MA DoR M-4 2012 free printable template

Show details

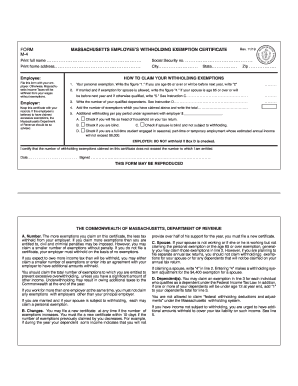

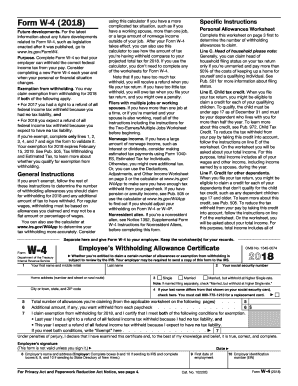

T City. State. Zip. Print full name. Print home address. Employee Rev. 1/12 TS MASSACHUSETTS EMPLOYEE S WITHHOLDING EXEMPTION CERTIFICATE D E PA R FORM M-4 SV B HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS File this form or Form W-4 with your employer. You are not allowed to claim federal withholding deductions and adjustments under the Massachusetts withholding system. If you have income not subject to withholding you are urged to have additional amounts withheld to cover your tax liability on...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA DoR M-4

Edit your MA DoR M-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA DoR M-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA DoR M-4 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MA DoR M-4. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA DoR M-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA DoR M-4

How to fill out MA DoR M-4

01

Obtain the MA DoR M-4 form from the Massachusetts Department of Revenue website or local office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about your employment, including your employer's name and address.

04

Specify the type of deduction you are claiming, ensuring you understand the eligibility requirements.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form to your employer or the appropriate state agency as instructed.

Who needs MA DoR M-4?

01

Individuals who claim Massachusetts state income tax exemptions.

02

Employees who wish to adjust their tax withholding.

03

Residents seeking to reduce their taxable income based on specific deductions.

Fill

form

: Try Risk Free

People Also Ask about

What is MA in state?

Massachusetts is one of the original 13 states (6th) of the Union (February 6, 1788). Boston, the capital of Massachusetts since its founding, dates from 1630. Capital: Boston.

Is it MA or MA for Massachusetts?

MassachusettsUSPS abbreviationMAISO 3166 codeUS-MATraditional abbreviationMass.Latitude41°14′ N to 42°53′ N49 more rows

What makes Massachusetts popular?

Part of the Northeastern United States, Massachusetts is the most populated of all the six New England states. History is alive here and aside from its natural beauty, the state is most famous for Pilgrims, the Mayflower, the Boston Tea Party, and the Salem Witch Trials.

Which state is MA in USA?

Massachusetts is one of the original 13 states (6th) of the Union (February 6, 1788). Boston, the capital of Massachusetts since its founding, dates from 1630. Nickname: The BAY STATE or the OLD BAY STATE is the nickname most commonly attached to Massachusetts.

What is Massachusetts famous for?

What is Massachusetts famous for? Plymouth and the Pilgrims. Thanksgiving tradition. Salem witch trials. Boston Tea Party. Fall foliage. Successful sports teams. Harvard and MIT. That unique accent.

Does MA mean Massachusetts?

MA stands for Massachusetts (US postal abbreviation)

What was Massachusetts best known for?

One of the original 13 colonies and one of the six New England states, Massachusetts (officially called a commonwealth) is perhaps best known for being the landing place of the Mayflower and the Pilgrims. English explorer and colonist John Smith named the state for the Massachusett tribe.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MA DoR M-4 to be eSigned by others?

Once you are ready to share your MA DoR M-4, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit MA DoR M-4 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing MA DoR M-4, you need to install and log in to the app.

How do I fill out MA DoR M-4 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign MA DoR M-4. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is MA DoR M-4?

MA DoR M-4 is a tax form used in Massachusetts for reporting certain income and deductions for corporate excise tax purposes.

Who is required to file MA DoR M-4?

Entities engaged in business activities, including corporations doing business in Massachusetts, or those that have certain levels of income or property in the state are required to file MA DoR M-4.

How to fill out MA DoR M-4?

To fill out MA DoR M-4, gather relevant financial information, complete the form by providing the necessary details about income and deductions, and ensure all calculations are accurate before submitting it to the Massachusetts Department of Revenue.

What is the purpose of MA DoR M-4?

The purpose of MA DoR M-4 is to enable businesses to report their income, deductions, and tax liability to the Massachusetts Department of Revenue for proper assessment of corporate excise tax.

What information must be reported on MA DoR M-4?

MA DoR M-4 requires reporting of total income, deductions, tax credits, apportionment factors, and any other required financial details specific to the entity’s operations in Massachusetts.

Fill out your MA DoR M-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA DoR M-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.