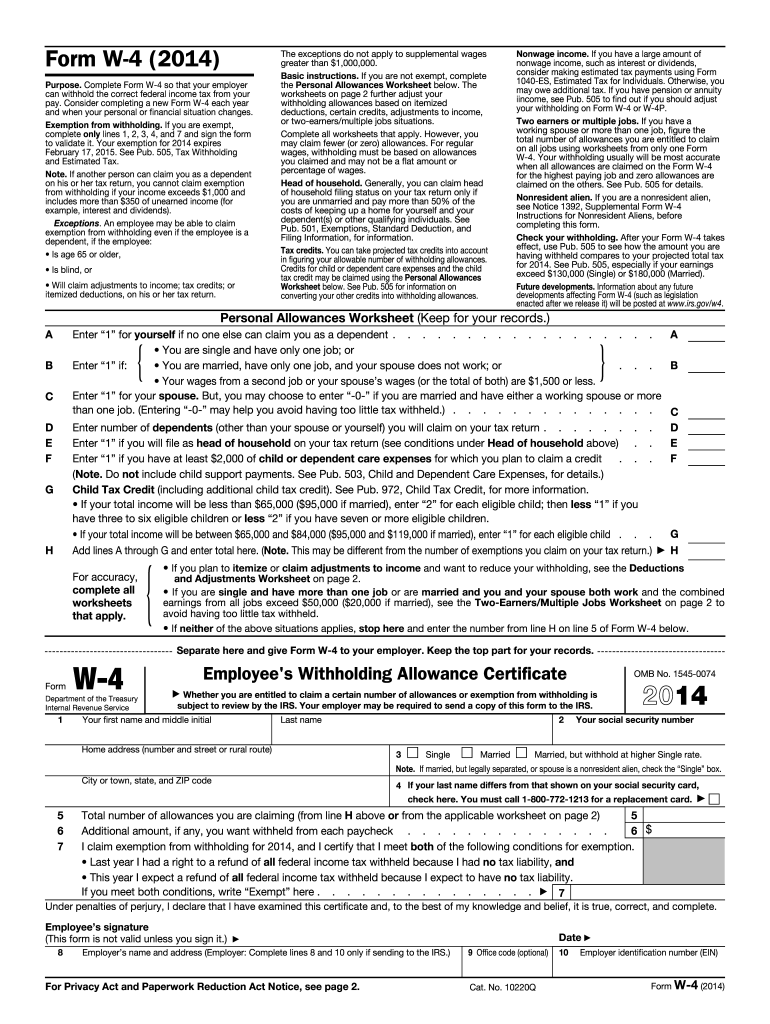

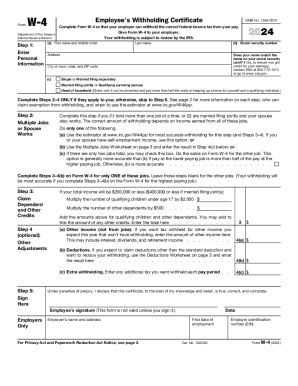

Who needs a W-4 Form?

The W-4 Form, also known as the Employee's Withholding Allowance Certificate form, is a document to be completed for the US Internal Revenue Service. This form should be submitted by employees to their employers in order to enable the latter to withhold the correct federal income tax from the employee's pay. Form W-4 gives employees an opportunity to determine the amount withheld from the paycheck in order to find out how much tax the employee owes or whether they are eligible for a refund when filing their tax returns.

When is the W-4 Form due?

An employee must file their W-4 when they are hired by a new employer or at any time during their employment if there is a need to change the withholding allowances or their personal information changes.

The IRS recommends employees file a new W-4 on a yearly basis.

How to fill out the IRS W-4 form?

The completed Employee’s Withholding allowance Certificate must clearly state the following details: full name, SSN, address, total and additional number of allowances, claimed exemption, deductions and adjustments, etc. The form also includes worksheets letting employees make calculations directly in the form.