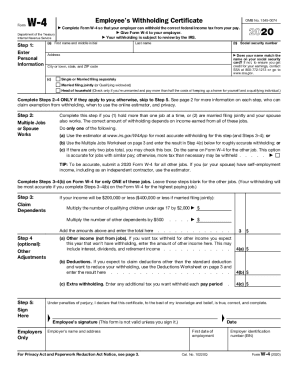

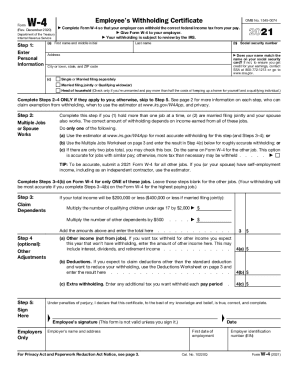

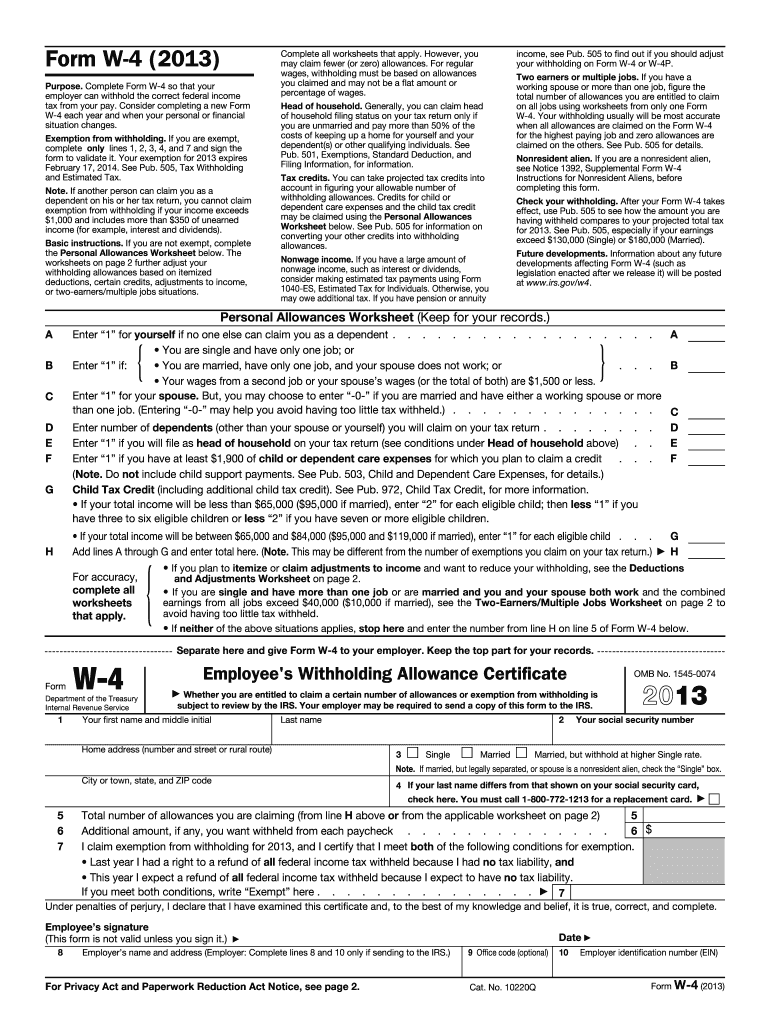

IRS W-4 2013 free printable template

Instructions and Help about IRS W-4

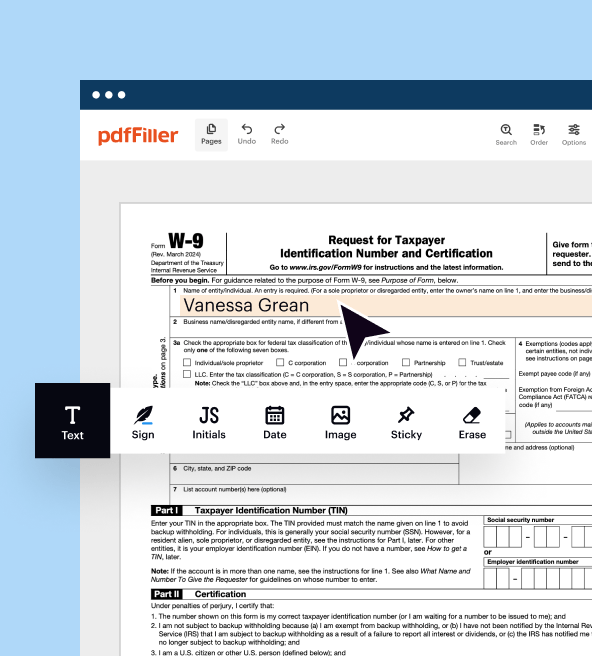

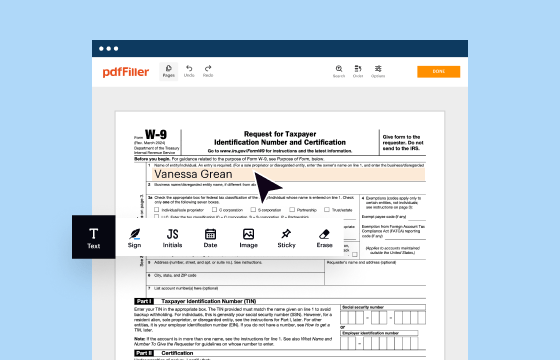

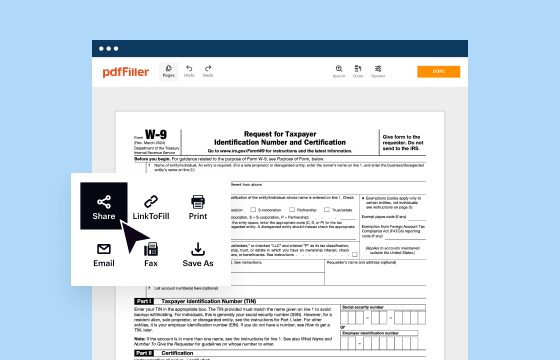

How to edit IRS W-4

How to fill out IRS W-4

About IRS W-4 2013 previous version

What is IRS W-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

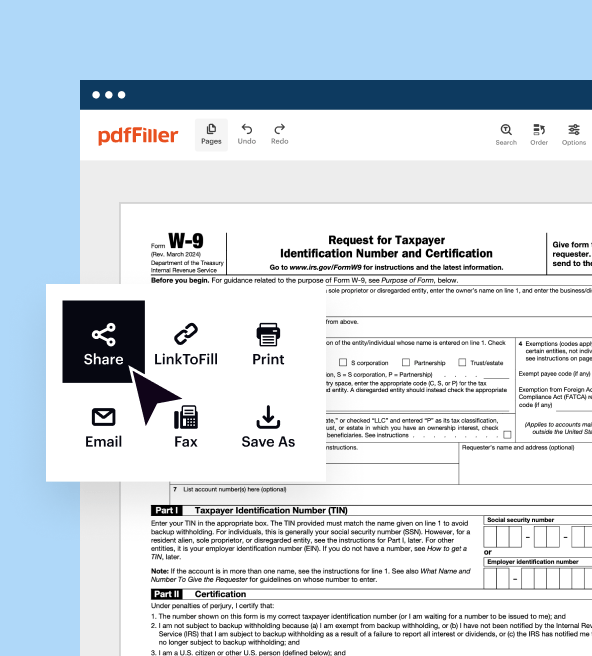

Where do I send the form?

FAQ about IRS W-4

What should I do if I made a mistake on my IRS W-4 after submission?

If you realize there's an error on your IRS W-4 after submitting it, you'll need to submit a new W-4 indicating the correct information. Ensure you notify your employer, as this will help them adjust your withholding accordingly. It's important to keep a copy of both the original and the corrected form for your records.

How can I verify if my IRS W-4 was received and processed by my employer?

To verify receipt of your IRS W-4, contact your employer's payroll department directly. They should be able to confirm whether they have processed your submission. If you submitted your W-4 electronically, check if your employer provides any online portal where you can track submission statuses.

