W-4 2017

What is w-4 2017?

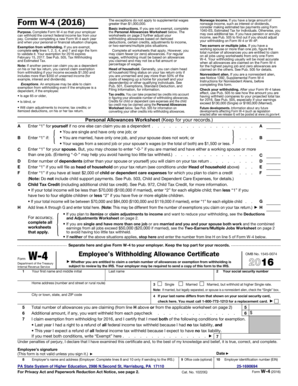

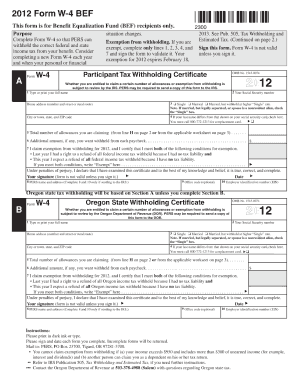

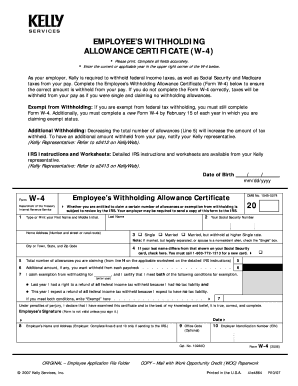

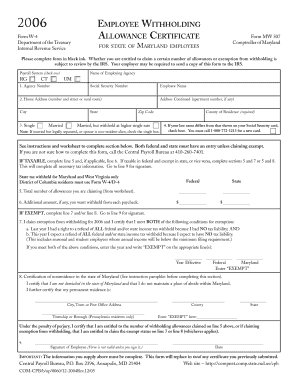

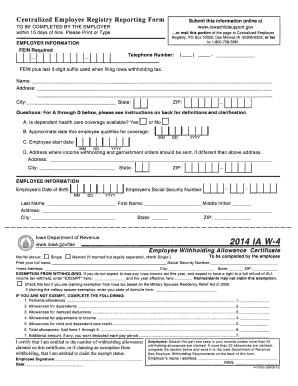

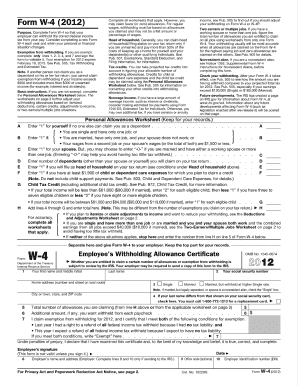

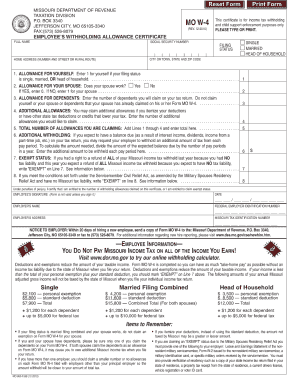

The w-4 2017 is a tax form used by employees to indicate their tax withholding preferences. It helps employers determine the amount of federal income tax to withhold from the employee's paycheck. By filling out this form accurately, employees can ensure that the right amount of tax is withheld from their earnings, minimizing any surprises or potential tax liabilities.

What are the types of w-4 2017?

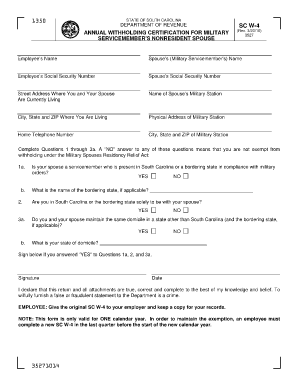

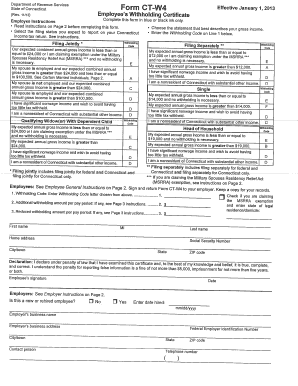

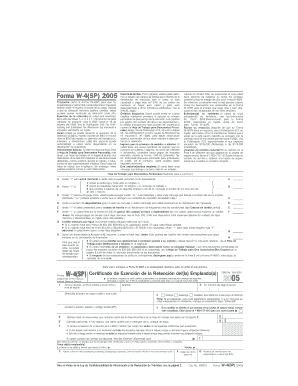

There are two main types of w-4 2017 forms: the Employee's Withholding Allowance Certificate and the Employee's Withholding Certificate for Nonresident Aliens. Each type is designed for specific circumstances. The Employee's Withholding Allowance Certificate is used by most employees who are U.S. citizens or residents. On the other hand, the Employee's Withholding Certificate for Nonresident Aliens is for individuals who are not U.S. citizens and are subject to different tax withholding rules.

How to complete w-4 2017

Completing the w-4 2017 form is a straightforward process. Here are the steps to follow:

Remember, if you are unsure about how to fill out the form, it's always a good idea to consult with a tax professional or refer to the instructions provided by the IRS. And don't forget, pdfFiller is a powerful online tool that empowers users to create, edit, and share documents, including w-4 2017 forms. With its unlimited fillable templates and powerful editing tools, pdfFiller is your go-to PDF editor for all your document needs.