reform, significant changes were made to the Tax Law. For tax years beginning on or after January 1, 2015, the maintenance fee under Tax Law, Article 9, section 181.2, and the license fee under Tax Law, Article 9, section 181.1, were repealed. Therefore, for those tax years there is no longer a requirement to file Form CT-245.

Who should file this form?

Any business incorporated outside New York State that is authorized to do business in New York State and wishes to disclaim tax liability. A qualified subchapter S subsidiary (CSSS) incorporated outside New? York State and authorized to do business in New? York State that is included in the parent corporation’s return. Any business incorporated outside New York State having an employee in this state and disclaiming tax liability. Foreign banking corporations described in Article 32, section 1452(a)(9) that are authorized to do business in New York State and wish to disclaim tax liability. Foreign banking corporations described in Article 32

section 1452(a)(2) through 1452(a)(8), insurance corporations, LCS, Laps, and publicly traded partnerships taxed as corporations under the IRC that are authorized to do business in New? York State are not required to file Form CT-245.

What information do I provide in form?

Employer identification number (EIN), File number, Business telephone number, Legal name of corporation, Trade name/DBA, Mailing name (if different from legal name), State or country of incorporation, Number and street or PO box, Date of incorporation. Maintenance fee, Total prepayments, Subtotal, Interest, Additional charges, Balance due, Refund of overpayment, Activities, List all locations of offices and other places of business in and outside New York State, Location. Name, Title, Date began, Duties and responsibilities, Compensation, Email address of authorized person, Telephone number, Date, Signature of individual preparing this return.

When and Where do I send form?

-

File this return within 2½ months after the end of your annual reporting period. New York State Tax Law does not provide for an extension of time to file Form CT-245.

-

NYS CORPORATION TAX PROCESSING UNIT PO?BOX?22038 ALBANY NY 12201-2038