What are the common mistakes to avoid when submitting an IRS W-4?

Common errors in the IRS W-4 include incorrect Social Security numbers, miscalculating the number of allowances, and not signing the form. Double-check each section before submission to reduce the likelihood of rejection or processing delays. Keeping your information up-to-date and accurate is crucial for proper tax withholding.

What should I do if my IRS W-4 submission is rejected due to e-filing errors?

If your IRS W-4 submission is rejected for e-filing errors, carefully review the rejection notice for specific codes and reasons. Correct the identified issues, typically related to formatting or information discrepancies, and then resubmit the W-4. Always ensure your contact information is accurate for any necessary follow-up.

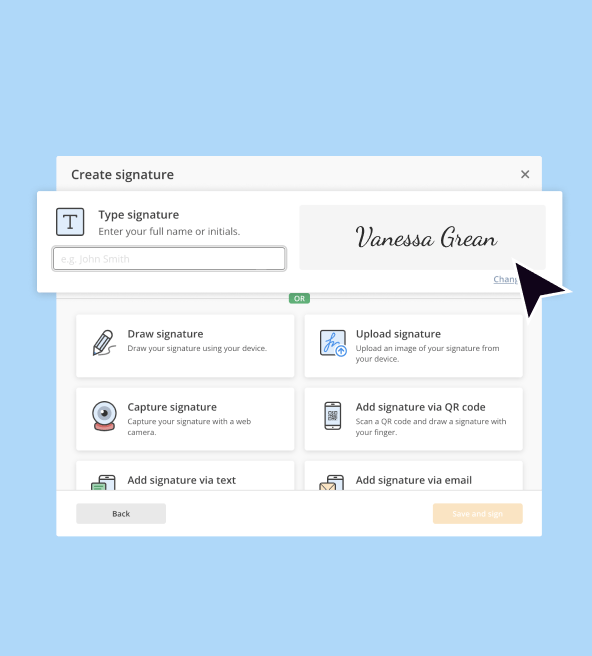

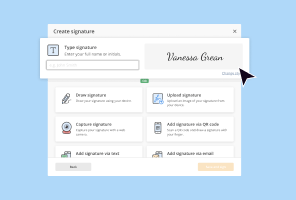

Are e-signatures accepted for the IRS W-4, and how does that affect submissions?

Yes, e-signatures are accepted for submitting the IRS W-4, provided that the employer's system supports them. When using e-signatures, ensure that your identity verification processes align with any legal requirements to maintain the integrity of your submission. Double-check the specific guidelines from your employer regarding electronic submissions.

See what our users say