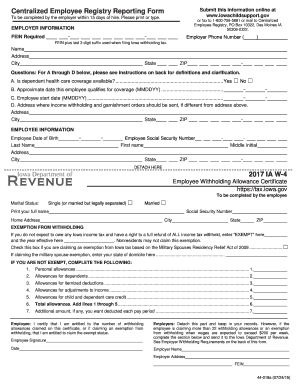

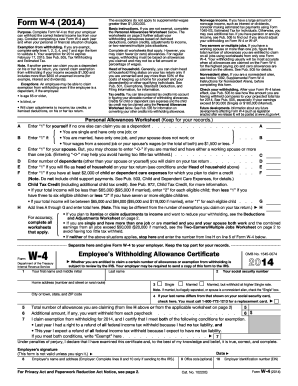

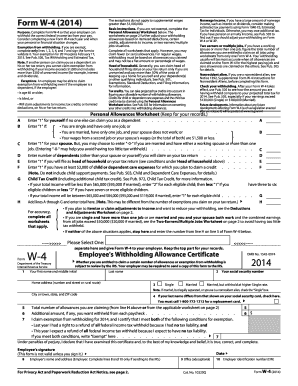

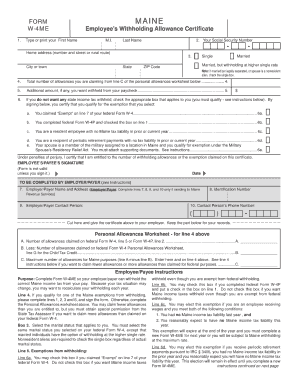

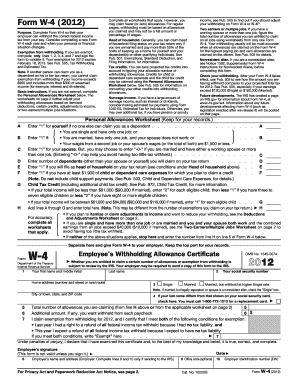

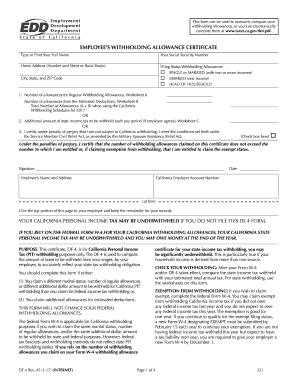

W-4 Form 2017

What is w-4 form 2017?

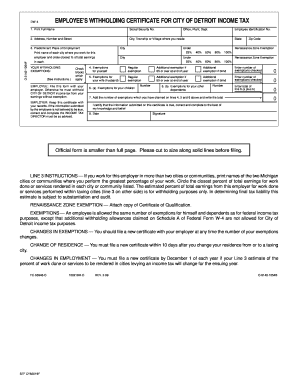

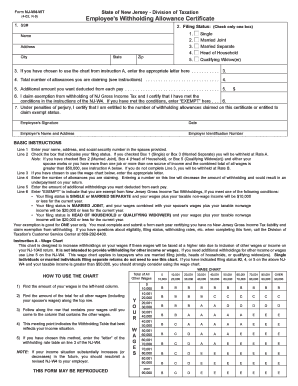

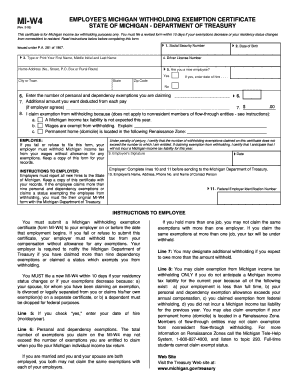

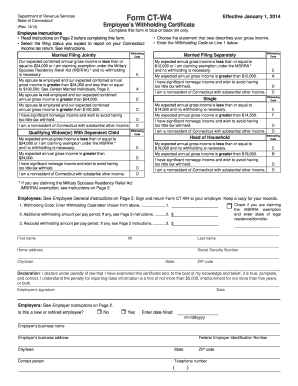

The w-4 form 2017 is a document used by employees to inform their employer the amount of federal income tax to withhold from their paycheck. This form is an important tool in ensuring accurate tax withholding throughout the year. By completing the w-4 form 2017 correctly, you can avoid any surprises when it comes to tax season.

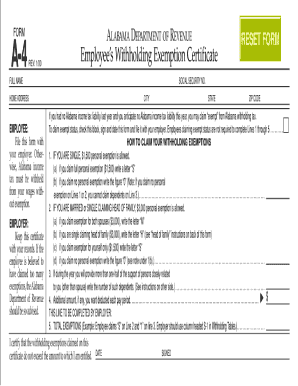

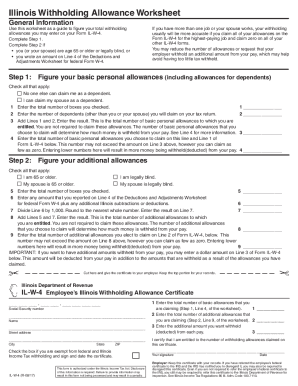

What are the types of w-4 form 2017?

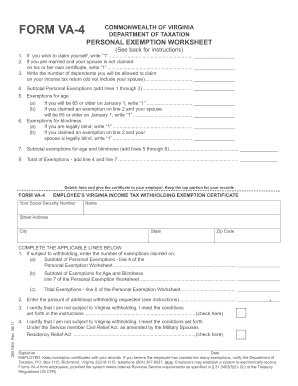

There are different types of w-4 form 2017 depending on your individual circumstances. These types include:

How to complete w-4 form 2017

Completing the w-4 form 2017 is a simple process. Here are the steps you need to follow:

pdfFiller is the ultimate solution for creating, editing, and sharing documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor that empowers users to get their documents done efficiently.